-

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The digital lender, which bought Radius Bancorp in February, still expects to record a full-year loss partly because of merger-related costs. But its stock price soared Thursday after it reported second-quarter net income of $9.37 million.

July 29 -

Democratic proposals to offer free accounts, restrict overdraft fees and cap interest rates have zero chance of passage. But analysts say lawmakers’ push for products that help consumers is influencing some banks’ decisions to institute reforms on their own.

July 28 -

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

States in its footprint have some of the lowest vaccination rates in the country. Another round of shutdowns could further damage industries like hospitality that have already been hit hard by the pandemic, executives said.

July 23 -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

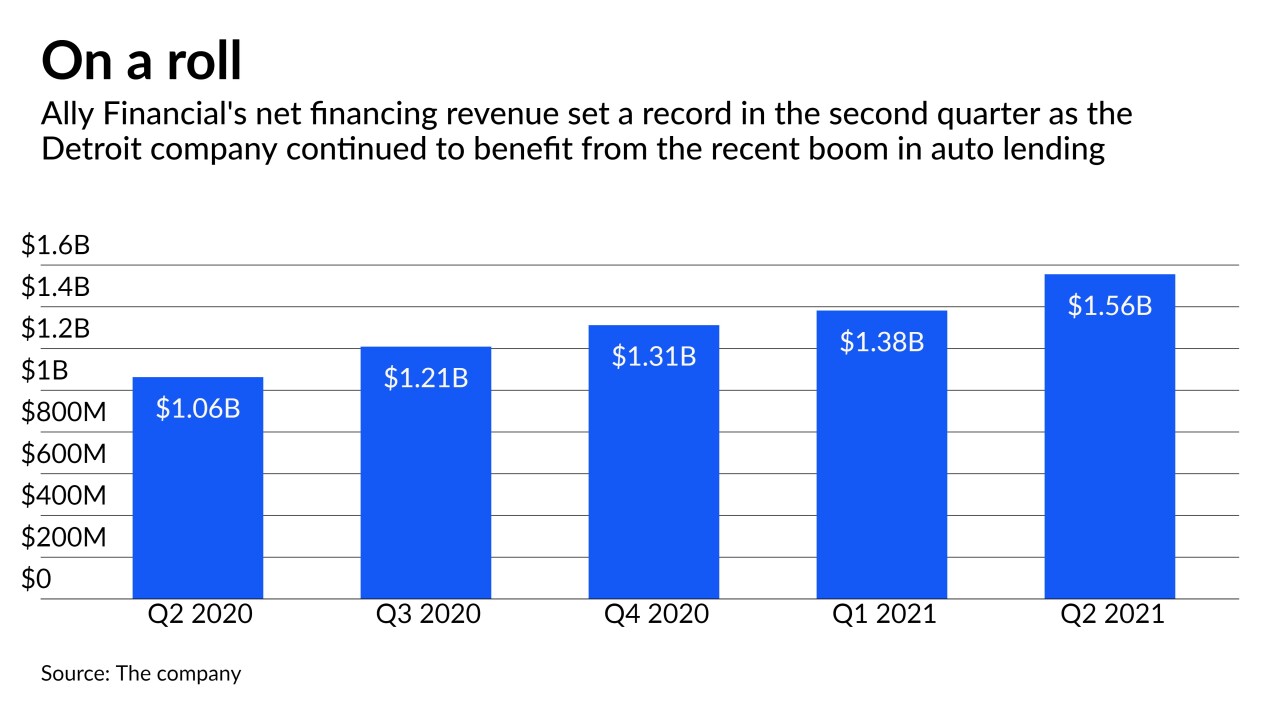

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

After a colossally “brutal” period in the beginning of the COVID-19 outbreak last year, a recent report from Kroll Bond Rating Agency noted that business development corporations mostly rebounded by year-end 2020 to bring a sense of renewed optimism into the alternative-lending space.

May 25 -

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

The West Palm Beach, Fla.-based lender sees an opportunity for even more growth after its deal to acquire a servicing portfolio from Texas Capital Bank.

April 29 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16 -

Bankruptcy courts saw a greater-than-average number of filings in the first quarter, though a year-on-year decline highlights the impact of cheap cash flowing to troubled borrowers.

April 7 -

The first-time securitization by the online commercial-finance will involve more than half of the San Francisco-based company's managed accounts portfolio.

March 26 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11