Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

-

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

An early look at securitized residential home-loan performance amid the coronavirus pandemic indicates encouraging trends thus far in impairment levels of non-qualified mortgages, according to a new report from investor analytics firm Dv01.

April 30 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

Nearly 70% of U.S. adults between the ages of 26 and 40 said their earnings had been negatively affected by the outbreak, about 10 percentage points higher than other age groups.

April 30 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30

-

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

April 29 -

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

April 29 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

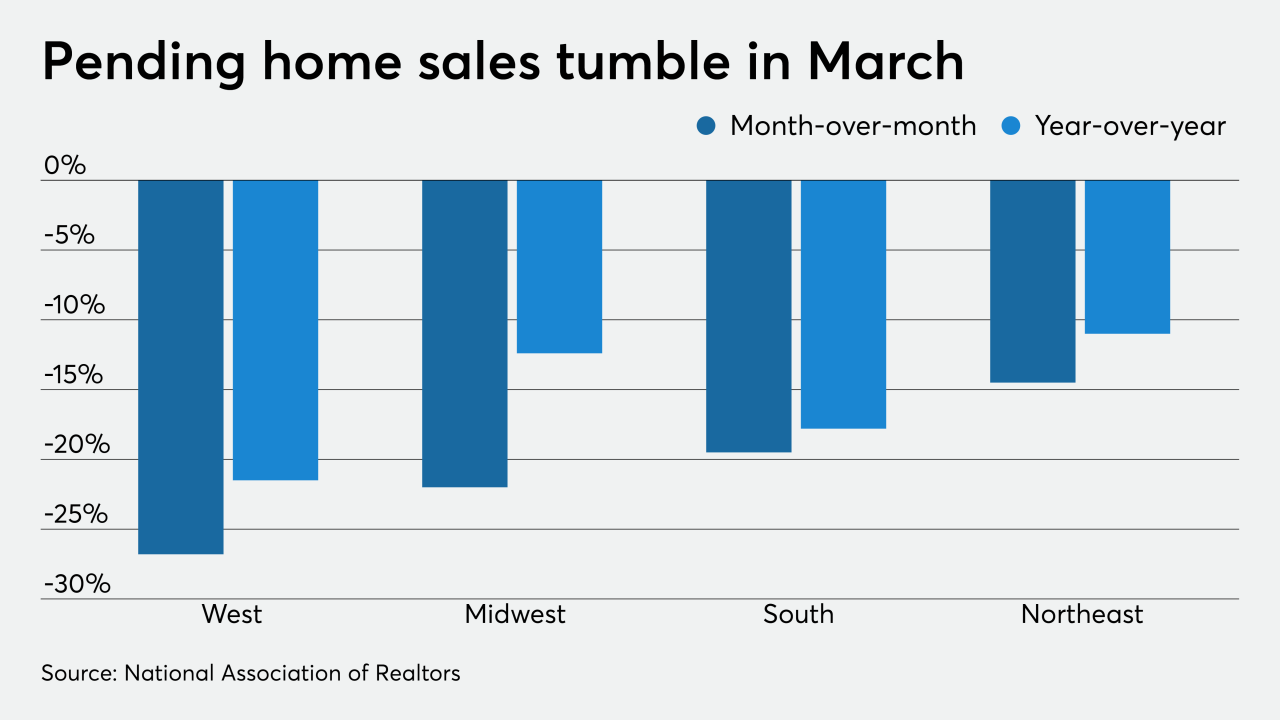

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

Hertz and Avis will likely each have to seek to relief from lenders – including asset-backed securities investors that make up the bulk of funding for both companies’ fleets, Moody’s stated in research reports.

April 29 -

The Consumer Financial Protection Bureau's chief operating officer will take a similar position at the Federal Housing Finance Agency, fulfilling one of the multiple recruiting goals the FHFA announced in January.

April 28 -

Falling used-car values, loan forbearance programs and economic uncertainty are weighing on the lower-end of the subprime auto finance sector.

April 28