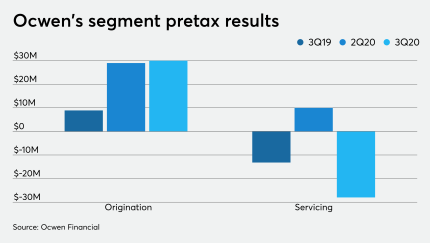

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

-

Mortgage applications increased 3.8% from one week earlier as a drop in most loan interest rates brought on an increase in refinance activity, according to the Mortgage Bankers Association.

November 4 -

If days go by without a clear result, the uncertainty could lead to market volatility, put off talks for a stimulus plan and complicate bankers' planning for a potentially new regulatory environment.

November 4 -

The race enters a complicated phase that could impact financial markets.

November 4 -

Loan issuers in the hotel/leisure, oil and gas, retail and business equipment/services industries – which make up nearly a quarter of the S&P/LSTA Leveraged Loan Index – are expected to lead the default tally over the next 12 months, according to a report from S&P.

November 3 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3

-

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Loop Capital Markets was lead underwriter and joint bookrunner on an upsized $1.2 billion deal that serves as the first asset-backed market transaction to feature a minority-owned firm as a lead.

November 2 -

But both fell short under the Duty to Serve goals in rural housing.

November 2 -

Payment rates for auto lenders and credit card issuers have remained strong despite a spike in unemployment. Whether these trends continue into 2021 will depend largely on the actions of Congress and the pace of medical advances.

November 2 -

A Democratic victory in Tuesday's election would likely produce new leaders at the CFPB and OCC who could take bank regulation in a sharply different direction. Here are some names potentially under consideration.

November 2 -

Annualized returns have now exceeded double digits for the 10th straight year, despite early 2020 volatility related to the coronavirus pandemic.

November 2