-

Even though delinquency rates were previously at extremely low levels, the recent uptick among poorer consumers is worth monitoring, New York Fed researchers said.

August 2 -

Fannie Mae and Freddie Mac asked originators to resubmit applications that contained errors and adjust sold mortgage information due to incorrect life-of-loan representations and warranties.

June 8 -

During the pandemic, consumer lenders have found it easier to collect payments because the federal student loan moratorium has made many borrowers more liquid. A plan for blanket forgiveness reportedly under consideration by President Biden could sustain that trend.

May 3 -

The company sold small businesses a credit-building product that fell short of its promises, and also failed to help them fix inaccuracies in their credit reports, according to the Federal Trade Commission. D&B has agreed to give refunds to many customers.

January 13 -

In a letter to the agency’s new director, top Senate Democrats recommended policy steps intended to limit mistakes in consumers’ credit files that they said “can ruin lives.”

November 11 -

Those leaving forbearance or other relief plans generally had higher credit utilization rates, were more likely to have mortgages, and experienced lower levels of bank card delinquencies, according to TransUnion.

October 7 -

Despite “color blind” underwriting algorithms, loan denial rates on mortgages that were not backed by the Federal Housing Administration and the VA skewed heavily toward minority groups, according to a study by The Markup.

August 27 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

Kikoff, whose investors include Golden State Warriors' star Stephen Curry, provides applicants with a no-fee $500 revolving line of credit they can use to purchase personal finance books and courses from its online store. The company then reports this payment activity to some credit bureaus.

June 30 -

Democrats are pushing for a public-sector alternative to the three main credit bureaus, but Republicans argue that the government is ill-equipped to safely handle consumer data and produce accurate reports.

June 29 -

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

Complaints to the Consumer Financial Protection Bureau jumped 54% to 542,300 in 2020. Concerns about credit reports have long outnumbered those in other categories and jumped significantly as a share of the total from 2019.

March 24 -

Federal relief efforts have minimized loan losses so far, but risks remain in credit card, auto and business lending. Many borrowers will need another lifeline to stay afloat until the economy rebounds, CEO Jamie Dimon says.

January 15 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

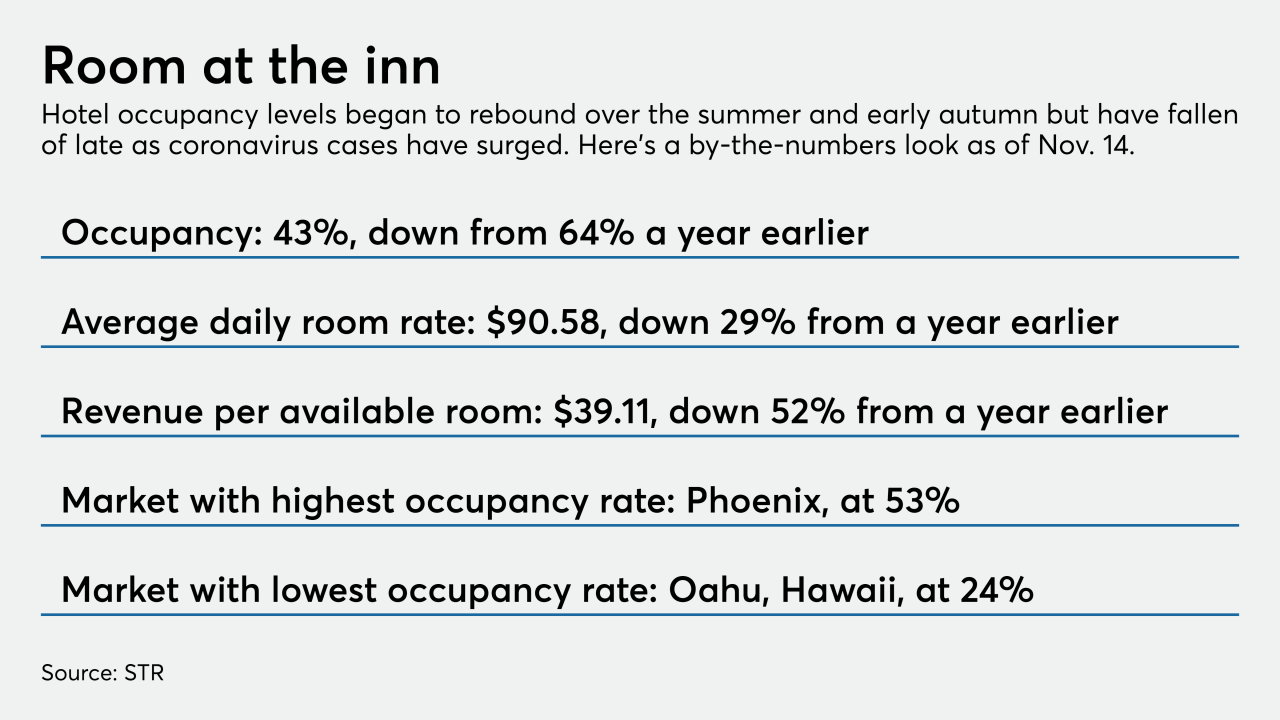

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16