-

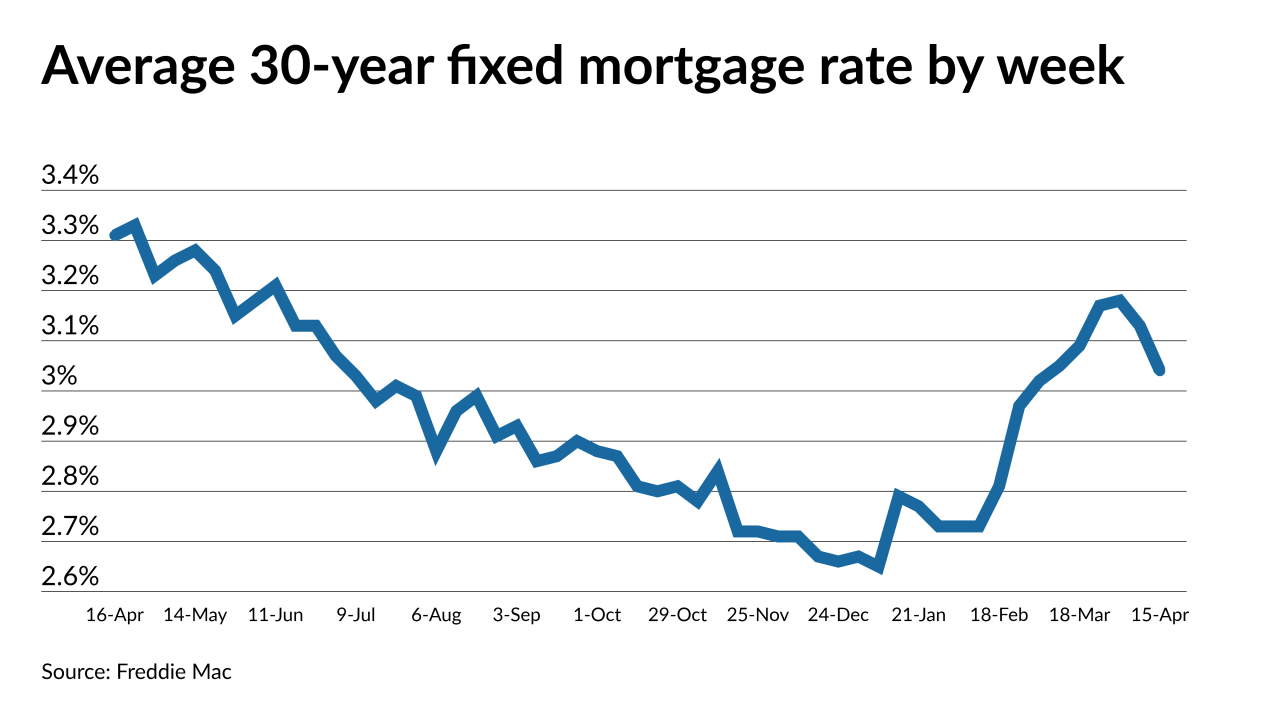

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

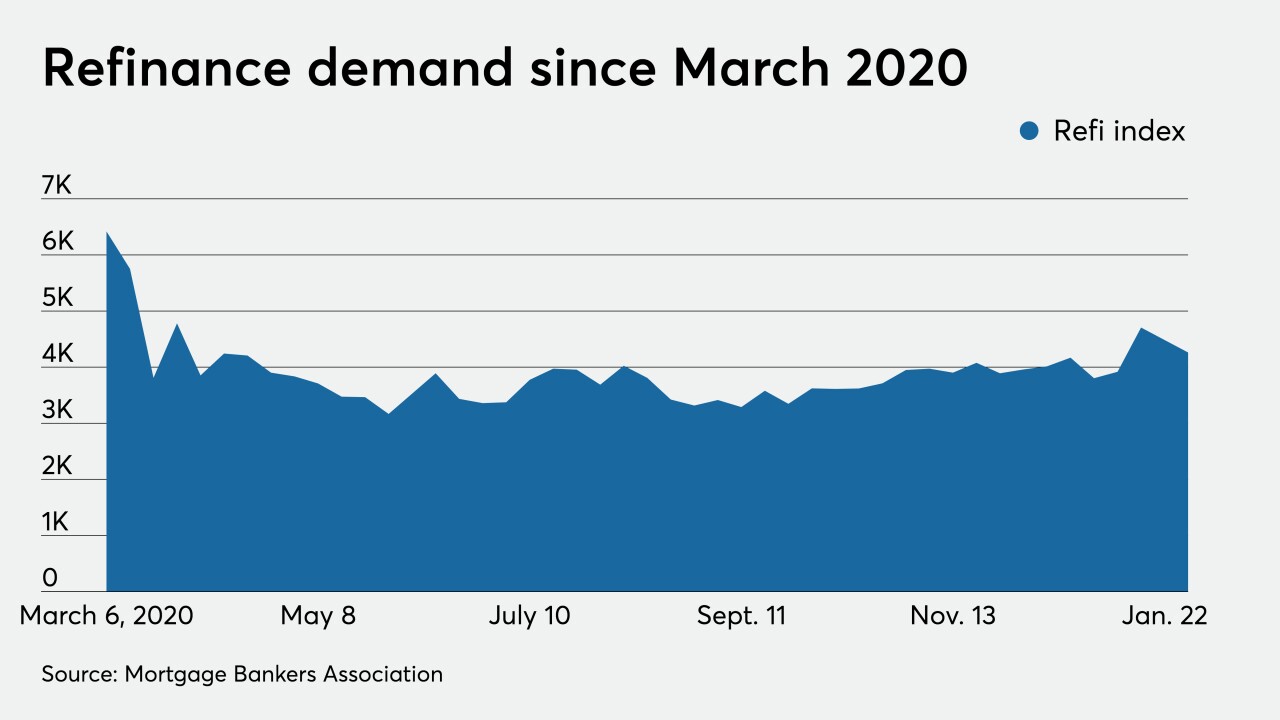

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

Just over 12 billion euros ($14.6 billion) of new issue, refi and reset paper has priced so far this year, surpassing a previous high of 7.3 billion euros in the first two months of 2018.

February 24 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

The $425 million loan securitization is among two single-asset, commercial-mortgage deals launching this week. Brookfield Asset Management's global real estate arm is also tapping investors to finance an $825 million loan backed by a downtown Manhattan office building.

December 15 -

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

November 18 -

FHA volumes, a key contributor to Ginnie Mae issuance, could fall as long as the refinancing boom continues — unless the FHA takes a step that could reverse that trend.

November 10 -

Brookfield and JV partner Swig Co. are refinancing debt and cashing out $200M in equity in the iconic, sloped-base midtown Manhattan office tower.

November 5 -

Mortgage applications increased 3.8% from one week earlier as a drop in most loan interest rates brought on an increase in refinance activity, according to the Mortgage Bankers Association.

November 4 -

Mortgage application fraud risk dropped drastically from 2019 with the spike in refinances, but the fallout from the coronavirus means next year could come with more risk, according to CoreLogic.

October 28 -

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

October 21 -

Mortgage applications decreased 0.6% from one week earlier, although a slight drop in purchase volume belied the fact that consumers are taking advantage of the current rate environment, according to the Mortgage Bankers Association.

October 21