While the collateral is high quality, analysts raised concerns about a number of key parties that they feel lack robust securitization experience and financial strength.

-

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1 -

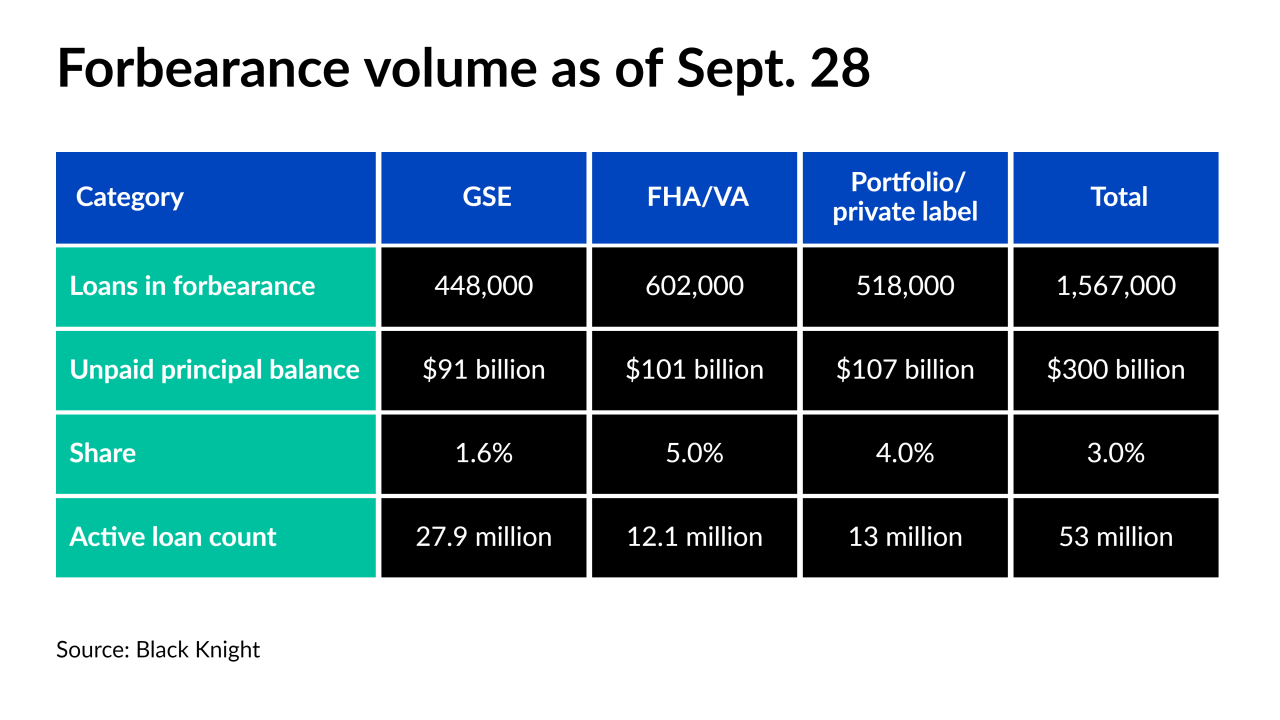

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

BDS 2021-FL9 is allowed to be fully collateralized by multifamily or manufactured housing properties, although it has concentration limits on other property types.

October 1 -

Based in Philadelphia, Mazzeo advises a range of client types on securitizations, and guides private equity and hedge fund managers through structured transactions.

October 1 -

While PLS loans still represent a sliver of the overall mortgage market and are nowhere near the $1 trillion level seen before the Great Recession, issuance jumped markedly this year.

September 30

-

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30 -

Taper announcement, slowing COVID cases help remove downward pressure, leading to increases across all loan-term types.

September 30 -

While the collateral is high quality, analysts raised concerns about a number of key parties that they feel lack robust securitization experience and financial strength.

September 30 -

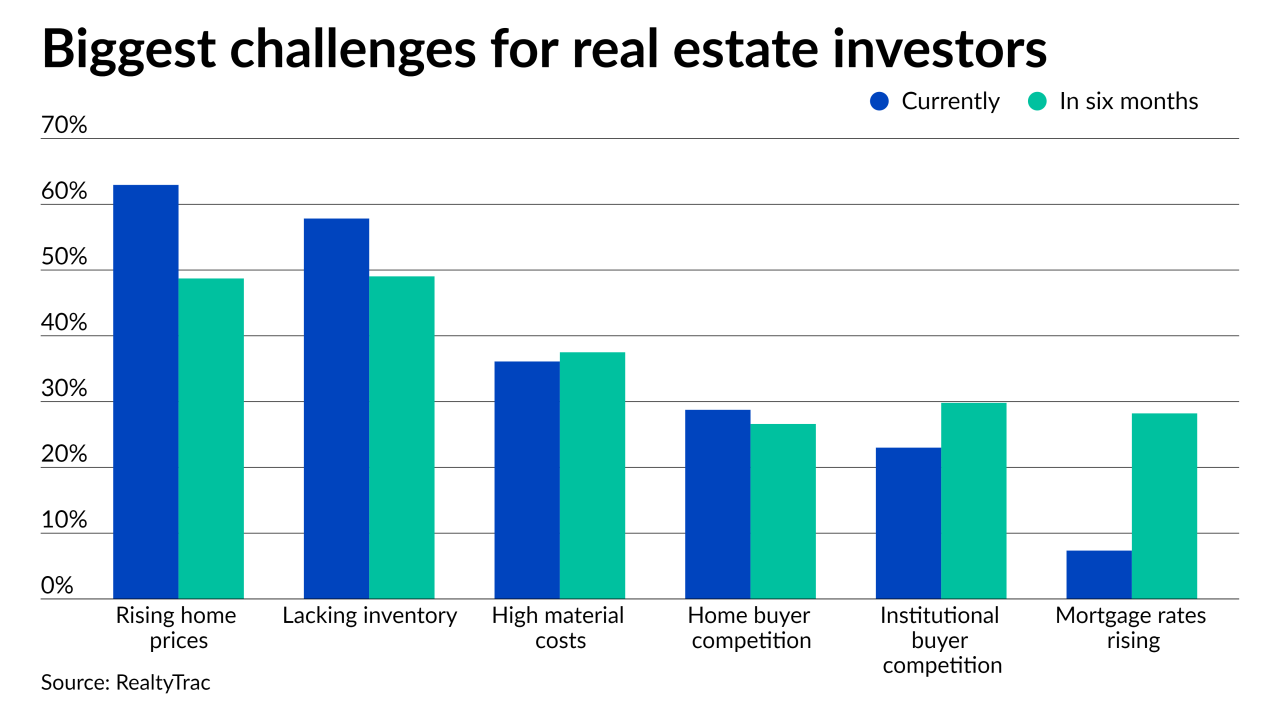

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Criticism from banking and other business groups of Saule Omarova’s candidacy could make it difficult for moderate Democrats to support President Biden's pick to lead the Office of the Comptroller of the Currency.

September 29 -

CIM is secured by home loans making the most of second chances, and borrowers retaining their homes throughout several economic dips.

September 29 -

Many banks are still making loans tied to the scandal-plagued benchmark despite years of preparation for its demise. The end of 2021 could prove hectic as bankers scramble to implement changes and explain them to commercial borrowers.

September 28