-

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

The council is exploring legislation to collect around $492 million in delinquent real estate taxes that could aid the city’s school district.

December 14 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

Farmer Mac has terminated President and CEO Timothy Buzby for violating company policies not related to its financial and business performance.

December 7 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

The Consumer Financial Protection Bureau’s 2013 guidance putting indirect auto lenders on the hook for unintentional discrimination by their partner dealers should have been subject to congressional review, the Government Accountability Office said Tuesday.

December 5 -

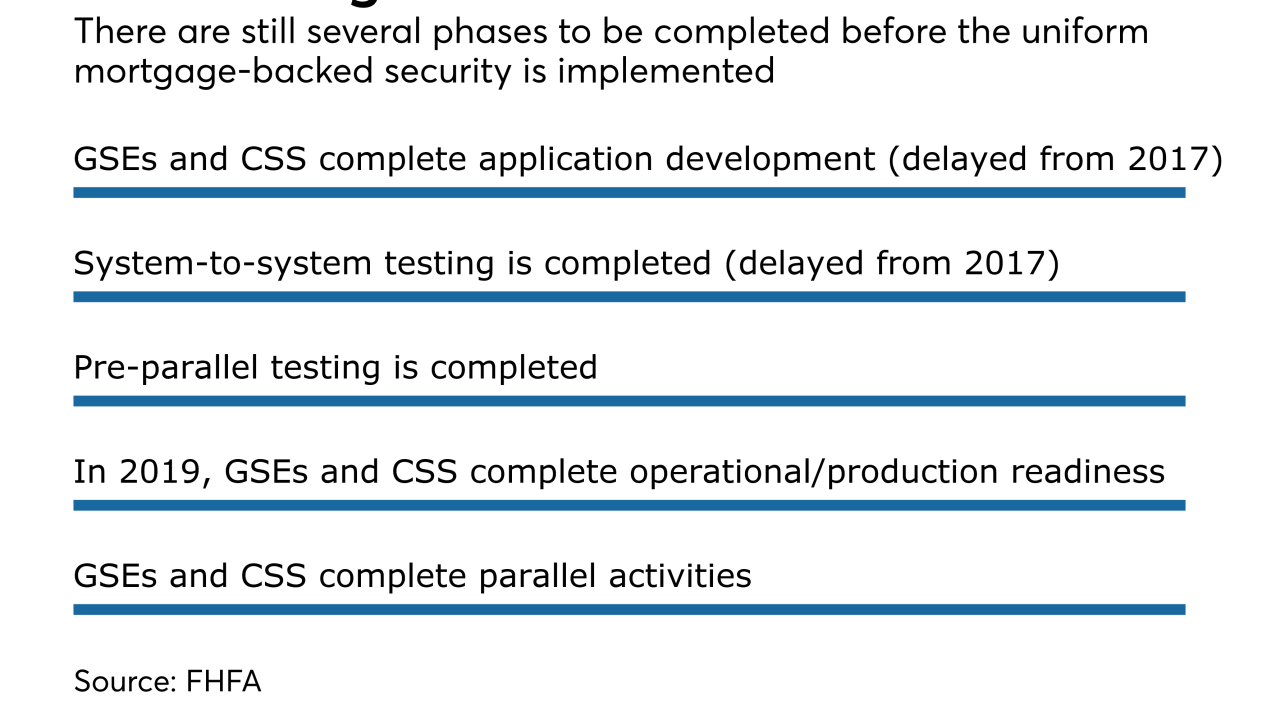

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

The court decision regarding the “valid when made” doctrine moved us further away from creating a more effective and inclusive financial system.

December 4 Fenway Summer

Fenway Summer