-

The Silicon Valley fintech expects to make $1.5 billion in auto loans this year after implementing key elements needed to achieve scale, said CEO David Girouard. The expansion comes as the automotive market continues to boom.

February 16 -

The company has agreed to pay at least $3.75 million to resolve allegations that it violated the District of Columbia’s 24% interest rate cap.

February 8 -

The deal is the latest example of a mainstream bank buying a point-of-sale lender focused on financing home improvement projects.

January 19 -

President Biden’s aspirations for aggressive forgiveness haven’t been fulfilled to date, but steps taken so far have lowered a key hurdle to entry-level homeownership.

January 14 -

Initial overcollateralization is 15%, with a build up to a target equal to the minimum of 21.5% of the current pool balance, and 16.5% of the initial pool balance.

January 12 -

The deal’s sponsor has issued a small rated portion to investors and sold the remainder back to loan-originator.

November 19 -

The sponsor’s Fortune 500 parent provides comfort in the face of the subprime-auto industry’s woes.

November 16 -

Trustmark Bank agreed to pay $9 million to resolve allegations that it discriminated against Black and Hispanic residents in Memphis, Tennessee. Attorney General Merrick Garland said the Department of Justice and other agencies will continue their crackdown.

October 22 -

The industry is prioritizing Black and Hispanic consumers in the interest of social equity and to tap new markets amid declining refinance volume and rising rates.

October 22 -

Banks, credit card issuers and debt collectors all supported the Consumer Financial Protection Bureau’s revised regulations. But they face a steep learning curve in complying with the rules, which take effect Nov. 30.

October 11 -

To help determine certain forms of credit enhancement and loss triggers, LendingPoint 2021-B is tightening its definition of what a charged-off account is.

September 24 -

The trust excludes loans from about six states with active legislation addressing the exporting of usury rates to out-of-state borrowers.

September 20 -

Known as MOHELA 2021-3, the trust will issue a mix of fixed- and floating-rate notes from a capital structure with three tranches, or note classes.

September 2 -

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The price for the 20% stake in Santander Consumer USA Holdings that Santander does not already own is significantly higher than what the buyer first offered in July.

August 24 -

Credit performance to LL ABS deals has been better than expected, as financial support to borrowers made exxtra cash available to pay down on other obligations.

August 16 -

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

The bureau said two rules related to communications with debtors will go into effect as originally planned on Nov. 30. The agency had previously proposed an extension to consider consumer advocates' concerns about the regulations.

July 30 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

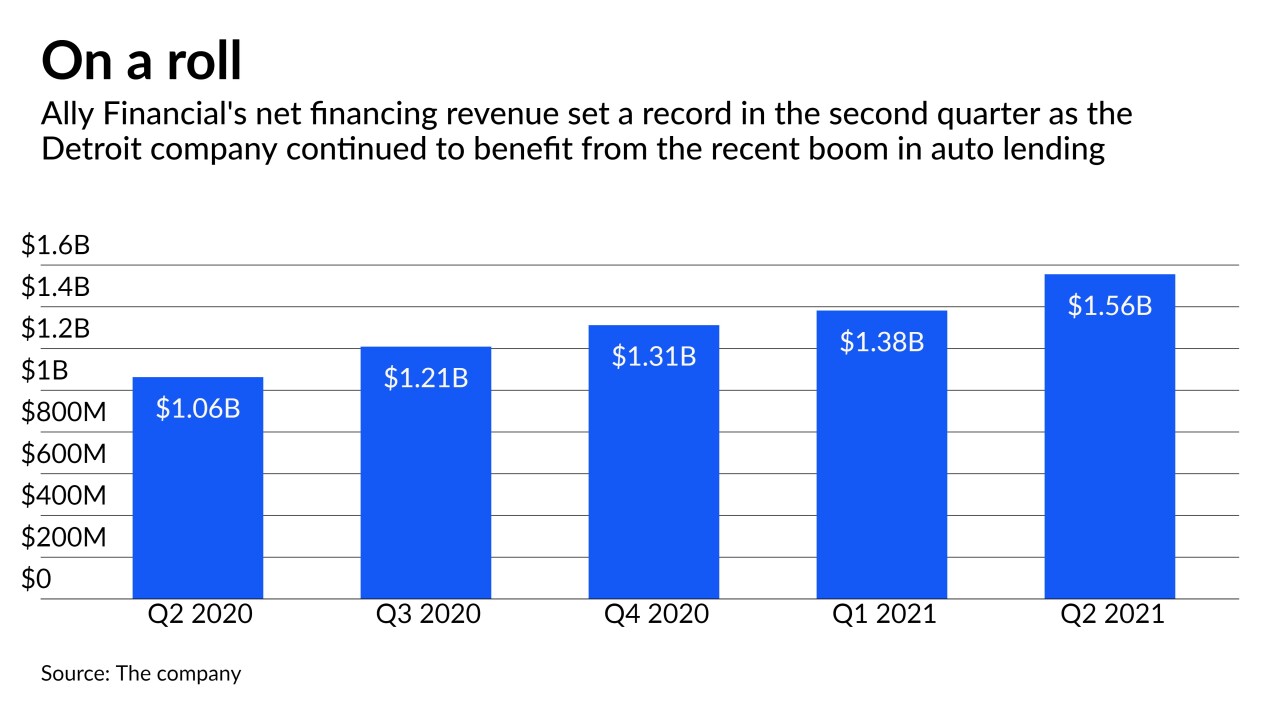

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20