-

The sale of the $318 million-asset portfolio comes five weeks after the Greenville, South Carolina-based company agreed to sell its investment advisory unit.

September 3 -

Recent rate movements have failed to result in significant purchase growth, but refinances are providing lenders some lift.

August 29 -

The 30-year fixed rate mortgage is lingering just shy of 6.5% level, which is not low enough to bring home purchasers back into the market, observers said.

August 22 -

Vice President Kamala Harris outlined a raft of populist economic proposals in her first major economic speech since securing the Democratic presidential nomination, including some aimed at lowering housing costs and boosting supply.

August 16 -

While the total dollar volume of apartment originations fell last year, the number of companies making loans increased from 2022, the Mortgage Bankers Association said.

August 15 -

Retail properties account for the largest portion, at 23.5%, according to KBRA. Lodging follows, with 22.1% of the pool.

August 14 -

Nearly two-thirds of consumers in a July survey said they expect mortgage rates to decline soon, but most want to see them cross a very specific threshold before they act, Mphasis Digital Risk found.

August 14 -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

The parent company of Fulton Bank announced the creation of three new management roles and promoted existing employees into those jobs. The changes follow the recent hiring of an outsider to be CFO.

August 6 -

Market turmoil is driving the 10-year Treasury yield downward and taking mortgage rates with it, putting more borrowers in the money to refinance, Intercontinental Exchange said.

August 5 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

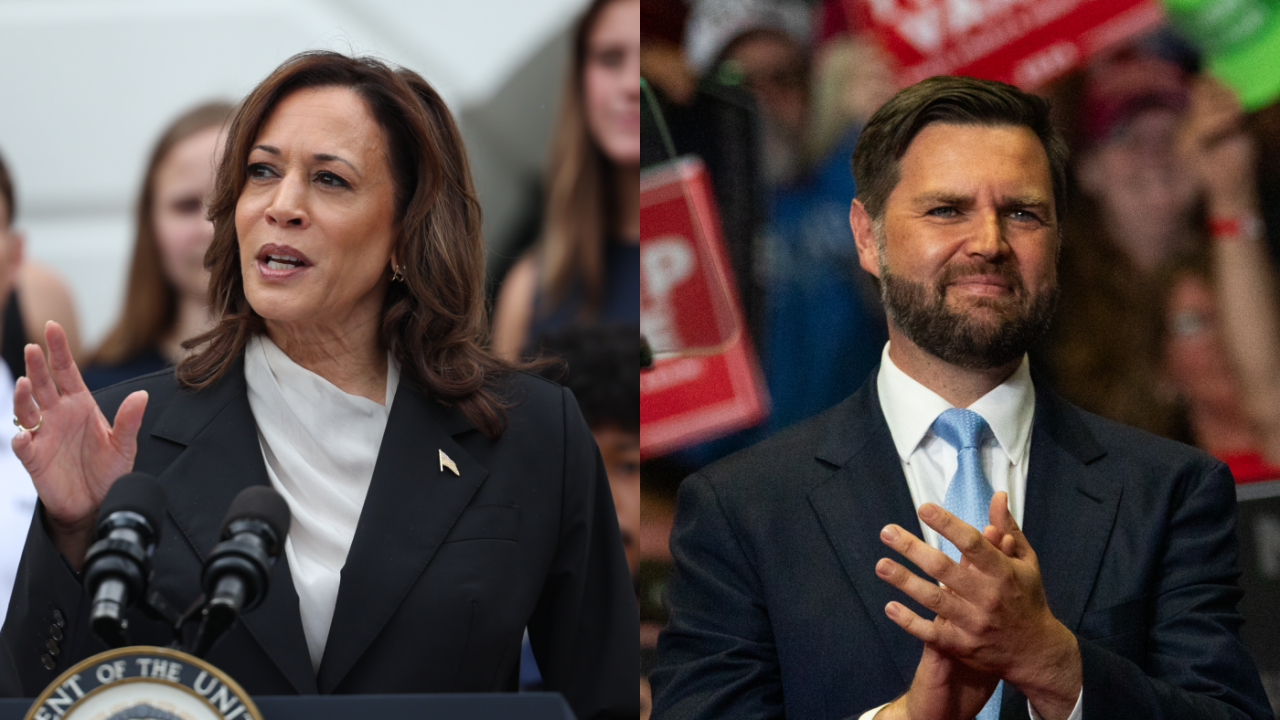

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The notes are expandable so that at any time during that revolving period the issuer can upsize the notes, to a maximum of $500 million in the deal.

July 16 -

The Federal Reserve's struggle in bringing inflation down from its current level to its 2% target may come down to how the government measures shelter costs in the U.S., leading some experts to question whether the problem is in the economy or in how it is measured.

July 4 -

But economists seem to differ on what the latest movement in mortgage rates means for the summer home sales business.

June 27 -

The decline for the third consecutive week reflects investors' belief that the Federal Open Market Committee is likely to cut rates this year.

June 20 -

A decline in interest rates during the first quarter drove a Freddie Mac indicator higher for the first time since mid-2023, while a leading investment firm announced a deal aimed at boosting originations for government-sponsored enterprise financing.

June 14