The supply chain crunch appears to be reflected in this deal, which has the smallest collateral pool of lease contracts since 2019, at 35,020.

-

Credit conditions are currently considered strongly favorable, but intractable issues from COVID-19, and the likelihood for high interest rates have money managers worried about the direction of corporate defaults.

October 25 -

Average incomes for this age group increased by 24% since 2012, but housing prices jumped 86%.

October 25 -

The enormous issuance is backed by a single loan secured by first-priority mortgages on a pool of about 6,148 single-family rental homes, and 299 townhouses.

October 25 -

The deal is fortified with collateralization, subordination and reserve accounts throughout the capital structure to get most of the notes to top ratings.

October 22 -

Trustmark Bank agreed to pay $9 million to resolve allegations that it discriminated against Black and Hispanic residents in Memphis, Tennessee. Attorney General Merrick Garland said the Department of Justice and other agencies will continue their crackdown.

October 22

-

The industry is prioritizing Black and Hispanic consumers in the interest of social equity and to tap new markets amid declining refinance volume and rising rates.

October 22 -

Roger Hochschild predicts consumers will keep using their Discover cards in the months ahead, particularly when shopping online.

October 21 -

The supply chain crunch appears to be reflected in this deal, which has the smallest collateral pool of lease contracts since 2019, at 35,020.

October 21 -

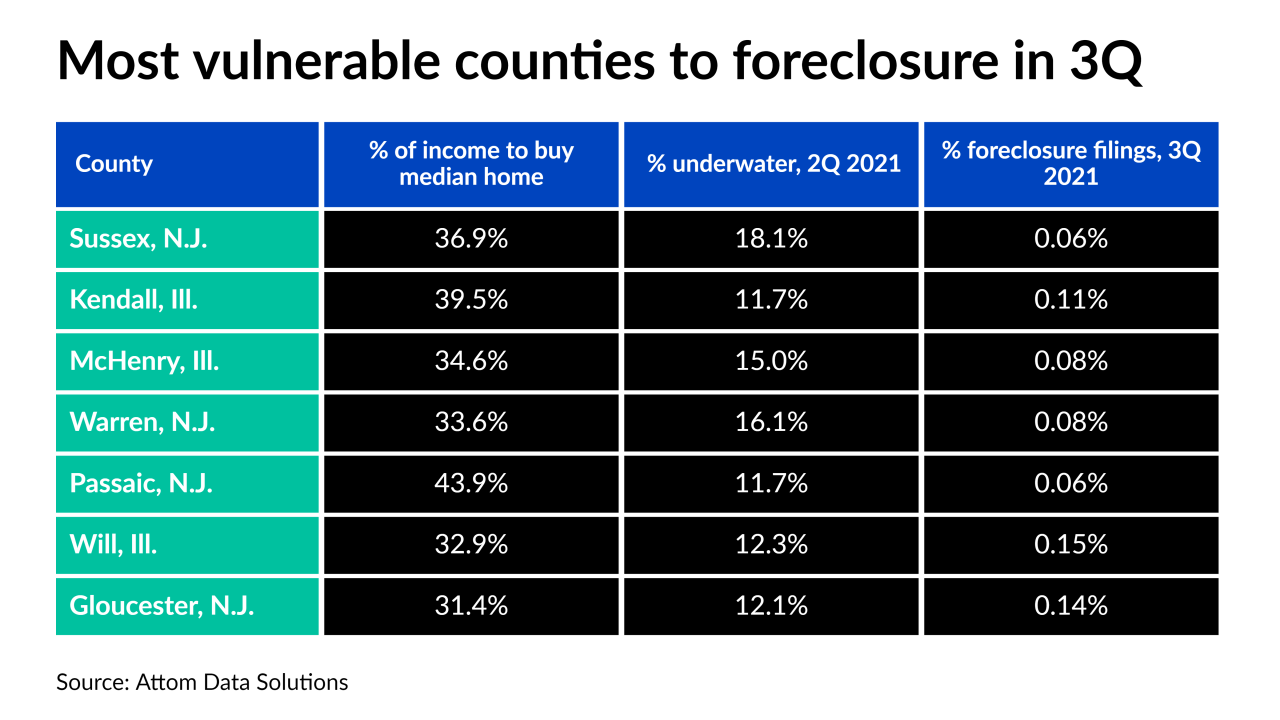

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

The Oportun Issuance Trust 2021-C is one of the first deals on the platform to be backed by secured personal loans.

October 20 -

The reception in the market to structured single-family CRTs' return at the government-sponsored enterprise was strong enough for it to plan to follow up this transaction with another one next month.

October 20 -

Federal and state banking agencies released a joint statement calling on financial institutions to conduct the "due diligence necessary" to select a new reference rate benchmark that is suitable for their risk profile.

October 20