The Blackstone Group is making its second trip to the commercial mortgage bond market this week to refinance hotels owned via a real estate investment fund.

The latest transaction is backed by a portfolio of four Club Quarters brand-managed hotels totaling 1,228 keys located across four major U.S. cities: San Francisco (346 keys; 39.4% of allocated loan amount), Chicago (429 keys; 26.4%), Boston (178 keys; 18.2%) and Philadelphia (275 keys; 16%).

Blackstone Real Estate Partners VII-NQ purchased the portfolio in February 2016 from Masterworks Development, an affiliate of Club Quarters, for approximately $410.0 million ($333,876 per key), according to rating agency presale reports. Including the $3.7 million invested since purchase, the current reported cost basis equates to approximately $413.7 million ($336,889 per key), well in excess of the subject loan amount.

The fund has obtained a $273.7 million loan from Bank of America; proceeds, along with $61.3 million of mezzanine debt and $8.1 million of equity, were used to refinance $336.1 million in existing debt and pay closing costs.

The first mortgage pays only interest, and no principal, has an initial two-year term and can be extended by one year up to three times, for a total term of five years. It is being used as collateral for a transaction called BX Trust 2017-CQHP.

Moody’s Investors Service and DBRS both expect to assign triple-A ratings to the senior tranches of notes to be issued.

Bank of America Merrill Lynch is the initial purchaser of the notes.

Unlike two hotels Blackstone is refinancing in a transaction launched earlier this week, the Club Quarters hotels are not luxury properties. DBRS considers them to be “average” quality and says that they have been “adequately” maintained over the years, with approximately $18.9 million ($15,415 per key) invested across the portfolio between 2010 and 2016. In its presale report, it notes that “the properties’ interiors are somewhat dated and would benefit from a refresh over the next few years, which seems to be on the sponsor’s wish list.”

Approximately $3.7 million ($3,013 per key) is budgeted for capital improvements in 2017 and further renovations are planned over the near term.

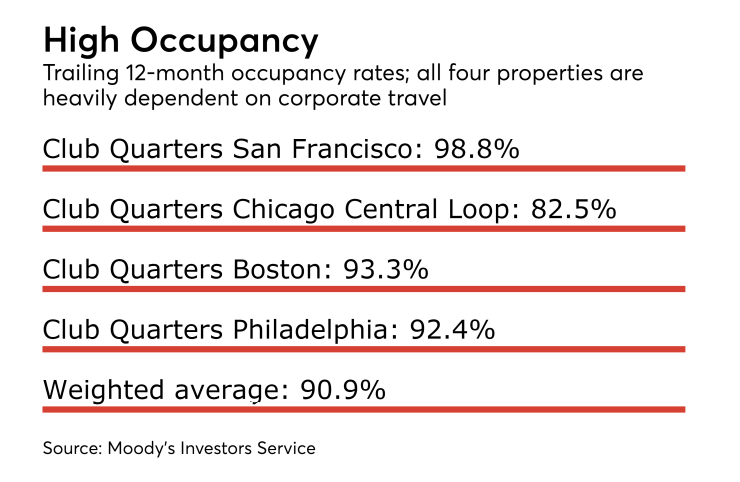

All four properties are managed by Club Quarters Management, which also acts as the franchise under which the hotels operate, with management agreements scheduled to expire in February 2041. Club Quarters operates 17 hotel properties located in the city centers of major markets across the United States and London, with a focus on a high-occupancy, high-margin business model.

As with the overall hotel market, average daily rates and occupancy levels at the subject properties have been posting strong gains over the past few years, though this growth has been moderating and turned negative in the most recent 12-month trailing period ending Aug. 31, 2017.

Moreover, there is new hotel supply in the works in each of the four markets.

Then there is the deal’s high leverage. DBRS calculates the loan-to-value ratio at 96.1%, though this is based on what it describes as “stressed valuation” for the properties of $284.9 million ($231,970 per key). That valuation in turn assumes a significant increase in market cap rates.

Moody’s put the LTV even higher, at 121%. And that’s before taking into account the mezzanine financing, which is held outside the securitization trust, and brings the LTV up to 148.1%.