-

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

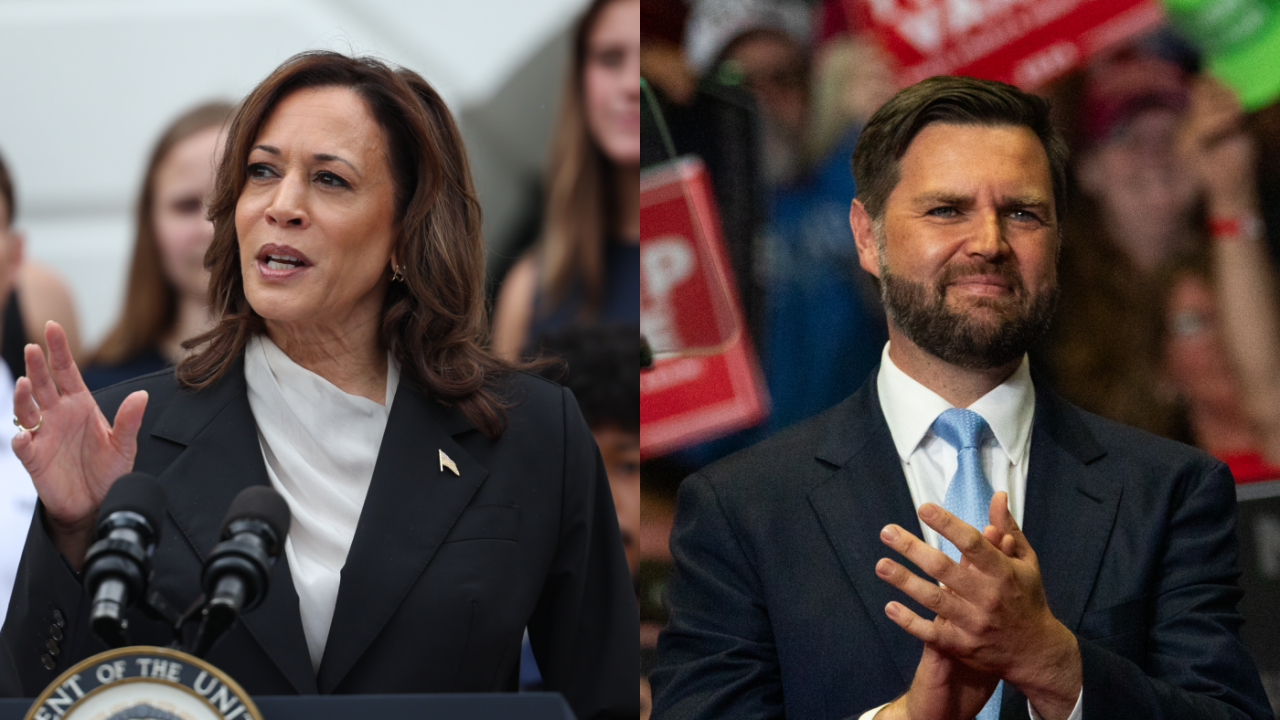

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The notes are expandable so that at any time during that revolving period the issuer can upsize the notes, to a maximum of $500 million in the deal.

July 16 -

The Federal Reserve's struggle in bringing inflation down from its current level to its 2% target may come down to how the government measures shelter costs in the U.S., leading some experts to question whether the problem is in the economy or in how it is measured.

July 4 -

But economists seem to differ on what the latest movement in mortgage rates means for the summer home sales business.

June 27 -

The decline for the third consecutive week reflects investors' belief that the Federal Open Market Committee is likely to cut rates this year.

June 20 -

A decline in interest rates during the first quarter drove a Freddie Mac indicator higher for the first time since mid-2023, while a leading investment firm announced a deal aimed at boosting originations for government-sponsored enterprise financing.

June 14 -

Federal Reserve Chair Jerome Powell says crushing inflation is the most important thing the Fed can do to reduce costs in the housing market. Some economists and policy specialists say higher rates are not the only tool at its disposal.

June 14 -

Markets appeared to welcome signs of future rate relief, with the latest Freddie Mac average falling for the fifth time in six weeks.

June 13 -

The 30-year fixed-rate mortgage average dropped back below the 7% level as investors reacted positively to news the economy is slowing, Freddie Mac said.

June 6 -

Yields on the benchmark 10-year Treasury also rose in the past week as bond and note auctions got tepid responses from investors.

May 30 -

In a speech, the Federal Reserve governor said she would have liked to see the Federal Open Market Committee move more quickly to reduce its holdings. The central bank is poised to begin slowing the pace of balance sheet runoff this week.

May 28 -

Fannie Mae economists suggest home sales will remain resilient amid anticipated dips in both home loan volume and consumer spending.

May 22 -

A recommendation to give Ginnie Mae expanded authorities is drawing focus in the reactions to a Financial Stability Oversight Council report on nonbank risks.

May 17 -

Stakeholders are watching carefully as the 2023 crisis and a capital proposal increase banker wariness of mortgage assets, speakers at Invisso's MBS Forum said.

May 14 -

The new Financial Stability Oversight Council report also recommends an expanded Ginnie Mae PTAP facility and an industry-funded liquidity resource.

May 10 -

The 30-year fixed rate mortgage fell for the first time in six weeks as the Federal Open Market Committee meeting outcome is finally priced in.

May 9