-

Many originators stopped making riskier products, including jumbo loans and low credit score offerings, during April.

May 7 -

The government-sponsored enterprises have set new temporary limits on mortgage sales while extending processing flexibilities related to COVID-19.

May 6 -

Some benefits are materializing from Fannie Mae's pledge to limit servicers' exposure to principal-and-interest advances the way Freddie Mac does, but counterparties of both GSEs remain exposed to other concerns.

May 6 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Correspondent loan sellers are hoping the new GSE purchases will help to open a market frozen by coronavirus-related risk — but the prices offered so far aren't too promising.

April 24 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

April 11 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to lend additional support to the mortgage-backed securities market and temporarily allow some flexibility in lending requirements to address coronavirus-related concerns.

March 23 -

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

March 20 -

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 -

Terry Wakefield, a technology consultant who helped launch Fannie Mae's mortgage-backed securities business and form Prudential Home Mortgage, has died. He was 70.

March 11 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

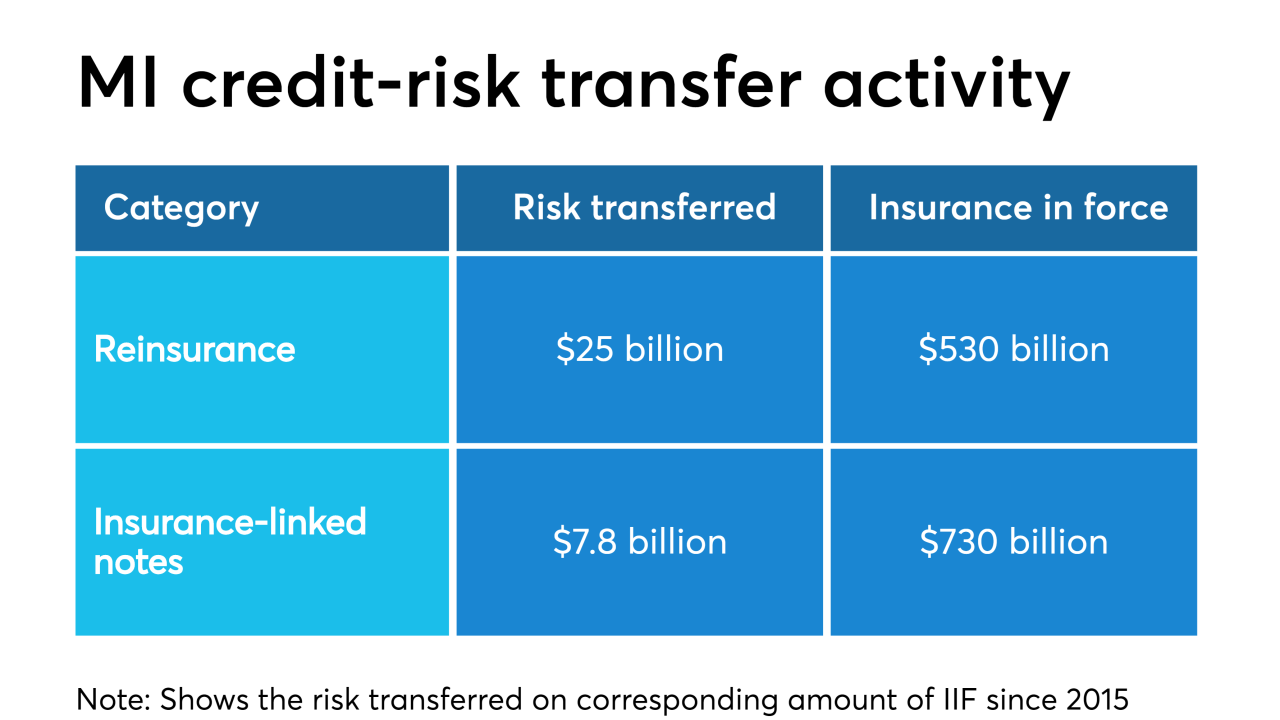

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

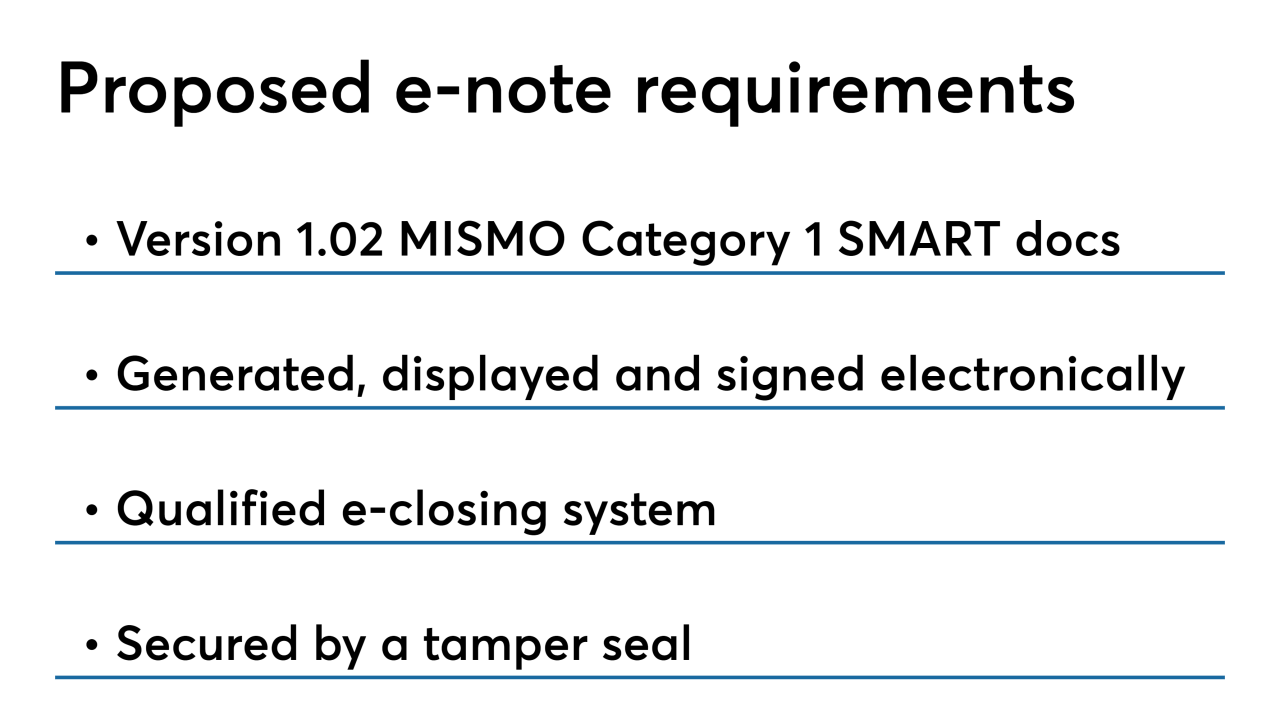

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28