-

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

After a colossally “brutal” period in the beginning of the COVID-19 outbreak last year, a recent report from Kroll Bond Rating Agency noted that business development corporations mostly rebounded by year-end 2020 to bring a sense of renewed optimism into the alternative-lending space.

May 25 -

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

The West Palm Beach, Fla.-based lender sees an opportunity for even more growth after its deal to acquire a servicing portfolio from Texas Capital Bank.

April 29 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16 -

Bankruptcy courts saw a greater-than-average number of filings in the first quarter, though a year-on-year decline highlights the impact of cheap cash flowing to troubled borrowers.

April 7 -

The first-time securitization by the online commercial-finance will involve more than half of the San Francisco-based company's managed accounts portfolio.

March 26 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Citigroup restated fourth-quarter results after writing down a portion of a loan to Revlon it now owns after losing a court battle.

March 1 -

The newly public digital mortgage giant is relying on a diverse set of loan channels to take on competitors in an increasingly crowded field, CEO Anthony Hsieh said in an earnings call this week.

February 18 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

Environmental, social and governance issues topped the list of risk managers’ concerns in a Deloitte poll .

February 2 -

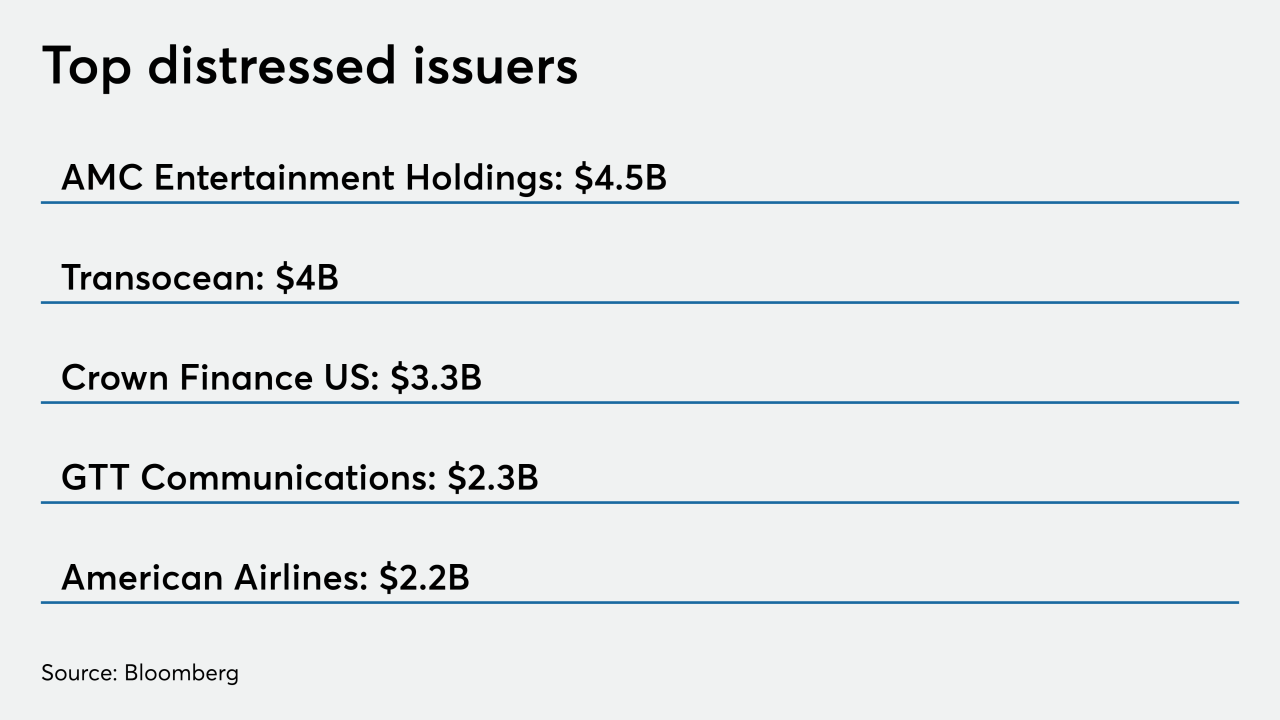

AMC and American Airlines took advantage of surprise stock-price surges to cash out shares and raise liquidity for possible debt reduction — a massive stroke of good fortune for the companies as well as their creditors.

February 1 -

Federal relief efforts have minimized loan losses so far, but risks remain in credit card, auto and business lending. Many borrowers will need another lifeline to stay afloat until the economy rebounds, CEO Jamie Dimon says.

January 15 -

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

The Georgia runoffs and resulting balance of power in Congress will help determine which bills on bankers’ wish list gain traction. But regardless, existing coronavirus relief such as the Paycheck Protection Program and a push for more economic aid will remain top of mind for lawmakers and the industry.

January 4 -

The buyout industry has about $3 trillion of unrealized value on its books, according to Preqin. And it’s tapping that to land loans for bolt-on deals, to refinance debt or bail out struggling companies in their portfolios.

December 31