Getting Fannie Mae and Freddie Mac out of conservatorship has been an elusive goal. It will remain elusive, says DeMarco, in the absence of broader reform of housing finance, something that will require bipartisan support.

-

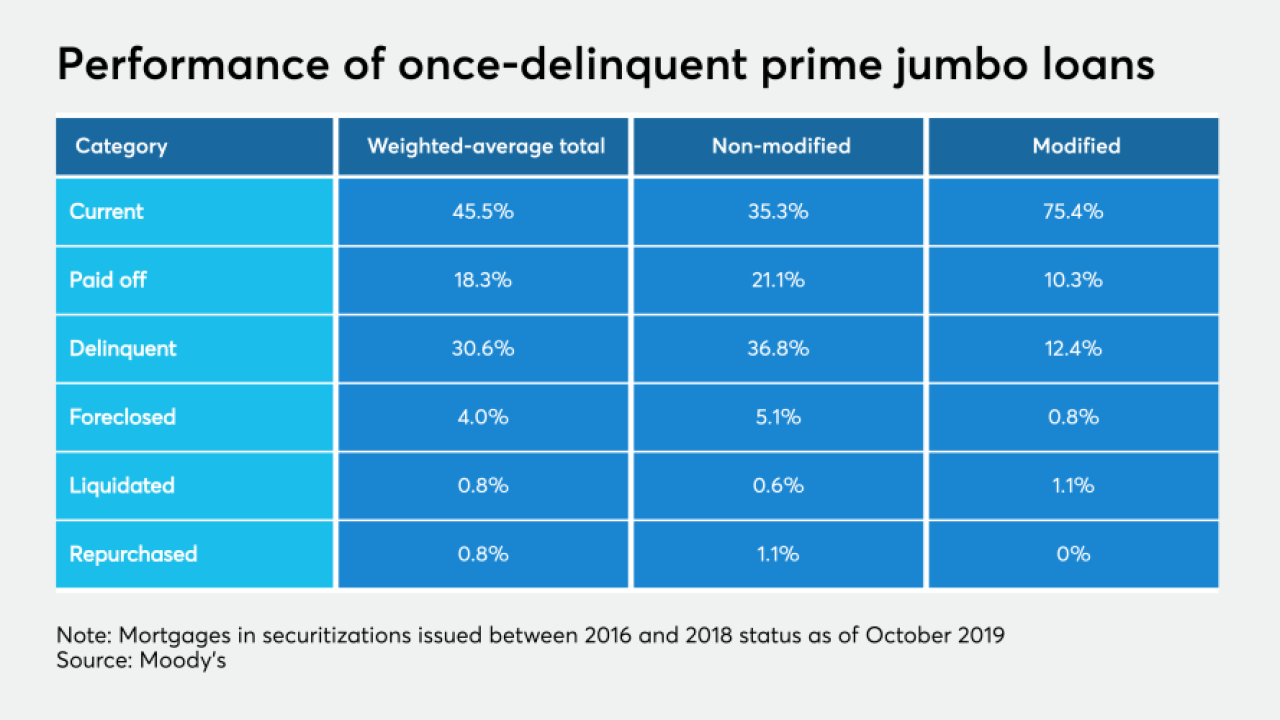

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 4 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 3 -

The two agencies said they will exchange student loan complaint data after their information-sharing efforts had been in limbo for over two years.

February 3 -

Sunnova Energy Corp. is marketing $313.5 million in bonds secured by receivables of a pool of residential solar-panel leases and power-purchase agreements issued in 20 states and three U.S. territories.

February 3 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3

-

The data management and analytics firm has tapped Craig Phillips, a former top aide to U.S. Treasury Secretary Steven Mnuchin, as a senior adviser for the five-year-old firm’s business and product development activities in the mortgage loan space.

February 3 -

Toyota Motor Credit Co. is sponsoring a $1.25 billion loan-backed transaction (potentially upsized to $1.75 billion), while regional Toyota captive finance lender World Omni Finance Corp. is sponsoring an auto-lease deal at either $766.5 million or $962.9 million.

February 3 -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 2 -

Nonbanks hold a disproportionate percentage of the worst-rated loans, but banks hold a majority of the market, and risk management safeguards are largely untested, according to an interagency report on shared national credit.

January 31 -

Mortgages, auto loans and credit cards should perform well for the next two quarters. Beyond that, all bets are off.

January 31 -

The agency has named Thomas G. Ward as the bureau’s assistant director for enforcement. House Democrats have questioned Ward's role as a political appointee in the Trump administration.

January 30 -

Sallie's first student-loan securitization of the year comes a week after SLM Corp. announced plans to sell more loans from its portfolio to fund a share buyback program.

January 30