-

Farmers were already taking on more debt to cover losses from falling crop prices. New tariffs and other retaliatory moves could hurt ag borrowers further and lead to loan losses and tighter underwriting.

May 16 -

The large single-loan transaction covers two lab-office facilities in the Boston area's crowded life sciences corridor near MIT.

May 9 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

April 23 -

Investors include New Orleans sports franchise owner Gayle Benson, placing the hotel under local ownership for the first time since it was built in 1976.

April 16 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14 -

Bancorp 2019-CRE5 contains 46 loans on apartment buildings accounting for 82.4% of the collateral pool; that's up from 78.8% for the sponsor's prior deal.

March 8 -

The bank gained $45 million in PACE financings, which let homeowners pay back the costs of efficiency projects over time.

March 1 -

The rating agency has developed rating criteria for bonds backed by oil and gas royalties, though such deals would be capped at the 'A' rating category.

February 14 -

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

While the London interbank offered rate won't go dark until 2021, the commercial real estate finance industry should start preparing for the transition now, says the Mortgage Bankers Association.

January 24 -

A lapse in rental-assistance funding, an understaffed FHA and other effects of the government shutdown are causing real harm to families, said the chair of the House Financial Services Committee.

January 11 -

Lagging construction, rising interest rates and the broader economy don't really bode well for buyers of commercial real estate, but most CRE lenders still expect originations to increase in 2019, according to the Mortgage Bankers Association.

January 8 -

Steven Mastrovich joins the firm a week after the departure of partner and CRE/CLO specialist Steven Kolyer for Sidley Austin.

January 7 -

The single-family rental market could benefit from more consistent loan terms and expanded secondary mortgage market opportunities, Freddie Mac found in a preliminary test of expanded involvement in the sector.

December 28 -

After 10 years of conservatorship, the new year could finally usher in big steps toward housing finance reform.

December 27 -

Live Oak Bancshares became an SBA juggernaut by making loans, selling them and making more. With economic conditions changing, it is retaining more credits.

December 14 -

Stricter energy regulations for European residential and commercial buildings, effective in 2020, will likely depress cash flow and property values, though the impact will vary by country, according to Moody's Investors Service.

December 12 -

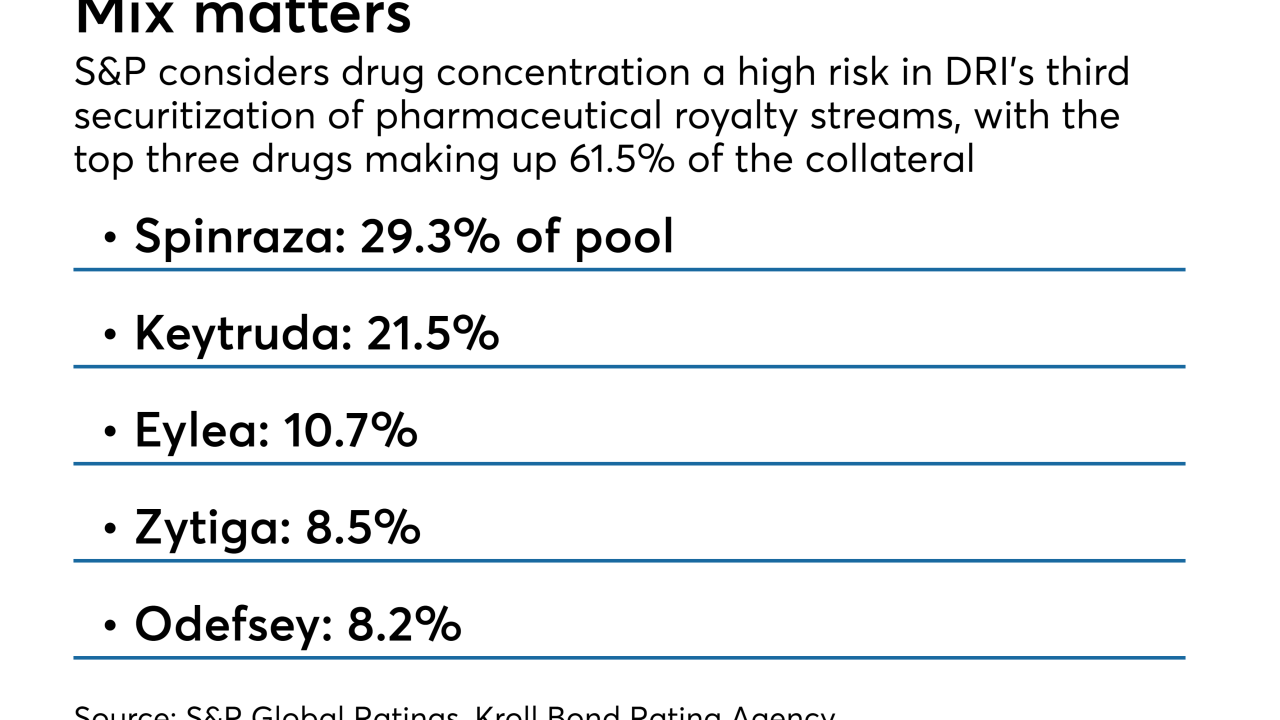

The bonds will be collateralized by payments from 15 royalty streams on 14 patent-protected drugs and technologies and will rank pari passu with securities issued from the same master trust in 2017.

November 28 -

The pool includes loans for 23 new construction, converted or acquired assets, each in a pre-stabilization phase awaiting refinancing through a permanent agency takeout loan.

November 21