Regulation and compliance

Regulation and compliance

-

The interagency Property Appraisal and Valuation Equity initiative, which was tasked by the Biden administration with rooting out bias in home valuations, appears to have run its course. But experts say it could be years before the group's efforts bear fruit.

August 26 -

Four companies are fighting CFPB enforcement actions by claiming the agency cannot be funded by the Federal Reserve, which has not been profitable since 2022. The consumer bureau calls the new legal theory "meritless."

August 19 -

A bipartisan group of ex-inspectors general is pushing Senate leaders to quickly confirm Christy Goldsmith Romero to chair the Federal Deposit Insurance Corp. despite scheduling delays and the upcoming election.

August 13 -

The change in medical debt reporting initiated by the three credit bureaus did not go far enough as 15 million Americans are still impacted, the groups led by the National Consumer Law Center said.

August 12 -

The Treasury, CFPB and Federal Trade Commission are joining forces to warn consumers about predatory practices in financing solar energy panels.

August 7 -

Sen. Jack Reed, D-R.I., asked the Federal Reserve to require public reporting of synthetic risk transfers — also known as credit risk transfers, or CRTs — through bank call reports and systemic risk reports.

August 5 -

Federal Deposit Insurance Corp. Vice Chair Travis Hill has called for a full reproposal of the Basel III endgame capital standards, emphasizing the need for joint advancement by all three major federal banking agencies and an additional comment period for industry feedback.

July 24 -

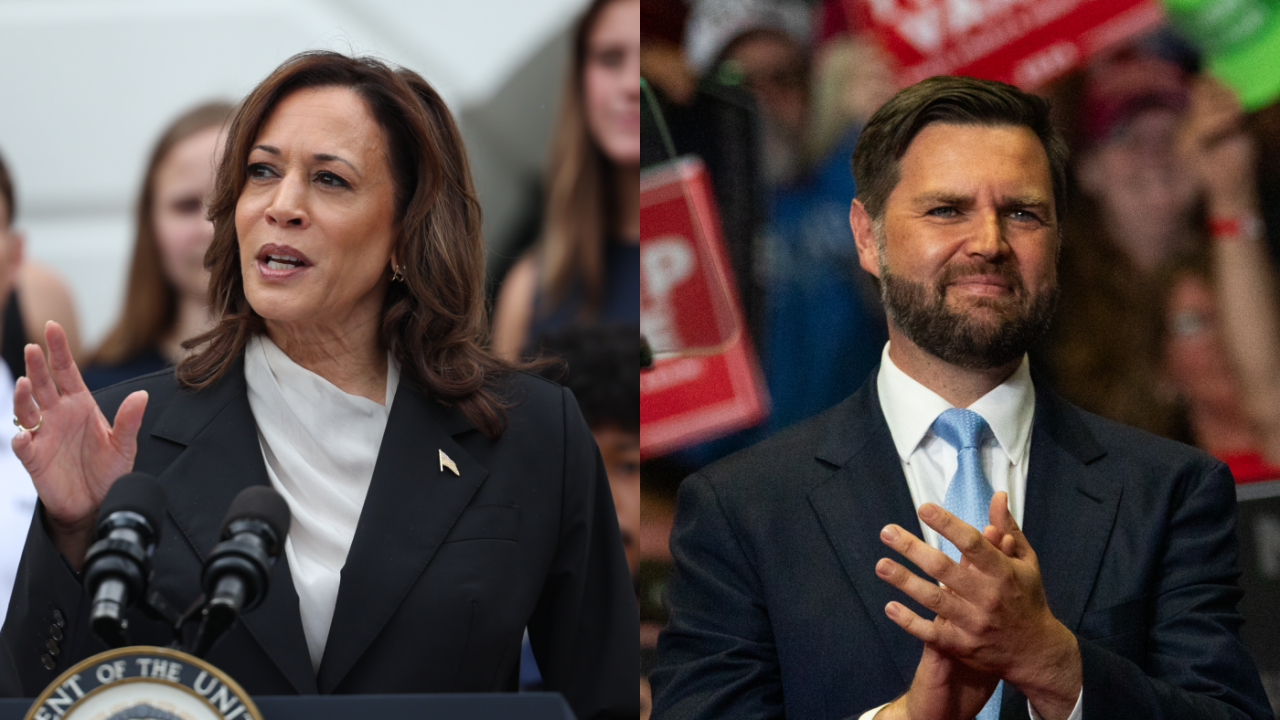

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

The final rule governing the use of automated valuation models for home assessments is substantially similar to the initial proposal made last June.

July 17 -

The investment banking giant said that it will "moderate" its pace of share repurchases as it continues to talk to the Federal Reserve, which recently increased its stress capital buffer from 5.5% to 6.4%.

July 15 -

During his second day of congressional testimony this week, the Federal Reserve chair said the central bank does not have supremacy over other agencies on their joint rulemaking.

July 10 -

At the CFTC Sterling oversaw the 3,300-plus banks, intermediaries and asset managers registered with the agency, and the examination, rulemaking and enforcement referral programs.

July 10 -

The Federal Reserve chair said there is a consensus within the central bank's board of governors for reproposing its capital rules, but notes that other agencies have not yet signed off on this approach.

July 9 -

Securitizations face fewer complications under the Corporate Transparency Act (CTA) but missed filings can incur stiff penalties.

July 3 -

Federal Reserve Chair Jerome Powell brushed away concerns that a second Trump presidency could imperil the central bank's independence.

July 2 -

The 45% charge provides an interim step toward a longer-term risk-based capital schema for insurers.

July 2 -

Banking experts are divided on how regulators will reshape the capital overhaul and if reported revisions being floated by regulators will meet the banking industry's demands.

June 30 -

The high court's much-anticipated ruling gives federal courts — rather than executive agencies — the power to interpret ambiguous statutes. The decision is expected to facilitate an increase in litigation over banking regulations.

June 28 -

The Federal Reserve attributes the uptick in simulated losses in this year's stress test examination to heightened risks on bank balance sheets and higher expense levels. Credit cards and corporate lending were top areas of concern for the central bank.

June 26