-

Multifamily borrowers with loans from Fannie Mae and Freddie Mac will get an extended break for coronavirus-related hardships if they continue to give their tenants relief as well.

June 30 -

Barclays Commercial Mortgage Securities Mortgage Trust 2020-C7 is backed by a pool of 49 fixed-rate loans collateralized by 153 commercial properties – of which 17 loans are tied to multifamily/manufactured housing properties representing 35.4% of the pool balance.

June 9 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

Fannie Mae and Freddie Mac have different timelines for the switch.

May 28 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

Tenants have threatened to suspend payments during the pandemic to pressure officials into providing rental assistance, but the effects on multifamily loans would compound concerns about servicers' liquidity and, ultimately, lenders' performance.

April 13 -

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

April 9 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

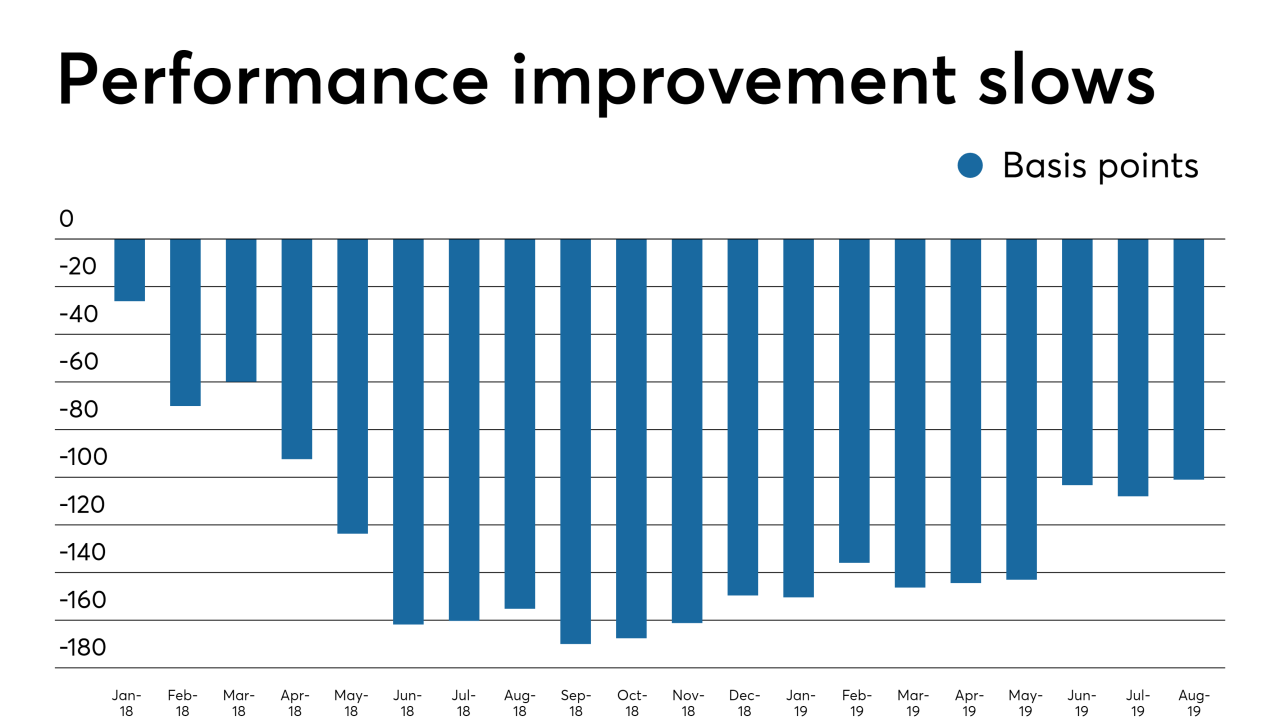

The falling rates continue a three-year trend of improving performance across numerous commercial mortgage sectors including multifamily, office and retail.

March 10 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Most of the pool is made up of office-property loans, but also includes a sizeable exposure to hotel and retail properties.

February 27 -

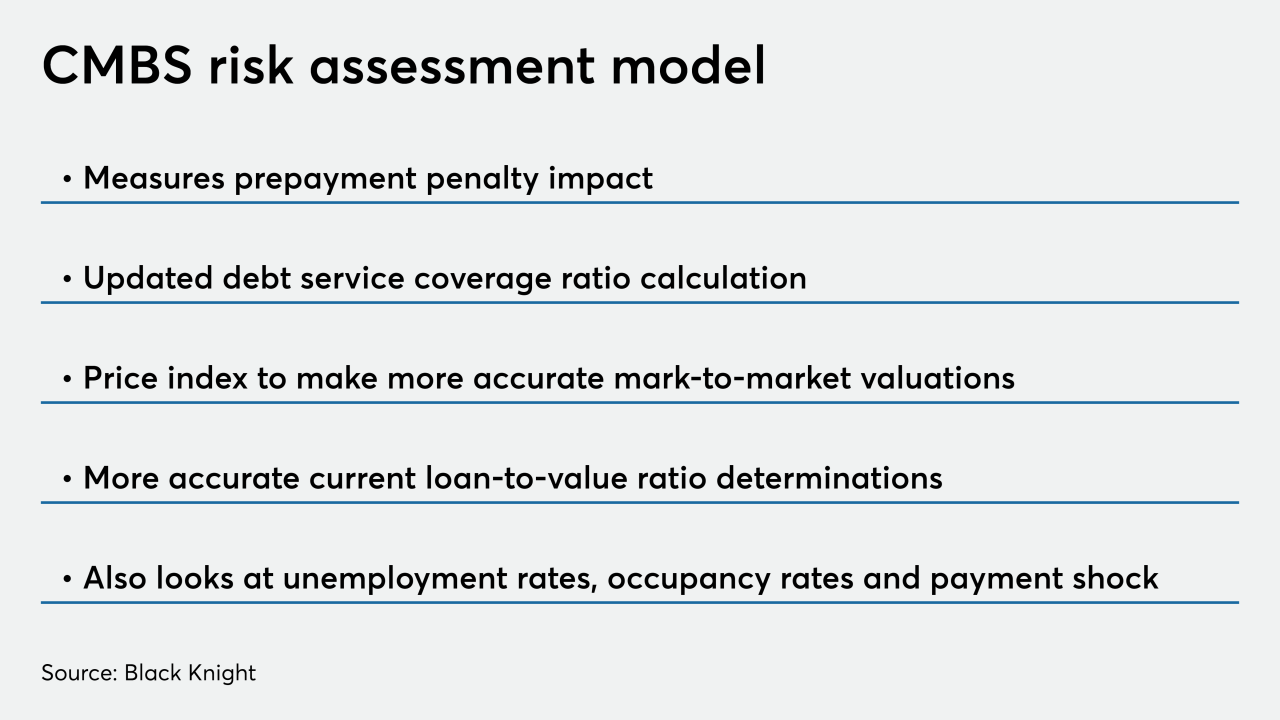

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

Bridge REIT LLC is sponsoring a securitization backed mostly by transitional and rehab multifamily properties via Wells Fargo.

January 6 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6