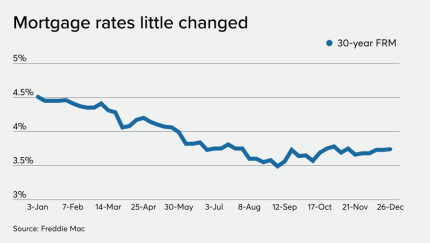

Mortgage rates ended the week little changed from the previous seven-day period and near historic lows for the year, according to Freddie Mac.

-

The Justice Department had issued subpoenas in 2014 and 2015 to GLS and other subprime lenders regarding underwriting criteria for lending as well as representations and warranties for loans being securitized, according to Kroll.

January 23 -

Regulators already finalized a rollback of the proprietary trading ban section of the rule but signaled then that their overhaul was not finished.

January 23 -

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 23 -

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

January 23 -

Nearly $1.2 trillion in speculative-grade debt is now set to mature between 2020-2024, including $750 billion in leveraged loans.

January 23

-

Treasure Island Hotel & Casino is the latest Las Vegas casino tapping the commercial-mortgage securitization market as it winds up a multi-year, exhaustive renovation program.

January 22 -

Natixis will be marketing bonds as well loan-specific certificates tied to a $160 million first-mortgage taken secured by an Amazon headquarters building in Seattle, and a $92.5 million loan backed by a newly built addition to NYC's sprawling Memorial Sloan-Kettering Cancer Center campus.

January 22 -

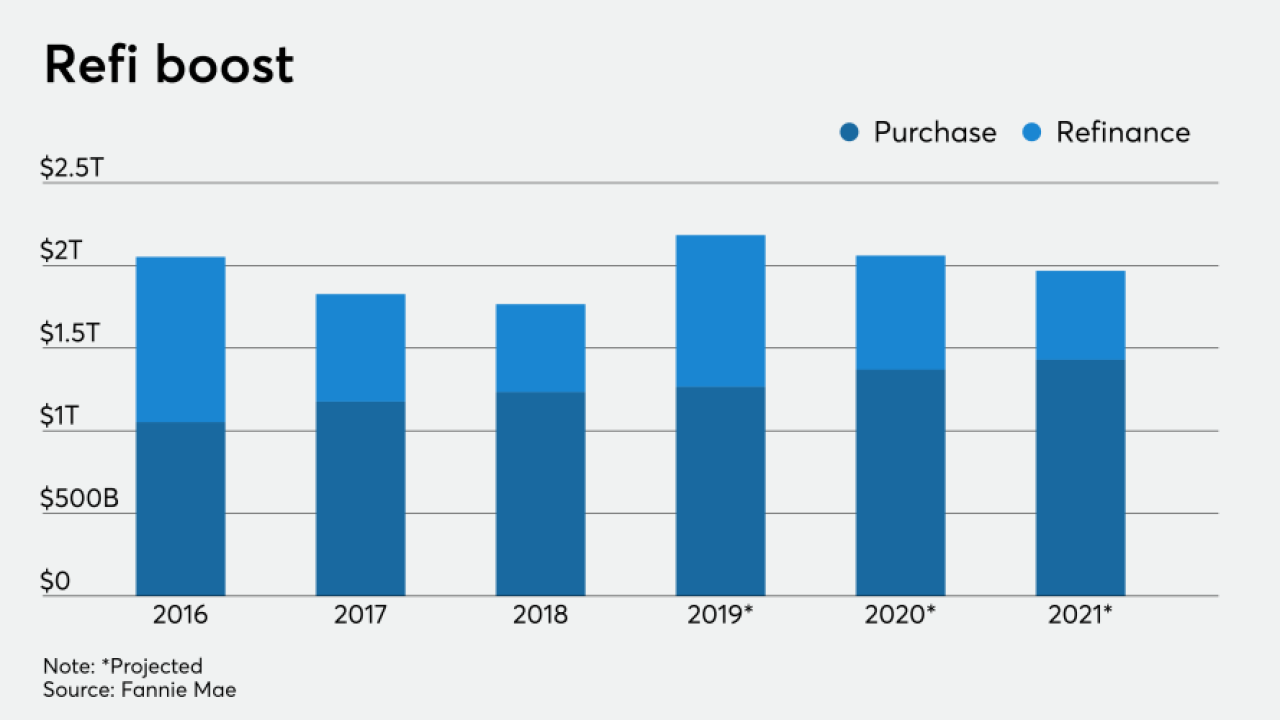

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22 -

The newly acquired industrial portfolio of transportation centers in major markets adds to Blackstone's global holdings of logistics properties in major transit hubs.

January 21 -

The Federal Housing Finance Agency is considering bringing back the idea of imposing stricter criteria for purchasing mortgages in areas where residential Property Assessed Clean Energy financing is available.

January 21 -

The $430.2 million PSMC 2020-1 transaction is a pool of 602 large-sized loans with an average loan balance of $715,978, all of which meet CFPB's QM standards.

January 21 -

The agency is sending a strong message that it won’t rush to end an exemption for Fannie Mae and Freddie Mac while also signaling longer-term changes that will affect all lenders.

January 21