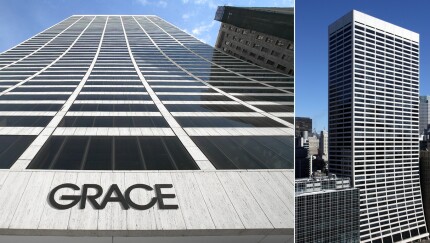

Brookfield and JV partner Swig Co. are refinancing debt and cashing out $200M in equity in the iconic, sloped-base midtown Manhattan office tower.

-

The Mills outlet property in Elizabeth, N.J., has been hit hard by tenant bankruptcies but kept its AAA with Fitch thanks to its proximity to New York and underlying debt-related metrics.

November 20 -

Treasury Secretary Steven Mnuchin called on the Federal Reserve Thursday to let several of its emergency lending facilities expire at yearend and return unused funds provided by Congress. But the central bank wants the programs to continue.

November 19 -

The California fintech plans to issue $80.7 billion in securities backed by consumer installment loans made in conjunction with banks.

November 19 -

Volkswagen has launched a $750 million auto-lease securitization that provides investors with more favorable terms than those it offered in more recent transactions.

November 19 -

Weaker consumer spending data coming into the holiday season, as well as a resurgence of the COVID-19 spread, pushed mortgage rates to a new low, Freddie Mac said.

November 19

-

A Freddie Mac study of loans in forbearance from 2017 and 2020 found that, over both periods, borrowers had low credit scores and high debt-to-income ratios.

November 18 -

Genesis Financial Solutions is pursuing a $135.9 million securitization of credit card receivables, including riskier point-of-sale credits that should provide investors with attractive spreads.

November 18 -

JPMorgan Chase CEO Jamie Dimon says the partisan bickering over coronavirus relief aid is harming households and businesses and jeopardizing the chances of an economic recovery.

November 18 -

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

November 18 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Stimulus and regulatory actions are the main ways in which government policy in the wake of the elections will impact structured finance, according to Fitch Ratings. The degree to which they are affected will depend heavily on Georgia runoff elections Jan. 5.

November 17 -

Three major commercial mortgage lenders have teamed up again this year to securitize $871 million in properties in a CMBS deal that provides investors with a highly concentrated loan pool and higher leverage.

November 17