-

Unusually for a debut transaction, the $329.7 million M360 2018-CRE1 will be actively managed: For the first 12 months after the closing date, funds from repaid principal can be used to purchase new loans, subject to eligibility criteria.

July 17 -

The $109.3 million CLEAN 2018-1 is also the first deal to be marketed as a Rule 144A transaction under securities regulation making it available to wide base of institutional investors.

July 10 -

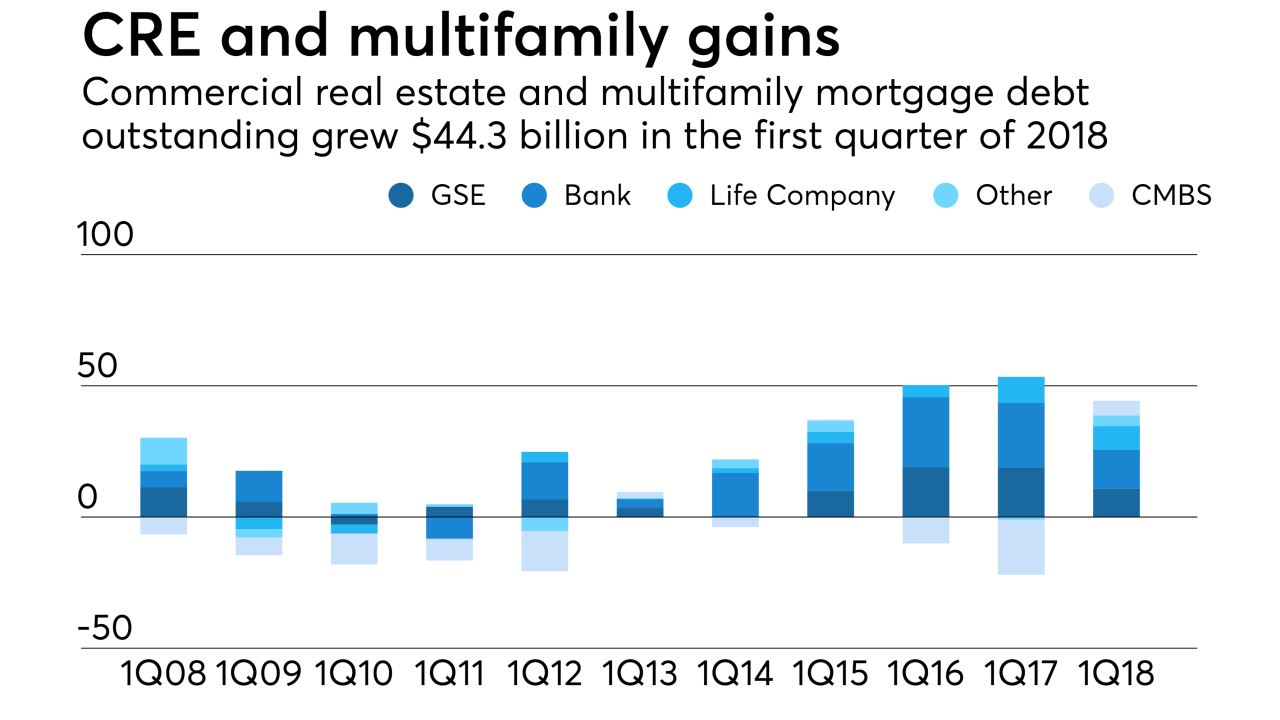

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

A continued "oversupply" of CLO deals, along with expectations for new debut or returning managers in the absence of risk-retention requirements, is expected to keep activity flowing.

May 21 -

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

May 17 -

The increase in the delinquency rate for securitized CRE loans for March ended an eight-month streak of declines.

April 3 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

February 8 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

Moody's considers the $932.4 million TPG Real Estate Finance Trust 2018-1 to be highly leveraged, though not as highly leveraged as Blackstone's inaugural transaction.

February 5 -

The Trepp CMBS Delinquency Rate for U.S. commercial real estate loans in CMBS is now 4.83%, a decrease of six basis points from the December level.

February 2 -

Varde VMC Lender, a Minneapolis firm specializing in distressed commercial real estate, has branched out to financing offices and apartment buildings being upgraded or repurposed.

January 25 -

The Taxs Cuts and Jobs Act preserves most of existing benefits for owners, operators, and investors, and provides a few new perks as well; there are some trade-offs to be made, however.

January 19 -

Some commercial buildings that are not required to obtain earthquake insurance may still be susceptible to significant structural damage that could put the borrowers at risk of default, according to Kroll Bond Rating Agency.

January 2 -

Speculators who bet on declines in commercial mortgage bond indexes as a way to profit from the expected demise of regional shopping malls may still be waiting for a big payout, according to Trepp.

December 28 -

Consumers’ desire to shop online is creating huge demand for distribution centers and forcing property owners to think creatively about redeveloping vacant retail space. Meanwhile, hundreds of billions of dollars will be spent rebuilding areas hard hit by hurricanes and wildfires.

December 27 -

A £366.2 million mortgage on 127 industrial properties is being used as collateral for a transaction called Taurus 2017-2 UK DAC.

December 19 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

November 15