The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

-

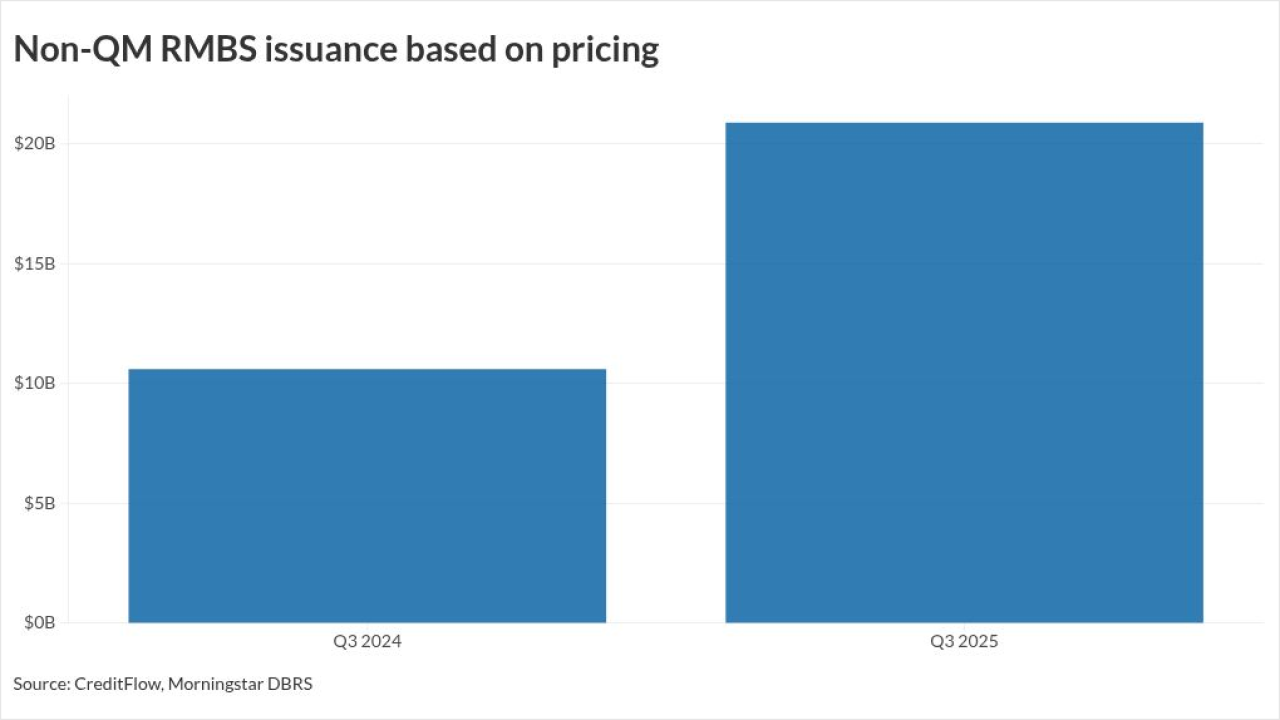

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

On a weighted average (WA) basis, the collateral mortgages have a slightly higher leverage level than previous transactions, although moderate, with an original loan-to-value (LTV) ratio of 71.9%.

November 21 -

Private-label CMBS loan delinquencies are rising, but ample liquidity is making 2025 issuance volume the highest since 2007.

November 21 -

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20 -

The Consumer Financial Protection Bureau plans to transfer its entire enforcement and legal divisions to the Department of Justice and is likely to staff in those units, according to sources briefed by agency leadership.

November 20

-

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

The capital structure for Volkswagen Auto Loan Enhanced Trust, series 2025-2, will remain the same, even though the deal can potentially be upsized to $1 billion.

November 20 -

The economy added an unexpectedly robust 119,000 jobs in September, though unemployment edged up to 4.4%. The report, delayed by the federal government shutdown, continues a trend of sluggish job growth in recent months.

November 20 -

A large majority of the pool assets, 86.2%, are second-lien home equity investment contracts that have a weighted average (WA) multiple share rate of 2.00x.

November 19 -

NSLT 2025-D comes to market as the private student loan sector is seeing increased issuance. Two of the program's deals, series 2025-B and 2025-C, accounted for $4 billion of issuance, almost half the sector's production.

November 19 -

President Trump has nominated Stuart Levenbach, associate director of the Office of Management and Budget, to be the director of the Consumer Financial Protection Bureau. His selection allows acting CFPB Director Russell Vought to remain in place for at least another 210 days.

November 19 -

Although the deal, which closes on November 26, is the first securitization from Ansley Park, its owned portfolio since January 2024 has had strong performances with no losses to date.

November 18