The trustee is piloting a distributed-ledger program that can automate much of the interaction between originators, servicers and MBS investors.

-

Tesla last week priced its latest auto-lease securitization at signficantly reduced spreads from its last deal—reflecting strong investor demand for TALF-backed securities and an improving outlook for the world's largest battery-electric vehicle (BEV) manufacturer.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

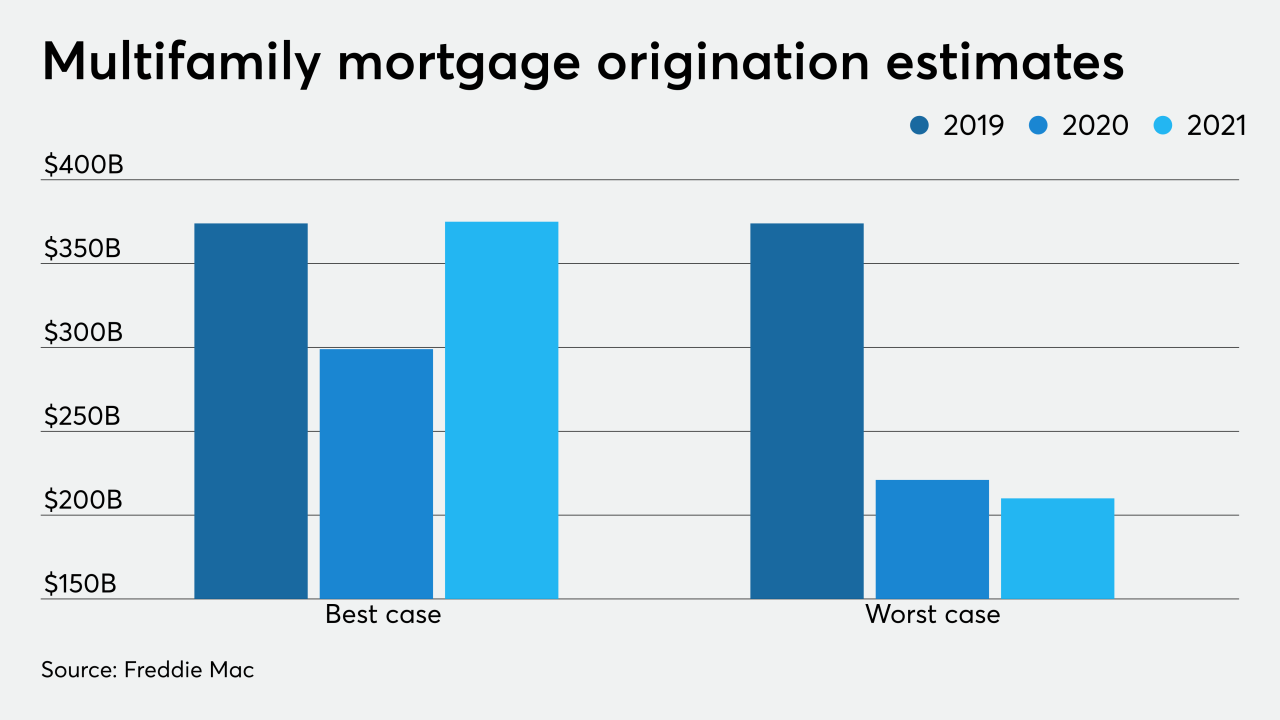

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

No two properties are alike, so lenders are tailoring their approaches for modification, forbearance and repayment of loans to a sector devastated by the pandemic.

August 2 -

The Conference of State Bank Supervisors, banking law scholars and consumer advocacy organizations filed amicus briefs siding with the New York State Department of Financial Services in its court battle with the federal regulator.

July 31

-

In its sixth securitization of 2020, IPFS Corp. is pursuing a $400 million deal backed by a revolving pool of insurance-premium finance loans and secured by the right to receive the unearned premium amounts from the loans.

July 31 - LIBOR

More than 2,500 Fitch-rated structured finance transactions face significant challenges transitioning from Libor to an alternative floating-rate benchmark, but the ratings agency doesn’t foresee that resulting in potential ratings downgrades until 2022.

July 31 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

The $156.5 million Amax Mortgage Loan Trust 2020-B is collateralized by 764 seasoned “re-performing” loans (RPLs), which are mortgages that were previously delinquent, as long as 90 days, but have recently been performing well.

July 30 -

Verizon is launching its 12th securitization of device payment-plan agreements, marking its second asset-backed issuance this year.

July 30 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

The private equity megalith's mortgage trust made a second-quarter net income of over $17.5 million and $85.2 million in core earnings.

July 30