Just in time for the New Year, Dick Clark Productions is returning with a $530M securitization of fees and revenues backed by its five core television broadcasts, including "Dick Clark’s New Year’s Rockin’ Eve."

-

Natixis will be marketing bonds as well loan-specific certificates tied to a $160 million first-mortgage taken secured by an Amazon headquarters building in Seattle, and a $92.5 million loan backed by a newly built addition to NYC's sprawling Memorial Sloan-Kettering Cancer Center campus.

January 22 -

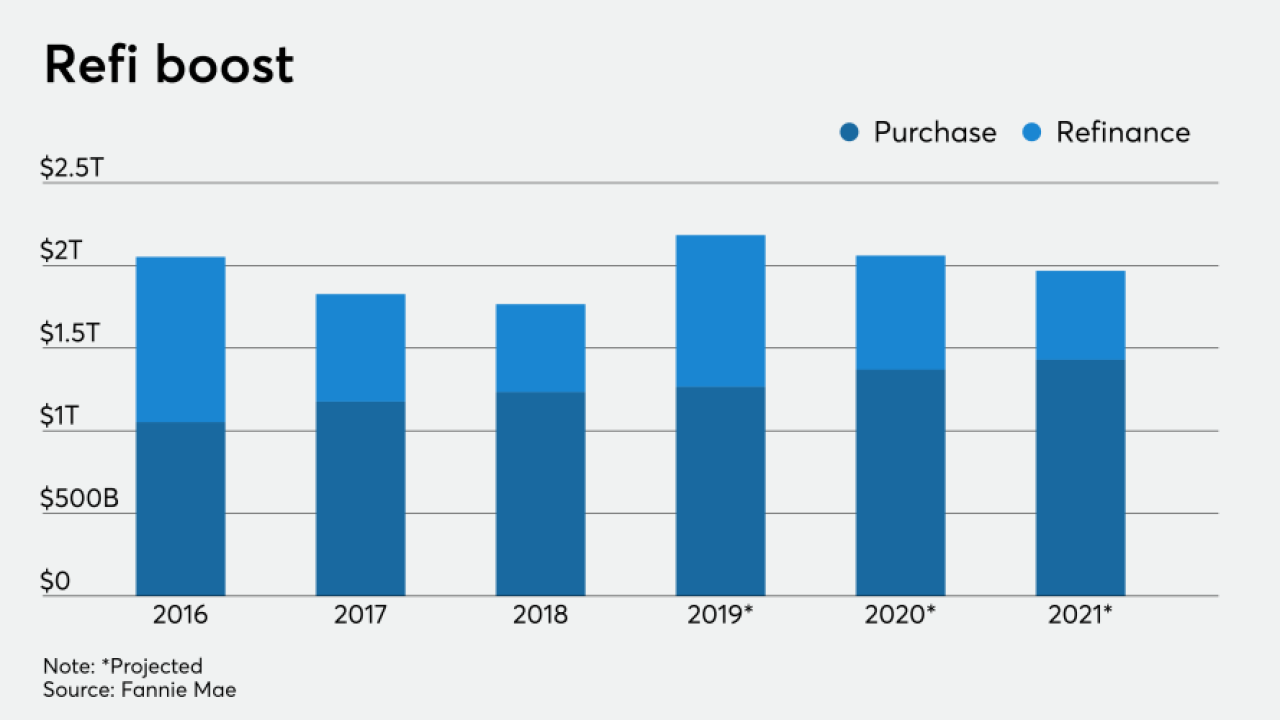

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22 -

The newly acquired industrial portfolio of transportation centers in major markets adds to Blackstone's global holdings of logistics properties in major transit hubs.

January 21 -

The Federal Housing Finance Agency is considering bringing back the idea of imposing stricter criteria for purchasing mortgages in areas where residential Property Assessed Clean Energy financing is available.

January 21 -

The $430.2 million PSMC 2020-1 transaction is a pool of 602 large-sized loans with an average loan balance of $715,978, all of which meet CFPB's QM standards.

January 21

-

The agency is sending a strong message that it won’t rush to end an exemption for Fannie Mae and Freddie Mac while also signaling longer-term changes that will affect all lenders.

January 21 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

Impact investing has long centered on environmental and social purpose, but governance could make huge strides as an ESG consideration in 2020.

January 20 -

Mercedes-Benz, Nissan and Ford will market up to $3.86 billion in new prime auto-lease securitizations, adding to a pipeline that opened up with Hyundai's deal last week.

January 17 -

The $243 million transaction – Small Business Lending Trust 2020-A – is backed by a static pool of 1,930 loans originated and serviced by an affiliate of the U.K.-based lender.

January 16 -

Asset managers appear mixed on whether credit conditions on spreads and corporate defaults will worsen in 2020 – or remain at today’s benign levels. But few expect any near-term improvement.

January 16 -

In another sign of state officials trying to outdo the Consumer Financial Protection Bureau, governors in California and New York want greater authority to license and oversee the debt collection industry.

January 15