The Federal Housing Administration is aiming to limit the share of borrowers who have been withdrawing money from the value of their homes.

-

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22 -

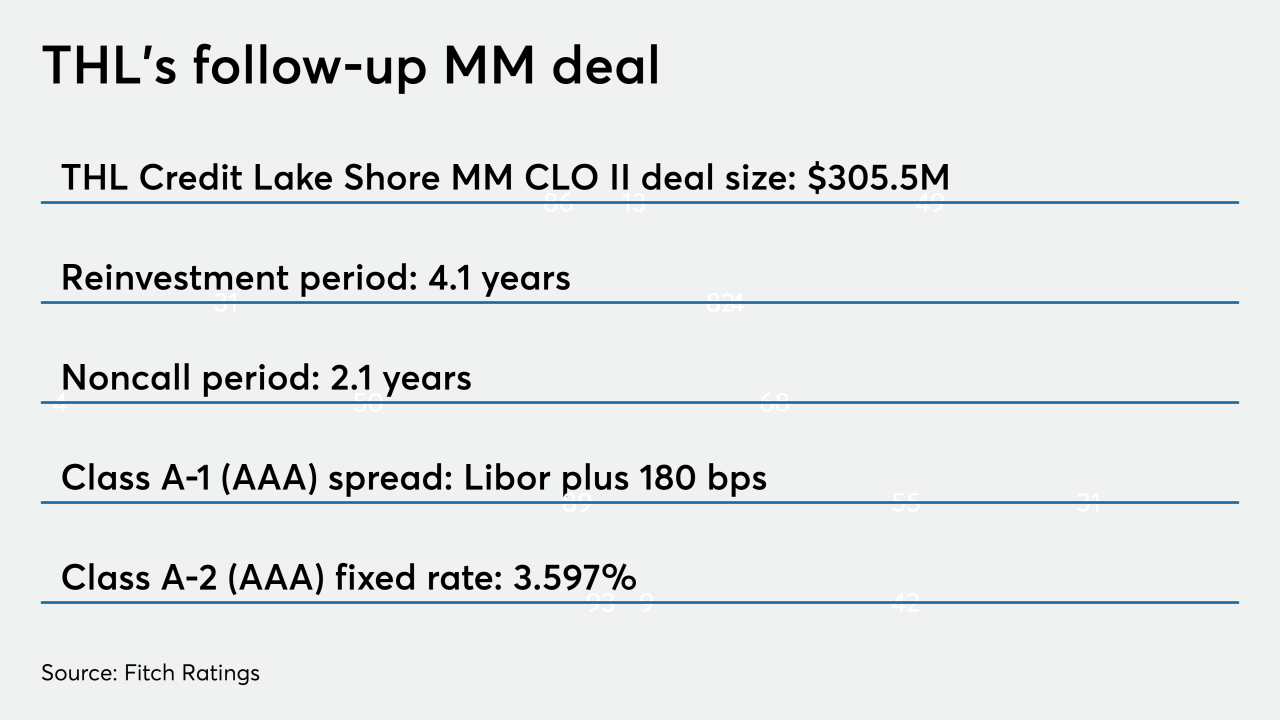

The manager will have four years to actively buy and trade loan assets in THL Credit Lake Shore MM CLO II, compared to two in THL's debut deal from March.

August 21 -

Sheila Bair, who holds board seats at several other organizations, will sit on Fannie's compensation, corporate governance and risk policy committees.

August 21 -

The new $258.4 million NP SPE IX transaction is scheduled to pay off in just seven years, compared to 10 years on NP's last deal in 2017.

August 21 - LIBOR

Trustees are concerned about obtaining proper consents from legacy residential mortgage-backed securities investors in a timely fashion in order to make the switch from Libor to another index, Fitch Ratings said.

August 21

-

After two regulatory agencies adopted final revisions to the rule, Dodd-Frank defenders expressed concern that the amendments to the proprietary trading ban undermined the post-crisis statute.

August 20 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

August 20 -

Freddie Mac is automating a manual form submission process used to correct post-settlement and real estate owned data, and adding policy changes aimed at accommodating electronic signatures on loss mitigation documents.

August 20 -

The agencies had proposed an "accounting prong" as an alternative means to determine which proprietary trades are banned, but their final rule heeded industry concerns that that would be worse than the current approach.

August 20 -

The collaborative workspace officer provider, which filed for its IPO last week, will be securitizing a $240 million loan used in the purchase of the San Francisco building where it leases space to member clients.

August 19 -

Banks stand to enjoy new flexibility in complying with Dodd-Frank’s proprietary trading ban, but it remains to be seen if regulators will grant them all the relief they have sought.

August 19 -

Robert G. Cameron, a former official at the Pennsylvania Higher Education Assistance Agency, will succeed Seth Frotman as the bureau's point person on student lending complaints.

August 16