-

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

The gap between supply and demand in the housing market is contributing to affordability constraints that are likely to limit homeownership long-term, according to Freddie Mac.

December 6 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

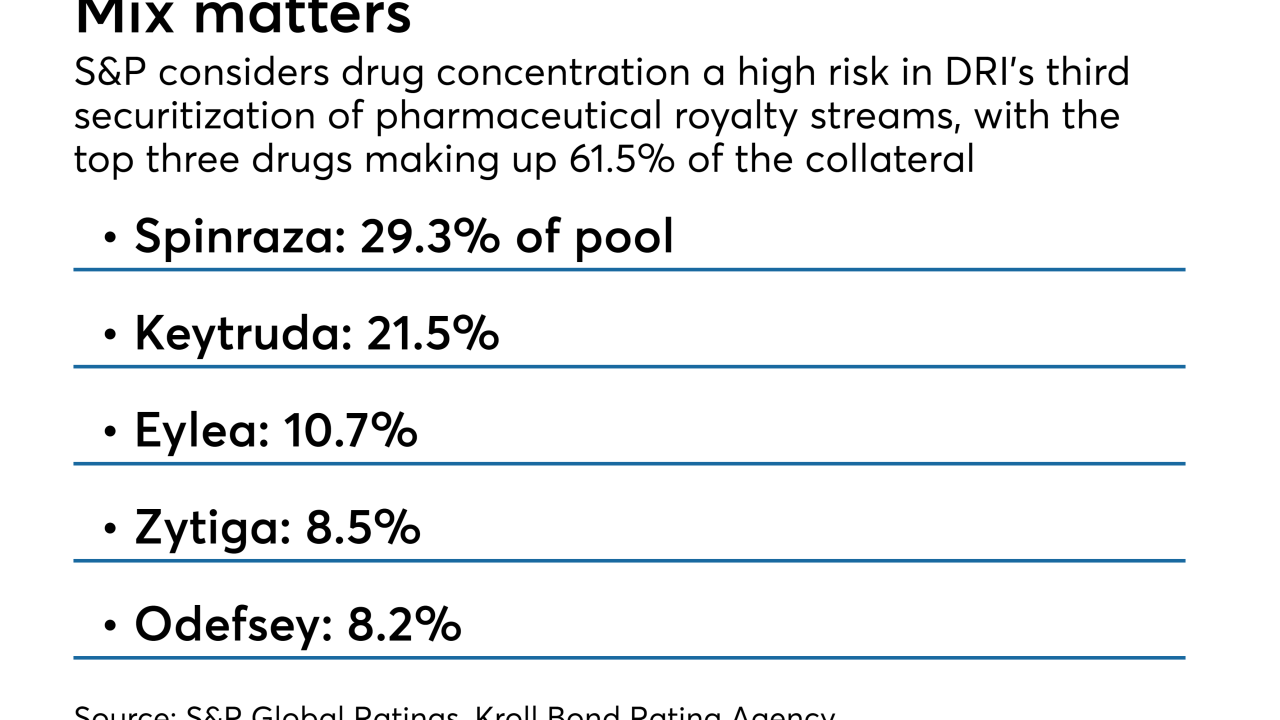

The bonds will be collateralized by payments from 15 royalty streams on 14 patent-protected drugs and technologies and will rank pari passu with securities issued from the same master trust in 2017.

November 28 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

The pool includes loans for 23 new construction, converted or acquired assets, each in a pre-stabilization phase awaiting refinancing through a permanent agency takeout loan.

November 21 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

Citigroup CEO Michael Corbat added to the chorus of bankers offering warnings about credit risks that loom outside of the banking industry.

November 14 -

While they won’t be in position to enact legislation, House Democrats could use their newfound power to spotlight issues that Republicans have largely ignored, including the exploding levels of corporate debt.

November 13 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2 -

Laurel Davis, VP, credit risk transfer at Fannie Mae, explains why the switch to a REMIC structure for CAS is important, and why it took so long.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

Fannie Mae has priced more securities that support a transition away from the London interbank offered rate.

October 26 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22