American Homes 4 Rent, one of the nation’s largest landlords, is tapping the securitization market again, but this time it’s financing lending by two much smaller players.

The $127 million transaction, RCO 2017-INV1, is backed by loans to small-time landlords originated by two private companies, Lima One Capital and Visio Financial Services, according to Morningstar Credit Ratings. Lima One originated 177 loans backed by 462 properties, while VFS originated 732 loans, backed by 883 properties.

American Homes 4 Rent is not particularly dependent on securitization for its own portfolio of some 50,000 single-family rental properties. It has an investment grade credit rating and has recently been issuing common stock, rather than tapping the debt markets, for funding. Last September, it went so far as to

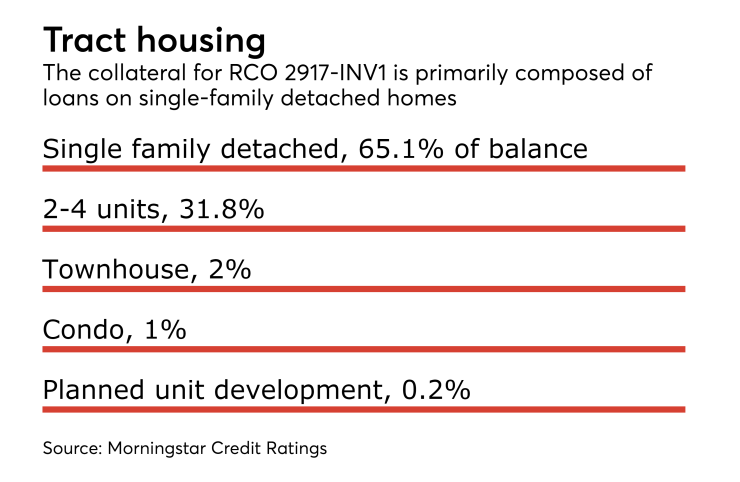

The collateral for RCO 2017-INV1 is broadly similar to a

The weighted average original loan-to-value ratio is 67.5%, and the weighted average original FICO score is 723, excluding 14 loans to foreign national borrowers without FICOs.

The weighted average seasoning of the loans is five months, and some of the FICO scores and appraisal values are aged more than 12 months.

Among Morningstar’s primary concerns in rating the transaction is the fact that neither Lima One nor Visio require a property to be leased before they will finance it. At origination, 79.7% of the properties were leased with fully executed arm’s-length lease agreements.

About 69.2% of the loans by current balance are backed by a single property, and 30.8% are backed by more than one property. The largest number of properties backing a single loan is 22.

Morningstar expects to assign an AAA to the senior tranche of notes to be issued, which benefits from 40.45% credit support. Four other tranches of notes will be issued with ratings ranging from A to B. There are also two unrated tranches of notes that will be retained by Residential Credit Opportunities II, an affiliate of American Homes 4 Rent that is the transaction’s sponsor, in order to comply with risk retention rules.

All of the notes have a legal, final maturity of November 2052.

The collateral pool is geographically concentrated, as about 52.8% of the loans by current balance are backed by properties in Florida, New Jersey, Georgia, New York, and Maryland. However Morningstar has taken this into account in its credit modeling, which accounts for house price projections at the ZIP code or regional level.

Investors are also taking on exposure to some large loans that account for an outsized proportion of the deal. Approximately 6.8% of the loans account for about 25% of the entire pool balance.

Another unusual feature: Eleven properties are leasehold properties, a form of tenure where one party buys the right to occupy land for a given length of time. The properties back eight Lima One loans. Seven properties are townhomes, three are single-family properties and one is a two-family house. All are located in Baltimore, Maryland with an average property value of about $94,000.

Morningstar does not have any specific concerns about the properties, however. It noted in its presale report that the appraisal values of the properties reflect the leasehold feature and that the terms of each lease do not terminate earlier than 10 years after the maturity the mortgage note or provides for an extension.