-

Democrats are pushing for a public-sector alternative to the three main credit bureaus, but Republicans argue that the government is ill-equipped to safely handle consumer data and produce accurate reports.

June 29 -

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

Complaints to the Consumer Financial Protection Bureau jumped 54% to 542,300 in 2020. Concerns about credit reports have long outnumbered those in other categories and jumped significantly as a share of the total from 2019.

March 24 -

Federal relief efforts have minimized loan losses so far, but risks remain in credit card, auto and business lending. Many borrowers will need another lifeline to stay afloat until the economy rebounds, CEO Jamie Dimon says.

January 15 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

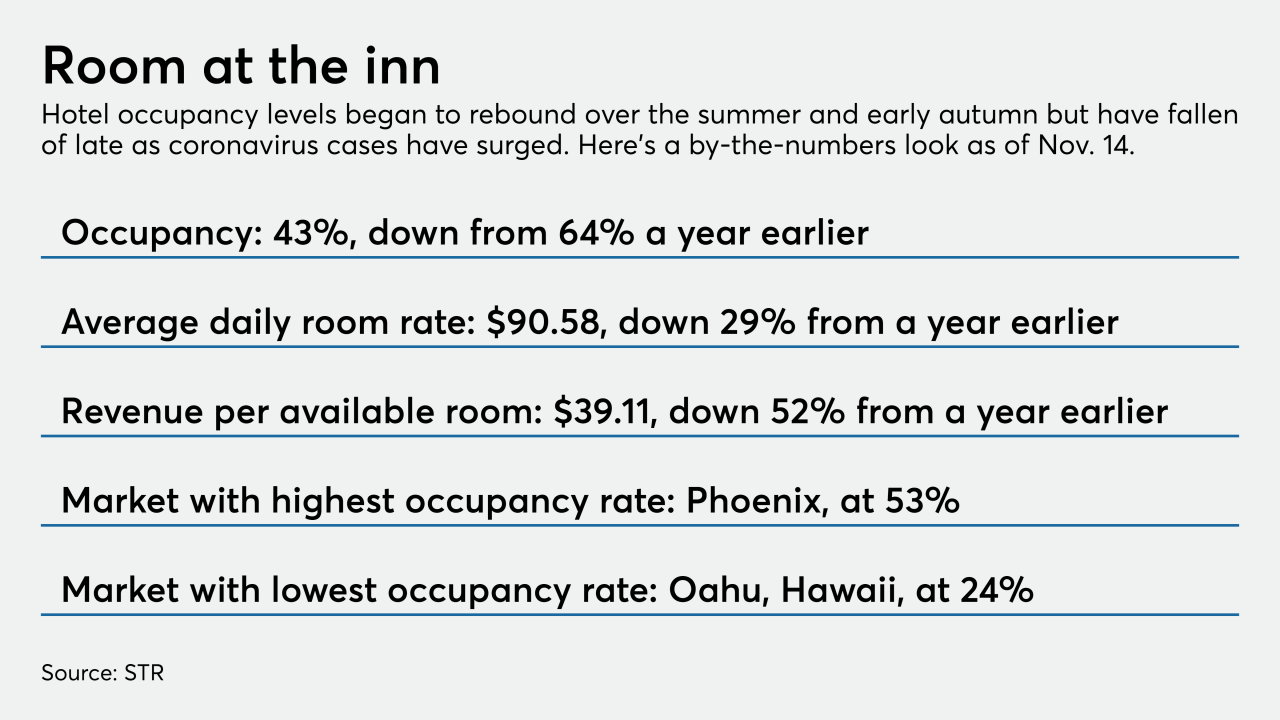

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

October 28 -

Credit portfolio manager’s outlook on corporate borrower defaults and spreads on their loans, while still gloomy, has improved somewhat as the pandemic continues.

October 15 -

Commercial real estate loans are vulnerable as financial assistance for tenants winds down and might not be fully renewed. Late rent payments could rise, leading lenders to press landlords to pay up.

September 23 -

More consumer and commercial borrowers are paying their loans, increasing the likelihood that charge-offs will be manageable for banks despite the ongoing pandemic.

September 11 -

Conditions have improved for the first time since November.

August 6 -

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

August 4 -

Bankers had asserted in April that they could handle a slump in oil prices tied to the coronavirus pandemic. Continued volatility, combined with declining collateral values and a rise in bankruptcies for exploration companies, is denting their confidence.

July 13 -

As revenue-starved retailers fall further behind on rent payments, landlords' cash flow will be strained, and defaults on commercial real estate loans could rise.

June 10 -

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5