-

An emergency expansion of federal rental assistance would cost between $12 billion and $16 billion a month, depending on whether enhanced unemployment benefits are extended alongside. That is a bargain in comparison with the $2.2 trillion price of the last coronavirus relief package.

September 8 -

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13 -

The collateral pool consists of 59 loans for mostly older garden-style and mid-rise apartment buildings that have undergone recent upgrades and renovation.

August 10 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

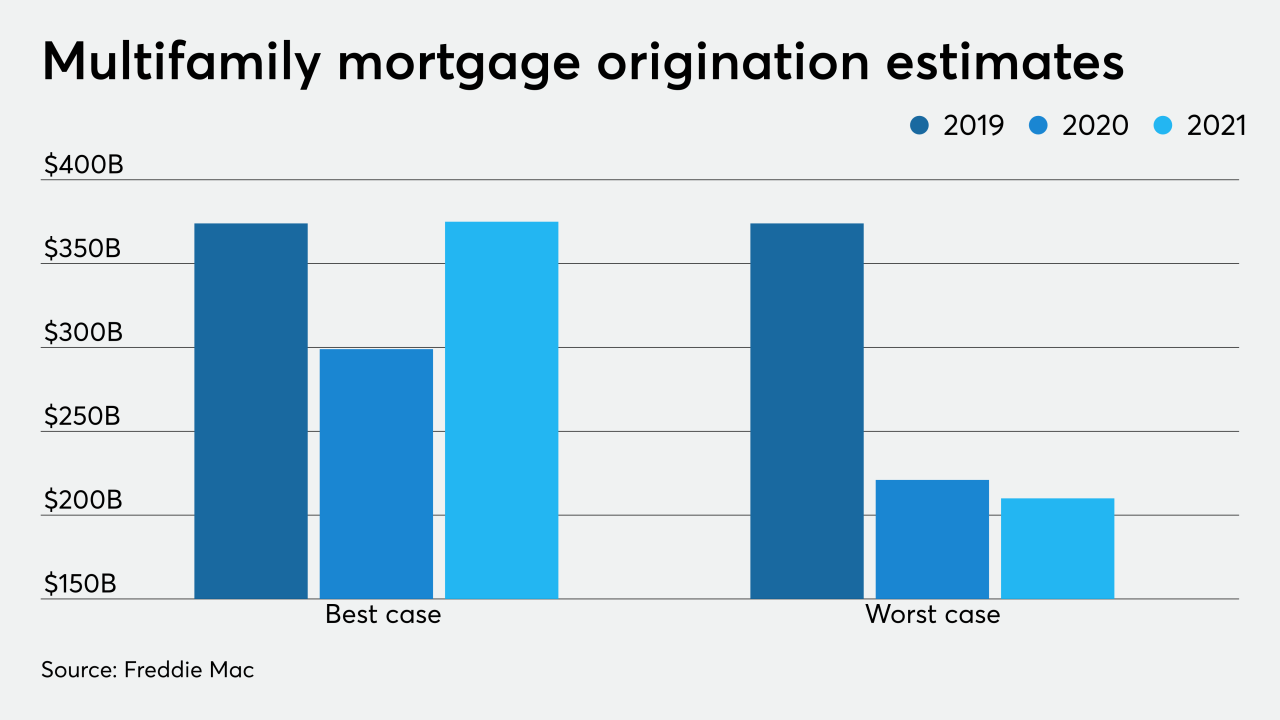

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

Nearly 12 million renters could be served with eviction notices in the next four months. And in some cities, like New York and Houston, more than a fifth of renters say they have “no confidence” in their ability to pay next month.

July 24 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

July 6 -

Multifamily borrowers with loans from Fannie Mae and Freddie Mac will get an extended break for coronavirus-related hardships if they continue to give their tenants relief as well.

June 30 -

Barclays Commercial Mortgage Securities Mortgage Trust 2020-C7 is backed by a pool of 49 fixed-rate loans collateralized by 153 commercial properties – of which 17 loans are tied to multifamily/manufactured housing properties representing 35.4% of the pool balance.

June 9 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

Fannie Mae and Freddie Mac have different timelines for the switch.

May 28 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

Tenants have threatened to suspend payments during the pandemic to pressure officials into providing rental assistance, but the effects on multifamily loans would compound concerns about servicers' liquidity and, ultimately, lenders' performance.

April 13 -

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

April 9 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

The falling rates continue a three-year trend of improving performance across numerous commercial mortgage sectors including multifamily, office and retail.

March 10 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3