Fewer obligors with troubled loans improved default exposure for managers of broadly syndicated CLOs, and provided deeper cushions for overcollateralization tests.

-

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

April 20 -

The pool of pass-through commercial mortgage-backed securities is mostly made up of single-family and multifamily residences.

April 20 -

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

Crédito Real targets borrowers with little or no credit history as well as bad credit, who are undocumented or were recently discharged from federal bankruptcies.

April 19 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16

-

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

Deals, trends and research in structured finance and asset-backed securities for the week of April 9-16

April 15 -

Also, even with bans in place, the total number of filings keeps inching up due to actions taken on vacant properties.

April 15 -

The Michigan lender agreed in 2012 to pay $133 million to resolve civil fraud charges tied to government-backed mortgages. But the deal with the Justice Department came with a catch that eventually allowed Flagstar to pay far less.

April 15 -

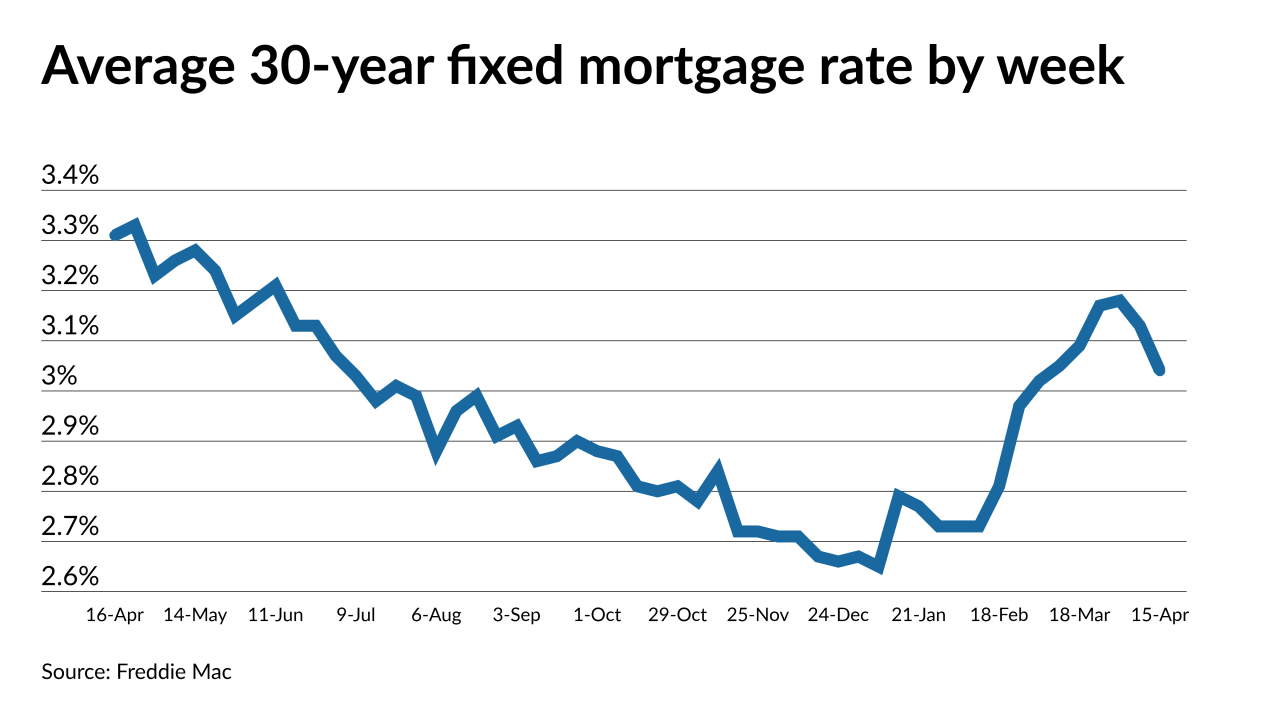

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

The $1.28 billion securitization includes a collateral pool with a higher WA FICO, lower LTV and shorter original terms that its previous loan ABS deal issued last October.

April 15 -

Oaktree Re VI 2021-1 will market $531 million in CRT notes that will provide NMI with partial reinsurance on a $45B pool of GSE-eligible loans.

April 14