-

Completions in August remained far lower than before COVID-19 arrived in the United States but initial actions rose fast enough to potentially meet expectations that they'll normalize in 2023.

September 8 -

A mix of new distress and declining cures drove the uptick, according to dv01.

September 1 -

The number of these mortgage borrowers getting back on track with payments has been roughly halved since March, according to Black Knight's initial take on July numbers.

August 24 -

Recent reports highlight the question of how much wage growth can do to sustain loan performance as pandemic relief gets rolled back, consumer costs rise and the housing market cools.

August 12 -

The jump for second mortgages and bank cards was even more pronounced, according to indices published by Standard & Poor’s and Experian.

July 20 -

But a slower-than-anticipated rate of repossessions suggest distressed homeowners are finding solutions.

June 14 -

While the government-sponsored enterprise’s single-family mortgages are still not performing as well as they did before the pandemic, the most recent vintages are getting there.

May 2 -

More than half of the seriously delinquent mortgages that did not have this type of payment relief were originated prior to ability-to-repay requirements enacted following the Great Recession, the latest Federal Reserve Bank of Philadelphia study found.

March 25 -

While smaller in number, initiated foreclosures had a similar consecutive-quarter gain as the market transitioned away from pandemic-related relief that has artificially constrained workout activity.

March 23 -

Private-market loans nudged the total number up during a processing lull, according to Black Knight.

March 18 -

The number of properties in limbo is up 10.3% from the same time last year, according to Attom Data Solutions.

February 24 -

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

February 7 -

However, the seven institutions in the Office of the Comptroller of the Currency study service 13% fewer loans compared with the third quarter of last year.

December 10 -

While over 112,000 loans exited plans in the past week, there is only a modest opportunity for continued improvement in the near term, Black Knight said.

December 10 -

Axylyum, which recently released information about its first named client, offers an alternative to other forms of risk sharing for private companies originating income-producing mortgages.

December 2 -

Like the stock market rout around news of the Omicron variant, the recent increase in payment suspensions suggests financial troubles associated with the pandemic may not be over.

November 29 -

The decline in late payments recorded in a trade group survey raise hope that many servicers will bear up under a wave of tighter enforcement coming from regulators.

November 10 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

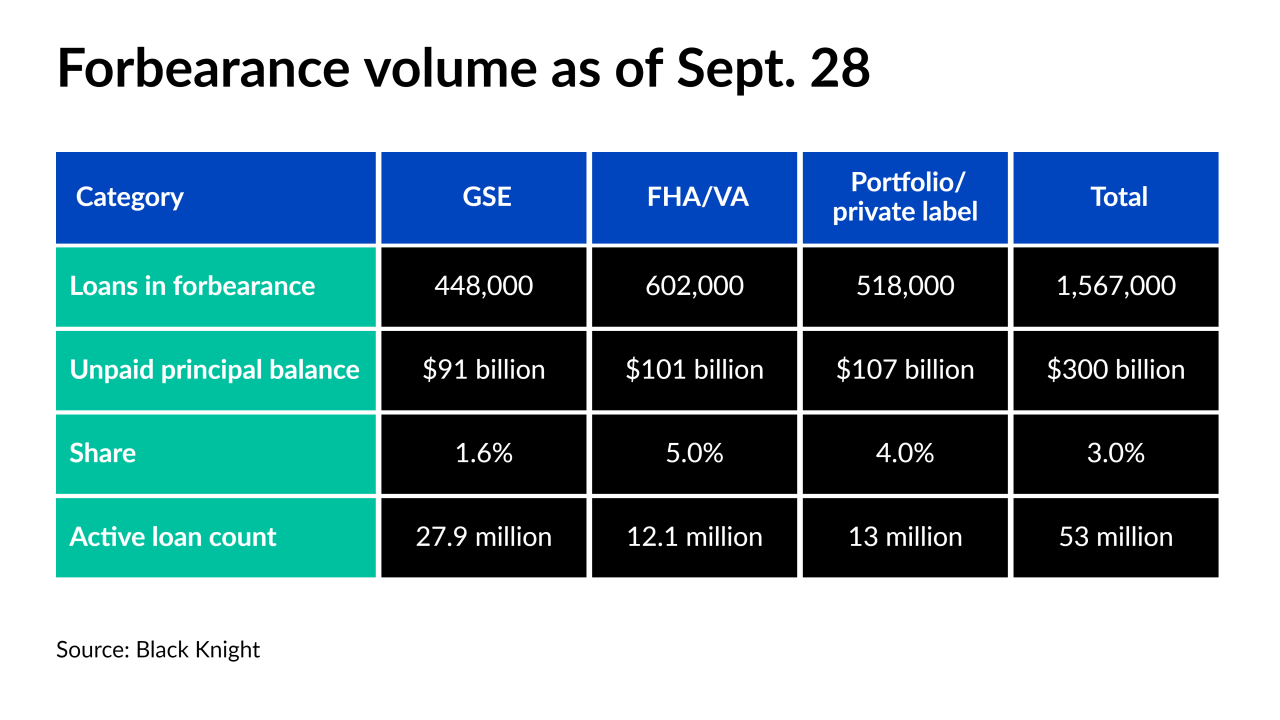

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

The end of many COVID relief plans in September have the industry holding its breath, with outcomes potentially foreshadowing the months to come.

August 27