-

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

A subsidiary of Citizens Financial Group placed first in a recent J.D. Power ranking of car dealer satisfaction with noncaptive auto lenders. However, that group — primarily banks and credit unions — lagged other types of auto lenders.

August 29 -

Asset Recovery Associates told borrowers that it could sue them, garnish their wages and place liens against their homes, according to a consent order by the consumer bureau.

August 28 -

The tech-driven asset management firm announced it had closed a $115 million asset-backed securities deal led by Cantor Fitzgerald, with unsecured consumer loans acquired from Prosper Marketplace.

August 22 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

August 20 -

Robert G. Cameron, a former official at the Pennsylvania Higher Education Assistance Agency, will succeed Seth Frotman as the bureau's point person on student lending complaints.

August 16 -

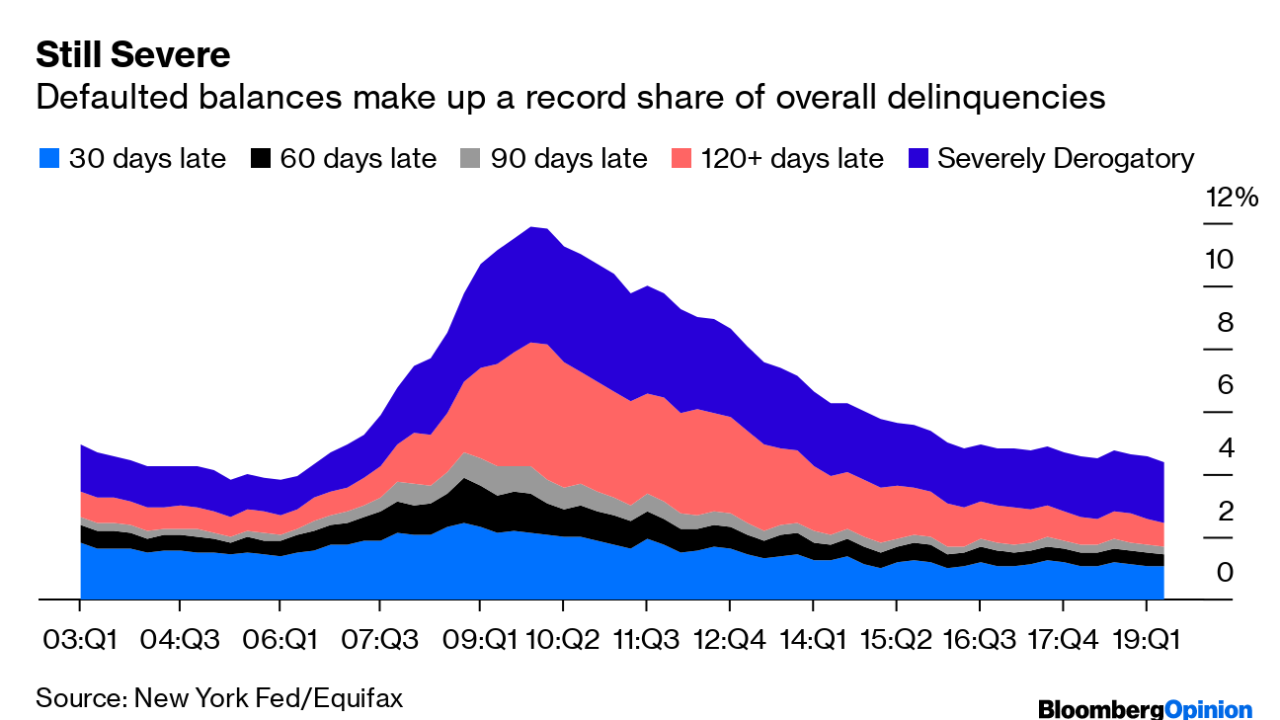

Of the roughly $250 billion severely derogatory outstanding balance, defaulted student loans make up 35%, a New York Fed report found. That’s a new phenomenon.

August 14 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

The decline in the share of "cured" delinquent loans is a potential signal for increased securitization losses in the months to come.

August 13 -

Lighter seasoning compared to American Credit Acceptance's last loan portfolio issuance is the primary reason, say ratings agencies.

August 8 -

“Buy here, pay here” auto lender Byrider’s improvements in recent ABS collateral performance and operational servicing changes are gaining favor with ratings analysts.

August 2 -

State and federal authorities say the network of firms in upstate New York sought debts that consumers weren't obligated to pay and impersonated government officials, among other things.

July 25 -

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22 -

In a registration statement filed with the SEC, the company revealed new details about its financial performance and its growth plans.

July 18 -

The agreement is expected to solidify a lending partnership whose status had been in doubt for more than a year. But it raised as many questions as it answered.

July 1 -

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

A DBRS report states rising concentrations of light-duty truck collateral adds risks to vehicle securitization portfolios, but risk may differ among ABS types.

June 20 -

Kroll this week withdrew ratings on the defunct subprime auto lender's loan securitization, which had undergone multiple downgrades.

June 19