-

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

Enpal and M&G's move comes at a complex moment for securitizations backed by energy infrastructure and home efficiency equipment.

October 21 -

Fiscal uncertainty in the US and the fact that Treasury yields aren't high enough to reflect the risk of holding them is making the securities less attractive.

June 19 -

The issuance marks the first time a multilateral climate fund is turning to the capital markets, as cash-strapped developed nations balk at providing the funds needed to cut greenhouse gas emissions.

January 15 -

Analysts are unsure what the Federal Open Market Committee will do with monetary policy in 2025. The panel projects two rate cuts, but some analysts expect more, and others see fewer.

December 26 -

The "greenium" spread is not economically feasible for bond issuers anymore, T. Rowe Price's Matt Lawton said.

December 9 -

The renewables firm also plans to raise as much as $500 million by February via banks or a private placement in the offshore market.

November 29 -

"Fed watchers will be parsing Powell's comments for signs that a 50bp rate cut is on the table for September," noted Lauren Saidel-Baker, an economist with ITR Economics. "However, the notoriously tight-lipped chair is unlikely to confirm this, making a 25bp cut the most likely outcome."

August 21 -

Sustainability-linked bonds (SLB) make up roughly $280 billion of issuance and can play an enormous part in transitioning the world economy.

March 26 -

The global shift to a low-carbon world will be "long, hard and complex," but Barclays's commitment is unwavering.

March 19 -

The company will use some of its fiber-optic network and associated customer contracts in the Dallas area to back a bond issue that will refinance some of the company's existing debt and finance a network expansion.

July 20 -

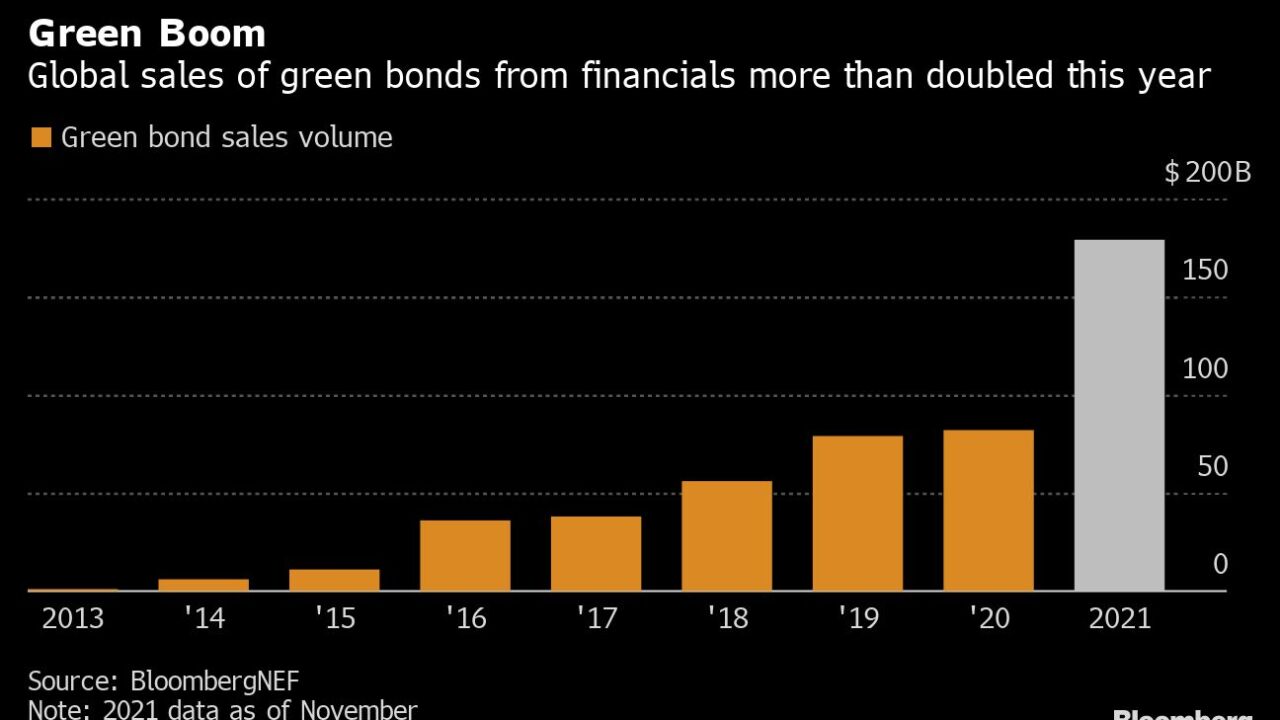

Almost $350 billion was raised from green bond sales and loan arrangements in the first half of this year, compared with less than $235 billion of oil, gas and coal-related financing.

July 5 -

GoodLeap 2023-2 has loans with fewer 25-year terms and higher FICO scores generally. Together, they'll have lower expected loss rates than those with longer terms and lower FICO scores.

May 5 -

Arrangers and analysts aren't predicting a return to the exponential growth of the past decade that turned a fringe concept into a $5.6 trillion asset class.

December 21 -

The single-family rental industry is slowly making its homes more energy-efficient. About 21% of total US energy consumption last year came from residential energy use.

October 4 -

A growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

December 22 -

Citigroup Global Markets is lead underwriter on the fourth issuance through Toyota’s ABS Green Bond program. The deal references two potential pools to be securitized.

June 4 -

JPMorgan Chase and Loop Capital Markets have submitted pitches suggesting ways to structure $1 billion of bonds that Governor Gavin Newsom proposed to build vehicle charging stations

March 24 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11