Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

-

The potential amendments could expand coverage but also add new record-keeping and systems requirements for large banks handling custodial accounts.

July 27 -

The trust scales back on its office concentration, and increases multifamily and retail exposure. The latter's concentration is higher than all YTD averages since 2019.

July 27 -

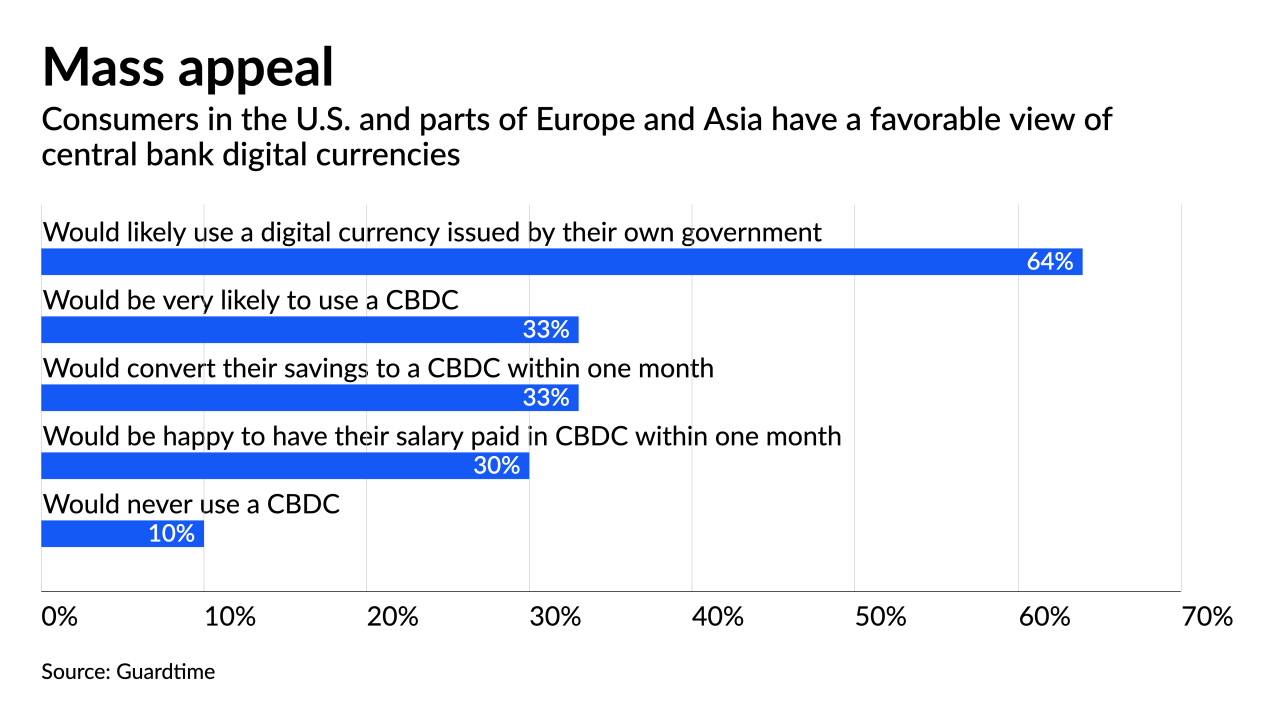

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

Expanded prime and non-prime mortgages underpin the pool in the deal, issuing $459.8 million in notes.

July 26 -

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26

-

States in its footprint have some of the lowest vaccination rates in the country. Another round of shutdowns could further damage industries like hospitality that have already been hit hard by the pandemic, executives said.

July 23 -

Similar to other CLOs, Golub 54 has a reinvestment period of four years, with a two-year non-callable period.

July 23 -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

Toyota had granted payment deferrals up to 120 days to eligible borrowers during the pandemic, and then resumed old deferral practices as of June 30, 2020.

July 22 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

The 10 largest loans in the deal have high balances, ranging from $2 million to $2.9 million, and California represents half of it’s geographic concentration.

July 22 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22