Trustees are concerned about obtaining proper consents from legacy residential mortgage-backed securities investors in a timely fashion in order to make the switch

"While the trustees await explicit guidance from external parties for Libor replacement, it's currently unclear that this guidance will be forthcoming in a timely manner," the ratings agency said in a press release reflecting recent roundtable discussions it had.

"The trustees highlighted a need for greater awareness of key bondholder communication challenges; they believe that the most significant concerns exist for legacy RMBS containing poorer index transition language in governing documents."

The

"While transaction documents for recently issued transactions

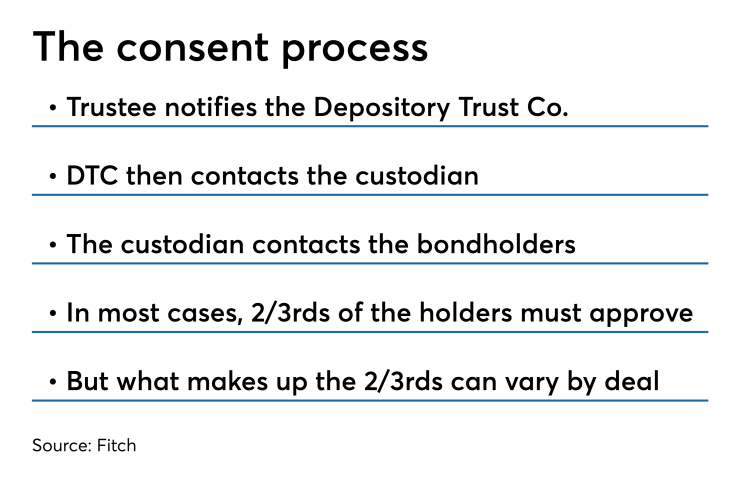

"The documents often require the trustee to obtain voting consent of 66.67% of the bondholders in a trust — sometimes based on each note and sometimes based on all notes combined — in order to enact a change such as this, increasing the bondholder communication challenge."

Meanwhile, RMBS trustees cannot communicate directly with investors in order to obtain the required consent. Instead they need to go through the Depository Trust Co. DTC will notify the custodians, who will then notify the bondholders. That impacts the timeliness.

There is a potential for payment interruption if the proper amendments to the trust documents for the securitization are not in place by the time the London Interbank Offered Rate sunsets in 2021.

And then there are other problems when it comes to resecuritized real estate mortgage investment conduit bonds, which became popular

"RMBS Re-REMIC deals pose additional complications since these deals may have another trustee in the structure, further extending the line of trustee communication," Fitch said. "Trustees are in discussions with the Structured Finance Association on how to streamline this process, but the incremental challenge in Re-REMICs remains in place today."