The news that Santander Consumer USA Holdings may soon sever its close ties with a major carmaker has raised more questions than answers about the auto lender’s future. Chief among them: Can it survive as a stand-alone company?

Dallas-based Santander has been a preferred lender of Fiat Chrysler's since 2013, but it said earlier this month that

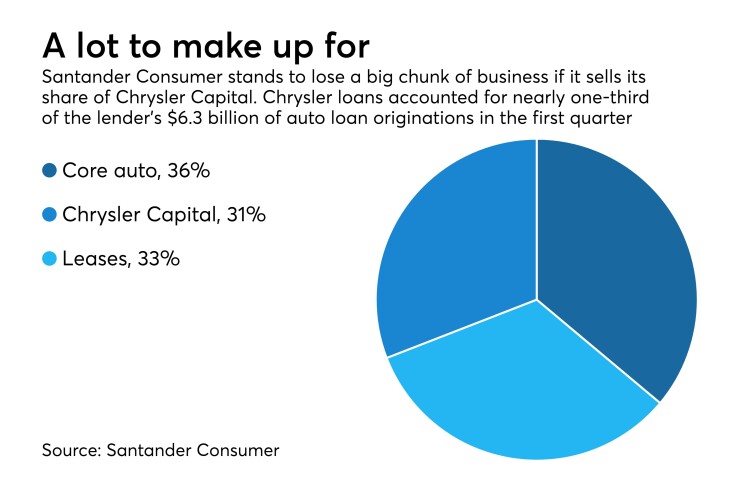

A breakup would deal a huge blow to the auto lender’s business, as the Chrysler loans accounted for nearly one-third of its $6.3 billion of loan originations in the quarter that ended March 31 and 36% of the loans it originated in last year’s fourth quarter.

While Santander could likely fetch a hefty price for its stake in Chrysler Capital, a sale could also leave it with mounds of excess capital that it could find difficult to safely deploy.

Given those challenges, analysts say that one likely outcome is that Santander Consumer winds up being merged with Santander USA Holdings, the U.S. arm of Spanish banking giant Banco Santander that already owns a large stake in the $40 billion-asset auto lender.

A split with Fiat Chrysler “increases the possibility that the parent could buy the subsidiary,” said Kevin Barker, an analyst with Piper Jaffray.

Boston-based Santander USA has slowly taken more control in Santander Consumer over the past few years. Last August, Scott Powell, CEO of the parent company,

The purchase gave Santander USA a nearly 70% stake in its troubled auto lender.

A full acquisition by Santander USA “has been a possibility for years,” said Christopher Donat, an analyst with Sandler O’Neill.

A split from Fiat Chrysler could be complicated. Chrysler Capital does not operate as a separate business line, meaning a sale would require Santander Consumer to carve out a legal entity with Chrysler-related loans, employees and other assets.

Moreover, the sale of the Chrysler Capital would likely leave Santander Consumer as much as $2.5 billion of excess capital, in addition to the $1.7 it already holds on its books, according to an estimate from Compass Point Research & Trading. Redeploying the capital back into the business would be challenging, executives said last week.

If Santander Consumer issues dividends, around 70% would simply go back to the Santander USA, given its ownership stake. If it chooses to do a buyback, it could repurchase all of its outstanding shares.

Santander “would be left with a smaller, overcapitalized origination franchise that would make more sense rolled up into the larger organization, in our view,” Michael Tarkan, an analyst with Compass Point, said in a recent note to clients.

Asked about possibility that Santander Consumer could be fully acquired by the $75 billion-asset Santander USA, a spokeswoman for the company declined to comment on the matter.

“I can’t comment on the speculation,” the spokeswoman said. She added that the auto lender is “committed to pursuing an outcome that is in the best interests” of shareholders and employees.

The uncertainty surrounding the Fiat Chrysler partnership is yet another challenge for Santander Consumer’s management to navigate.

The auto lender has been rocked in recent years by a range of problems, from accounting snafus, including

When Powell, Santander Consumer’s third CEO in as many years, came on board last year, investors hoped he could instill a much-needed sense of stability.

As of March 31 the parent company’s auto book had more than doubled from a year earlier, to $38.6 million, according to the Federal Deposit Insurance Corp.

Meanwhile, at Santander Consumer, total loans originated through the Chrysler partnership jumped 27%, to just under $2 billion. A majority of those loans went to borrowers with FICO scores above 640.

But while Powell succeeded in ramping up lending, Santander Consumer continued to fall short of the agreement’s target

Discussing Fiat Chrysler’s plans to form a so-called captive-finance unit, Fiat Chrysler CEO Sergio Marchionne suggested last week that the plans stemmed in part from shortcomings on Santander’s end.

“If we have had proper service, and we have not had it,” the Italian-American automaker would not be as “keenly interested as we are in this topic today,” Marchionne said at the company’s

The separation of Santander Consumer and Fiat Chrysler would serve as the latest example of how auto makers and banks are “cleaning up the unusual relationships that were created during the financial crisis,” said Sandler O’Neill’s Donat.

Fiat Chrysler is currently one of the only big, U.S. auto makers without its own captive-finance unit. The company first partnered with Santander in 2013, shortly after it

In 2012, General Motors exited a similar financing agreement with Ally Financial, creating its own captive unit

During a conference call with analysts Friday, Powell emphasized that the Chrysler agreement, a 10-year contract, remains in place.

“Just to be really clear, that agreement has not been terminated and remains in effect,” Powell said, praising the company’s recent performance. “Our Chrysler Capital business continues to operate in business as usual mode.”