The Detroit lender disclosed that the consumer bureau had sent a civil investigative demand to Rocket Homes Real Estate for potential violations of the Real Estate Settlement Procedures Act.

-

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

The global pandemic and stalled trade negotiations have discouraged farmers and ranchers from taking on more debt and made banks uneasy about extending more credit.

August 4 -

Avis is sponsoring its next $500 million securitization financing its rental fleet amid the continued economic impact of the COVID-19 pandemic on the travel industry.

August 4

-

Besides reauthorizing the Paycheck Protection Program, Congress should upgrade the loan forgiveness process, offer businesses the chance to take out a second loan and ensure the pricing satisfies lenders, bankers say.

August 4 -

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

August 4 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

Tesla last week priced its latest auto-lease securitization at signficantly reduced spreads from its last deal—reflecting strong investor demand for TALF-backed securities and an improving outlook for the world's largest battery-electric vehicle (BEV) manufacturer.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

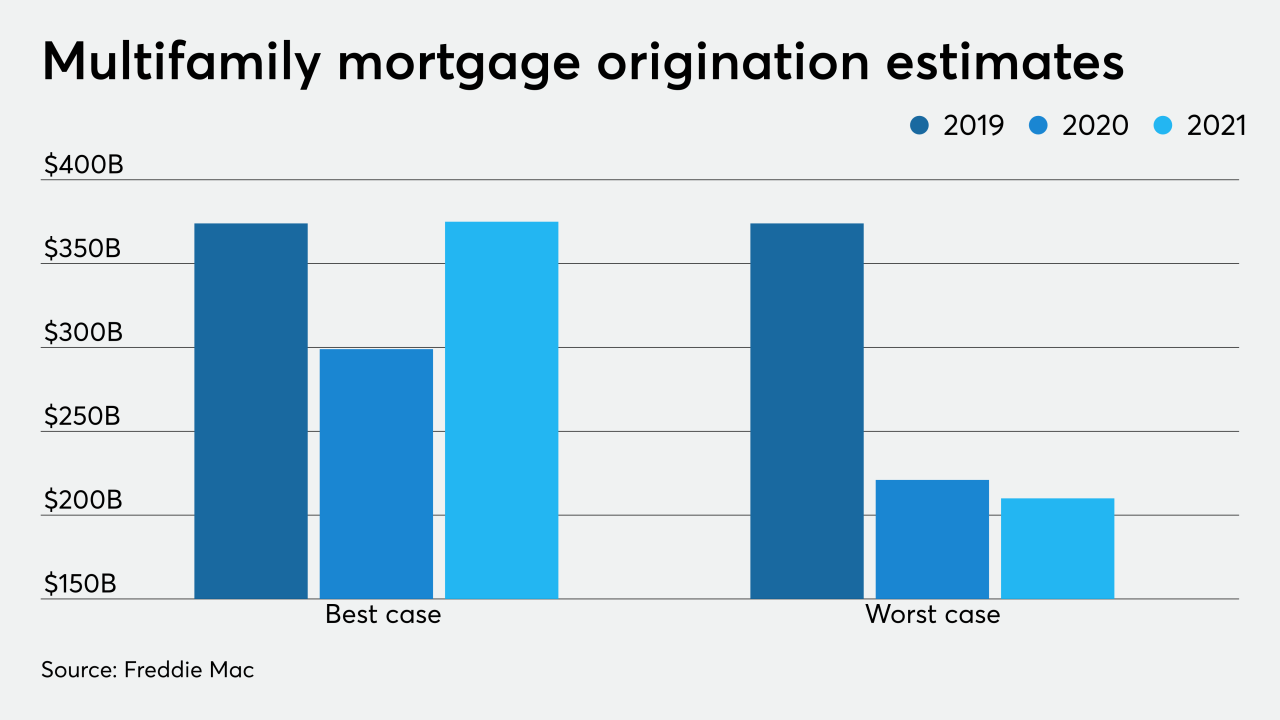

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

No two properties are alike, so lenders are tailoring their approaches for modification, forbearance and repayment of loans to a sector devastated by the pandemic.

August 2