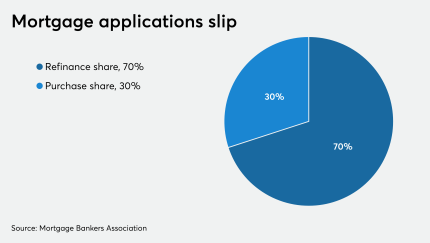

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

-

Vice Chairman of Supervision Randal Quarles said the agency wants to figure out why banks are holding on to capital that could be used more aggressively to respond to the pandemic.

December 2 -

Even government-sponsored enterprise loans, which have seen forbearance rates drop for 24 weeks in a row, saw a slight uptick.

December 1 -

The third offering of bonds secured by non-guaranteed private student loans has a senior-note weighted average life of just 3.44 years, compared to over five years each for two prior Navient SLABS deals this year.

December 1 -

The agency finalized a policy allowing companies to submit formal requests for clarification on a regulatory issue. The bureau said it will publish the advisory rulings in the Federal Register.

November 30 -

Other portions of the casino-property loan have been previously assigned to nine other commercial-mortgage securitizations.

November 30

-

The extension of the FHA’s willingness to conditionally endorse loans with suspended payments came amid a renewed push by public and private entities to spread awareness of the CARES Act option.

November 30 -

The WA FICO of 710 contrasts with the range of 554 to 635 in recent Carvana securitizations centered on subprime borrowers.

November 30 - LIBOR

The move would alleviate near-term risks and potential disruption with legacy securitization and structured-finance portfolios should all key Libor rates cease publication after 2021, as originally planned.

November 30 -

The central bank will prolong the life of the Commercial Paper Funding Facility and three other programs while returning congressionally approved funds for five separate facilities that will shut down Dec. 31.

November 30 -

Deals, trends and research in structured finance and asset-backed securities for the week of Nov. 20-27

November 29 -

The proceeds from funds drawn from the notes will be used to replenish the rental car firm's 2021 fleet as it winds through bankruptcy court.

November 27 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25