Although the deal, which closes on November 26, is the first securitization from Ansley Park, its owned portfolio since January 2024 has had strong performances with no losses to date.

-

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

GDLP 2025-3 has a so-called vertical risk retention structure, where 95% of the collateral balance is allocated to the noteholders, while retained interest noteholders will hold the rest.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Spread premiums on esoteric ABS attract new types of investors, including those managing insurers' assets.

November 18 -

If class A notes fail a credit enhancement rest, a cumulative default ratio amortization event occurs, or the pool balance is 10% or less, then GSKY 2025-3 will move to a sequential pay structure.

November 17

-

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

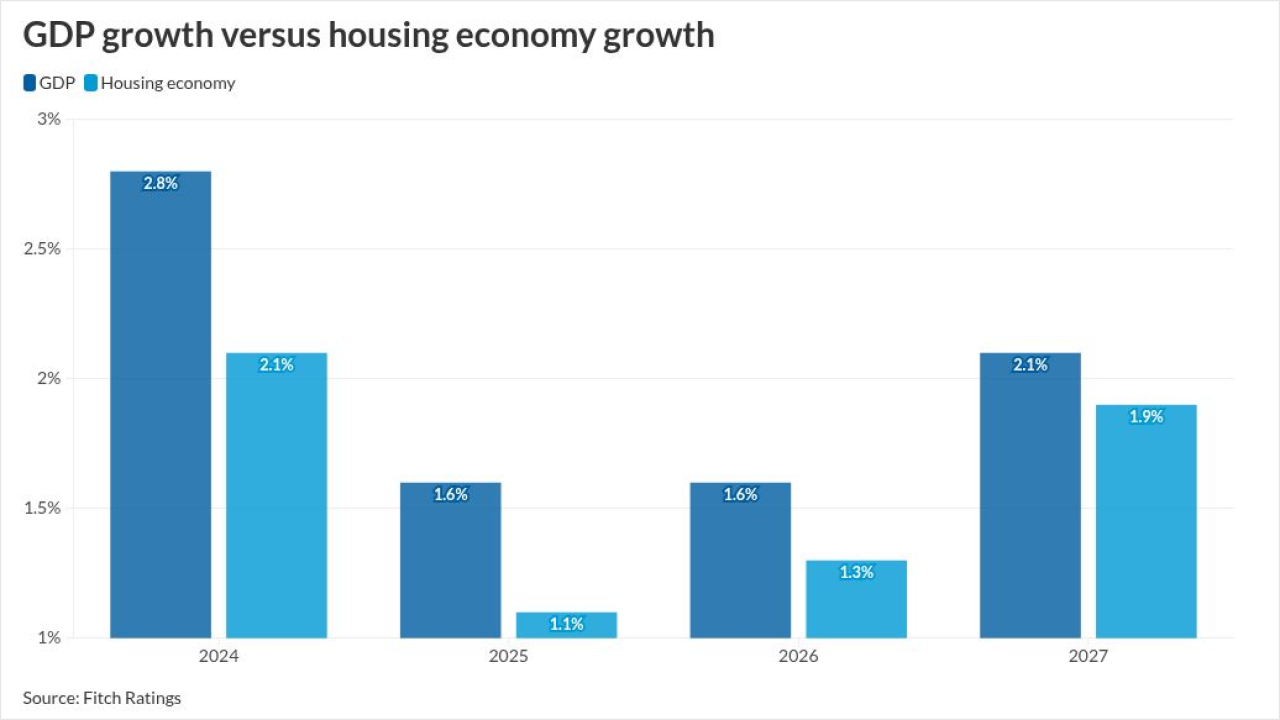

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

Since introducing the Upstart Macro Index to address increasing delinquency rates in previous years, the changes to its underwriting and credit models have improved future vintages' performances.

November 14 -

Loan sizes are only $477.50 on average, while borrowers attached to the contracts have weighted average FICO scores of 727.

November 13 -

The proceeds from the deal will recoup costs for repairs on energy infrastructure damaged after Hurricane Helene in 2024.

November 13 -

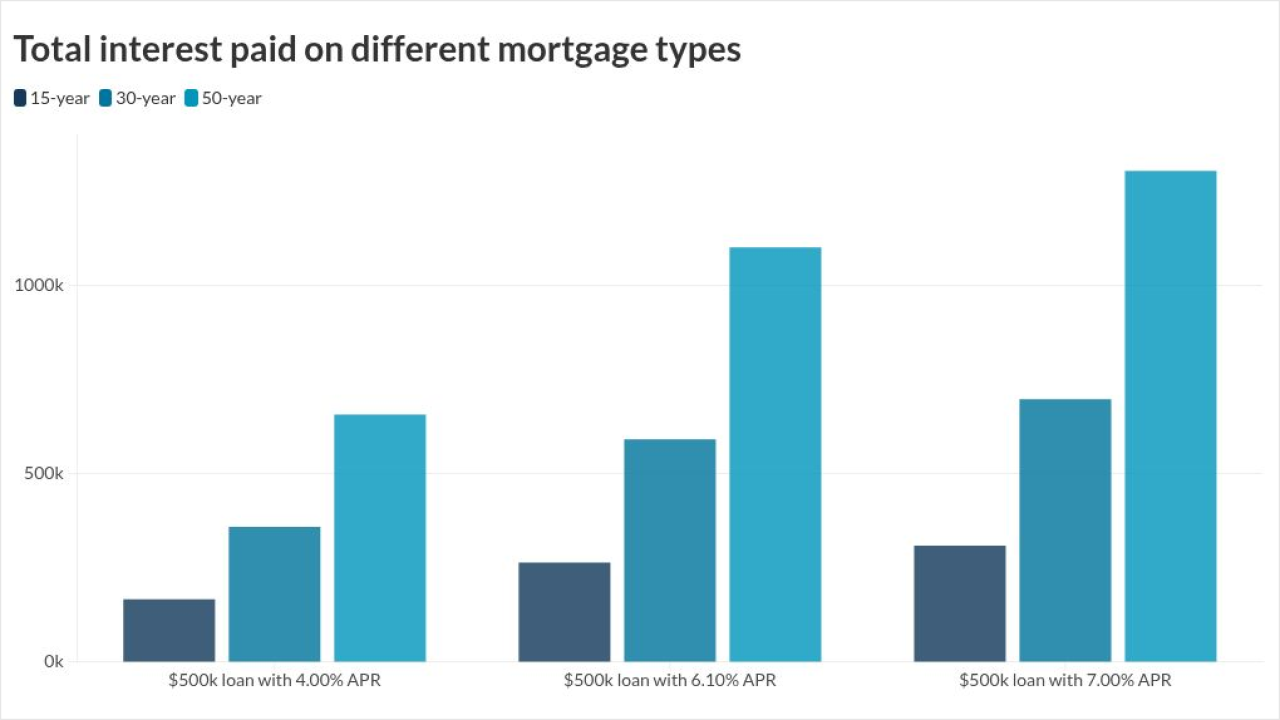

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13