Market conditions suggest that the SFR has positive forward momentum, with a healthy stream of deals in the securitization pipeline through the end of 2021.

-

Primarily, the underlying mortgage collateral consists of 1,982 peak-vintage seasoned and re-performing loans, about 90% of which have been modified.

July 14 -

The Capital One Multi-Asset Execution Trust, a master trust, resurfacing after 2019, has the flexibility to issue either a single-note or multiple-note series.

July 13 -

Single-family rental houses and townhomes underpin the securitization, with a feature to transfer or obtain a release of any property that meets conditions.

July 13 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

The card network and telco are designing systems that use 5G to support more payment processes hosted in the cloud rather than on local hardware. The goal is to make services such as autonomous checkout available to small businesses.

July 13

-

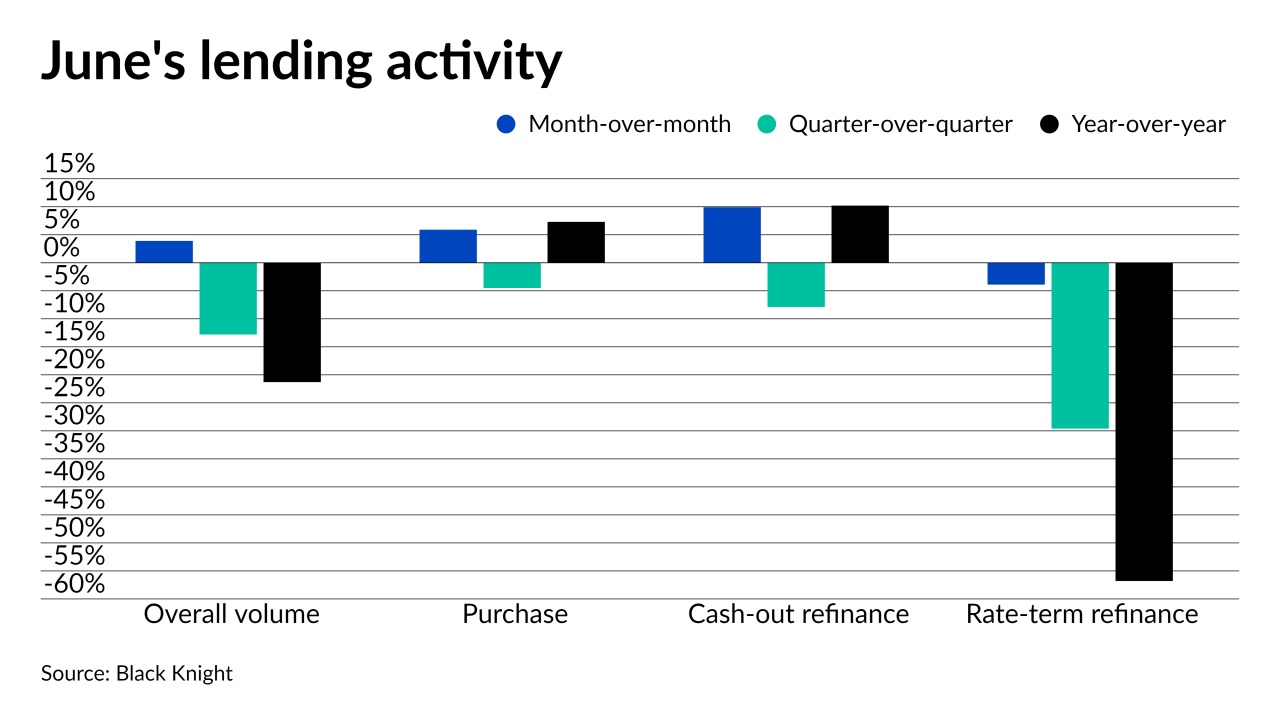

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

The sweet 'WBS' deal will raise funds from Nothing Bundt Cakes' vast franchise operation to repay corporate debt and help fund general corporate purposes.

July 12 -

Market conditions suggest that the SFR has positive forward momentum, with a healthy stream of deals in the securitization pipeline through the end of 2021.

July 12 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12 -

KBRA highlights regulatory issues surrounding the deal and sector.

July 9 -

KBRA says credit quality is assessed via the firm's internal assessments.

July 9 -

Both the prime and non-prime auto loan ABS sectors are seeing activity.

July 8