If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

-

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

November 26 -

Baby Boomers' annuities purchases continue to fuel banks' lending to collateralized loan obligations, asset-backed securities and special purpose entities.

November 26 -

The Federal Reserve, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. issued a final rule Tuesday that softens leverage demands for the biggest and most systemically risky banks and lowers the community bank leverage ratio to 8%.

November 25 -

For TIP Solar ABS, the securitization share of ADSAB and cashflows payable to the cash equity holder, are about $200 million and $171.4 million.

November 25 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25

-

There is also a class N tranche of notes that make payment to those noteholders if funds are available after the overcollateralization.

November 24 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

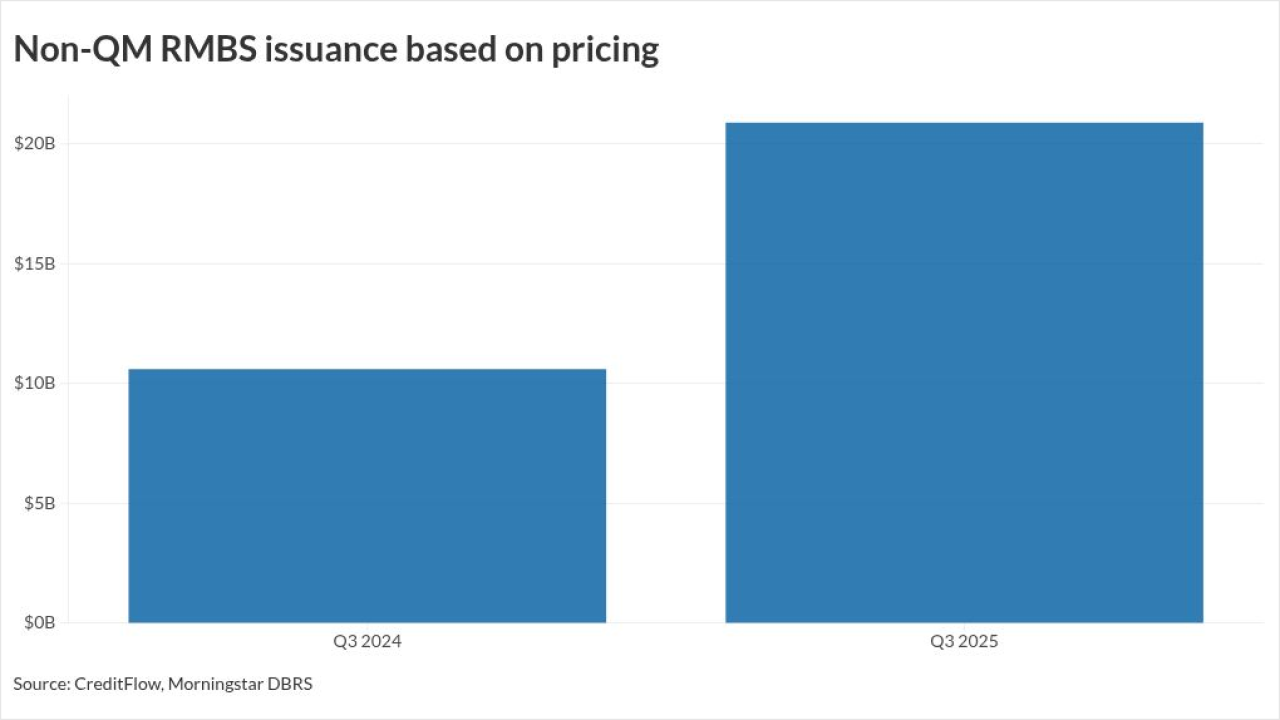

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

On a weighted average (WA) basis, the collateral mortgages have a slightly higher leverage level than previous transactions, although moderate, with an original loan-to-value (LTV) ratio of 71.9%.

November 21 -

Private-label CMBS loan delinquencies are rising, but ample liquidity is making 2025 issuance volume the highest since 2007.

November 21 -

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20 -

The Consumer Financial Protection Bureau plans to transfer its entire enforcement and legal divisions to the Department of Justice and is likely to staff in those units, according to sources briefed by agency leadership.

November 20