-

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

While the mortgage market began the year healthy, lenders and borrowers need to prepare for the impacts of the coming coronavirus recession.

March 23 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

March 17 -

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

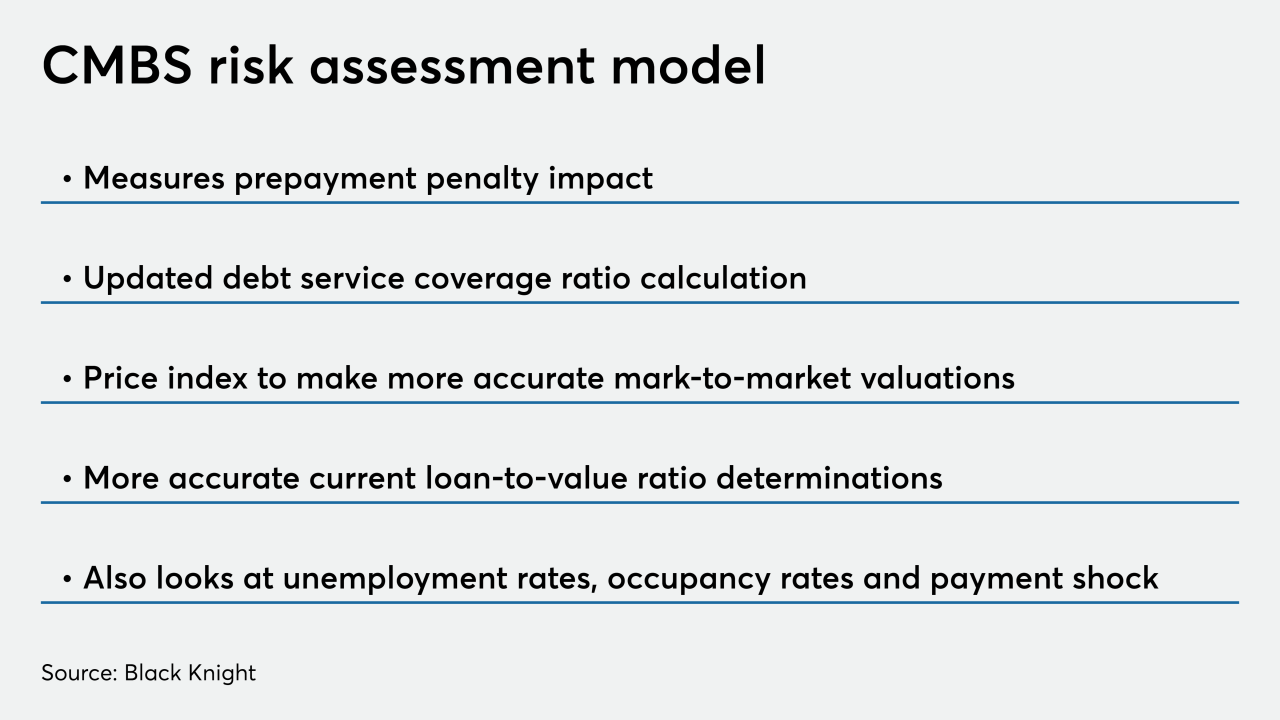

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

SoFi Professional Loan Program 2020-B Trust is a $1.06 billion asset-backed offering of bonds secured by a pool of loans made to advanced-degree graduates of medical, dental or legal universities, or MBA recipients.

February 19 -

A dip in conventional mortgage refinance demand drove mortgage application volume down compared with one week earlier, according to the Mortgage Bankers Association.

February 19 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

The 34 narrowbody and widebody aircraft in the portfolio are older-vintage planes with a weighted average age of 13.8 years, but all but one of the planes remains an in-production model.

February 4 -

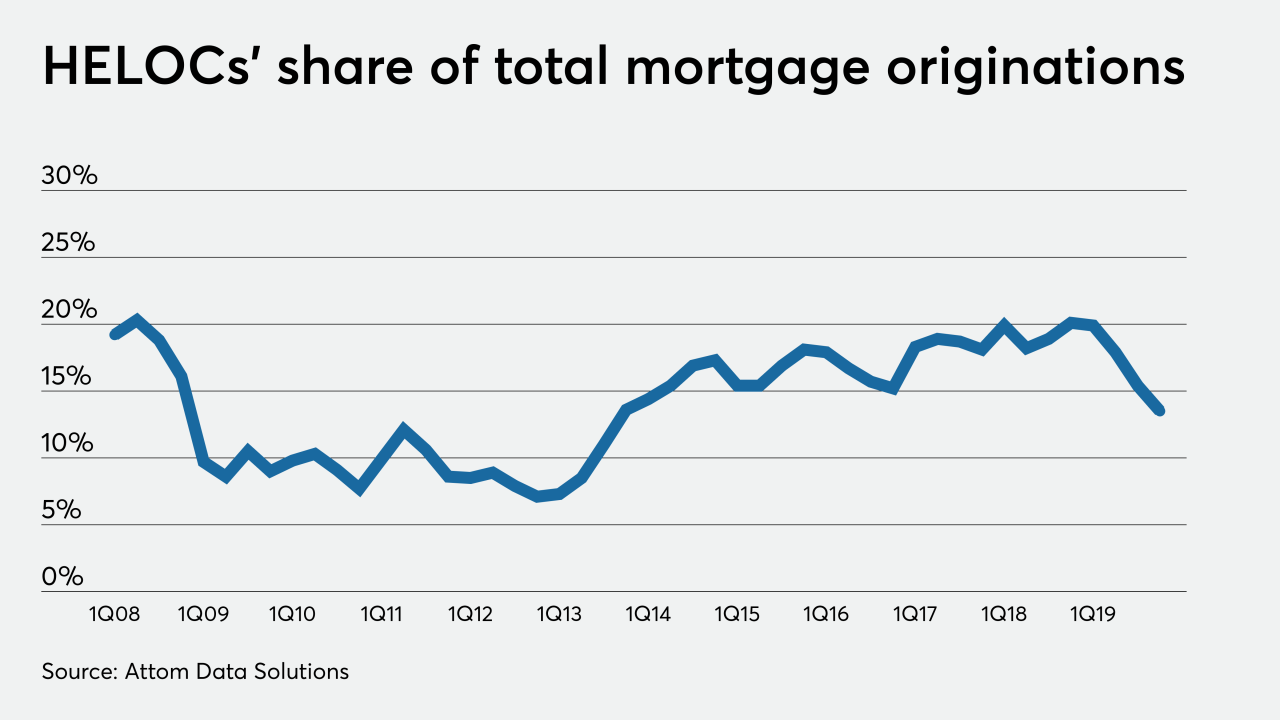

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

The sponsors of the Class A structure, deemed a “trophy asset” by Kroll Bond Rating Agency, are placing $825 million of a $1.2 billion whole loan into a transaction dubbed CPTS 2019-CPT.

November 12 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

A swell of refinance demand amid a low mortgage rate environment pushed lender profit margin outlooks to the highest level since the first quarter of 2015, according to Fannie Mae.

September 11 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28