The current deal uses a capital structure virtually identical to the 2021-NMQ2, with three classes of senior notes with ratings ‘AAA’ to ‘A’, that will pay on a pro rata basis.

-

The supply chain crunch appears to be reflected in this deal, which has the smallest collateral pool of lease contracts since 2019, at 35,020.

October 21 -

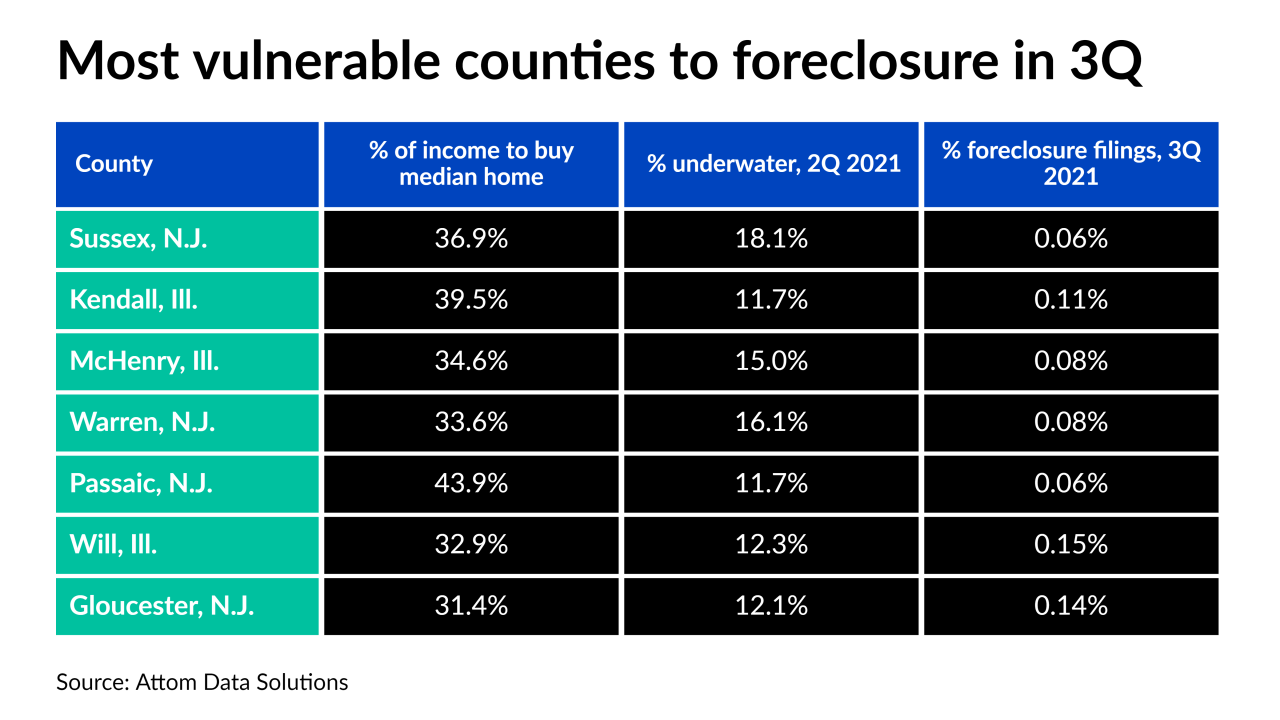

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

The Oportun Issuance Trust 2021-C is one of the first deals on the platform to be backed by secured personal loans.

October 20 -

The reception in the market to structured single-family CRTs' return at the government-sponsored enterprise was strong enough for it to plan to follow up this transaction with another one next month.

October 20 -

Federal and state banking agencies released a joint statement calling on financial institutions to conduct the "due diligence necessary" to select a new reference rate benchmark that is suitable for their risk profile.

October 20

-

Borrowers on the underlying loans in PMT Loan Trust 2021-INV1 have a weighted average (WA) original credit score of 778, plus a WA debt-to-income ratio of 34.6%.

October 19 -

Velocity has seven classes of securities divided into 25 subclasses, including 15 that are entitled to principal and interest, seven to only interest, and one to any remaining excess cash.

October 19 -

The current deal uses a capital structure virtually identical to the 2021-NMQ2, with three classes of senior notes with ratings ‘AAA’ to ‘A’, that will pay on a pro rata basis.

October 18 -

The transaction is a $340.0 million interest-only, floating-rate mortgage loan with an initial three-year loan term and two successive one-year extension options.

October 18 -

Changes in the Fed, including the replacement of Jay Powell as chairman, might shift the board back to a dovish economic position.

October 18 -

The size of the current deal stems mostly from the ‘AAA’ piece, which was $210 million, compared to $162 million in the last ABS. Earlier deals hovered around $250 million.

October 15 -

The bank, which acquired General Electric’s health care lending business in 2015, is looking to expand its presence amid a merger boom in the sector.

October 15