Progress Residential is marketing $271.1 million of bonds backed by a single loan secured by a portfolio of 1,598 single-family rental properties, the smallest such transaction to date.

This is the private equity firm’s eighth single-family rental securitization to date. A total of 191 properties, or 11.4% of the pool, were previously securitized in transactions completed in 2014 and 2015 and repaid using a portion of the proceeds from a 2016 transaction.

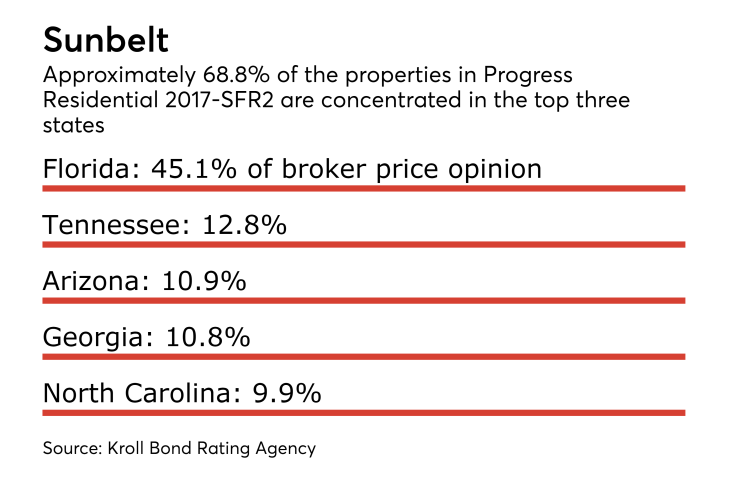

Once this transaction is completed, Progress will have six outstanding totaling $3.1 billion that securitize nearly its entire portfolio of 20,000 homes in 14 markets across nine states.

On average, the homes being securitized in the latest transaction are newer (17 years) and are larger (1,833 square feet) compared with prior transactions in the broader single-family rental securitization market, according to Kroll Bond Rating Agency. Kroll generally views larger, newer homes as being more marketable than smaller, older homes.

Some 4.2% of the subject properties are vacant, while 10 tenants (0.7%) were delinquent on their rent payments.

Based on the aggregate value for the homes, based on broker price opinions, the transaction has a loan-to-value ratio of 78.3%, which is high compared with the 74.6% average other transactions Kroll has rated.

A total of 374 homes, or approximately a third, by broker price opinion, experienced damage as a result of recent hurricanes, but this is primarily limited to roofing and fencing, according to Kroll. None are uninhabitable. The cost of the damage is estimated to be less than $475,000 and in most cases is below insurance deductibles.

The homes are financed with a fixed-rate loan that Progress obtained from a subsidiary of Deutsche Bank; this loan, which pays only interest, and no principal, for its entire five-year term, serves as collateral for the transaction, dubbed Progress Residential 2017-SFR2. Six tranches of notes with ratings ranging from AAA to BB- will be issued in the transaction; the most subordinate tranche is unrated and will be retained by Progress in order to satisfy risk retention requirements.

Excluding the subject transaction, there have been 33 other single-borrower, single-family rental securitizations issued since November 2013, nine of which will have been repaid in full prior to maturity. (Two more, Invitation Homes 2014-SFR2 and 2014-SFR3, are expected to fully repay this month.)

All of the transactions will come due between June 2020 and December 2022, and Kroll cites this concentrated debt maturity profile as a risk that could result in increased financial stress for Progress. However, some of the deals can be extended, which provide some flexibility to stagger the maturities.

Moreover, the single-family rental sector, though still quite new, is benefiting from expanding sources of financing. In addition to private-label securitization, some deals have been refinanced using equity or securitizations that benefit from a guarantee from Fannie Mae.