RFS Asset Securitization could issue additional notes, up to $500 million, at any time during the revolving period, which could be as soon as June 2024.

-

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

Toyota had granted payment deferrals up to 120 days to eligible borrowers during the pandemic, and then resumed old deferral practices as of June 30, 2020.

July 22 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

The 10 largest loans in the deal have high balances, ranging from $2 million to $2.9 million, and California represents half of it’s geographic concentration.

July 22 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22

-

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

RFS Asset Securitization could issue additional notes, up to $500 million, at any time during the revolving period, which could be as soon as June 2024.

July 21 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

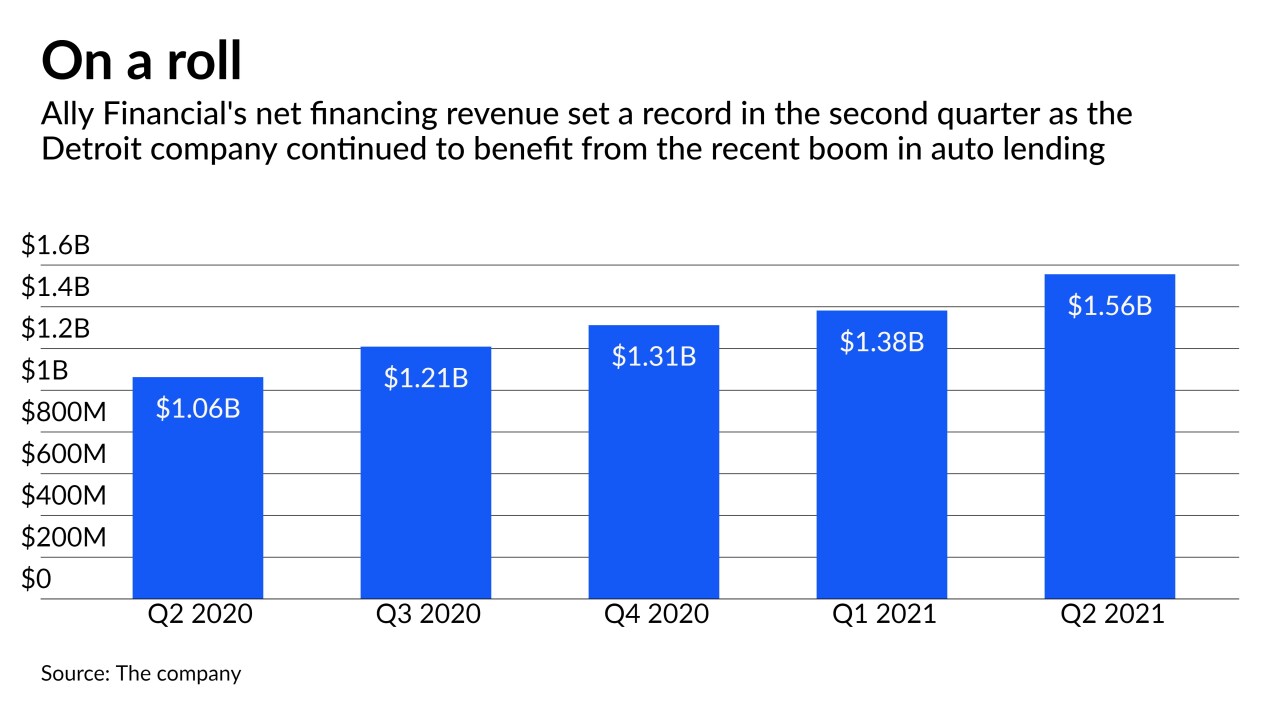

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

Industry observers say they expect current market conditions to support healthy deal flow through the end of 2021.

July 20