-

Carlyle has raised an additional $800 million for "opportunistic" debt and equity investments of third-party CLOs, in a planned expansion of its $19.4B in structured credit business assets under management.

January 2 -

AXA Investment Advisors' two primary-issue CLOs in 2017 were each priced within the past month.

December 29 -

Many raised large amounts of capital to put to work in the equity, or riskiest slices of their deals, allowing them to resume issuing new deals just as new loan issuance was taking off.

December 22 -

Exposure to PetSmart's now triple-C rated loan will strain the distressed debt limits of 24 collateralized loan obligations, while two other deals face potential interest-diversion test failures.

December 21 -

Banking regulatory agencies Thursday announced that they would raise the aggregate loan commitment threshold for syndicated loans to be included in the Shared National Credit program from $20 million to $100 million.

December 21 -

Only 2.6% of speculative-grade rated firms with public financials carry Moody's weakest liquidity rating, a drastic reduction since March 2016, helped by a recovery in the oil and gas sector.

December 20 -

The collateralized loan obligation market is ending the year at nearly full throttle with nearly $18 billion in new deal/refi volume month-to-date, with more on the way.

December 20 -

The first refinancing, in January, was primarily intended to extend the life of the post-reinvestment period deal; this time, the manager is also lowering the interest paid.

December 18 -

Lee Shaiman, who oversaw $20 billion in leveraged finance and other fixed-income investments at Blackstone, will succeed Bram Smith. who announced his retirement in early 2017.

December 13 -

The collateralized loan obligation manager launched a fifth 2017 U.S. deal totaling $510 million, while its European subsidiary is preparing a third transaction totaling €400 million.

December 13 -

The $12.9 billion in collateralized loan obligations issued last month brings the 11-month total to $108 billion, just shy of the 2014 record of $124 billion.

December 8 -

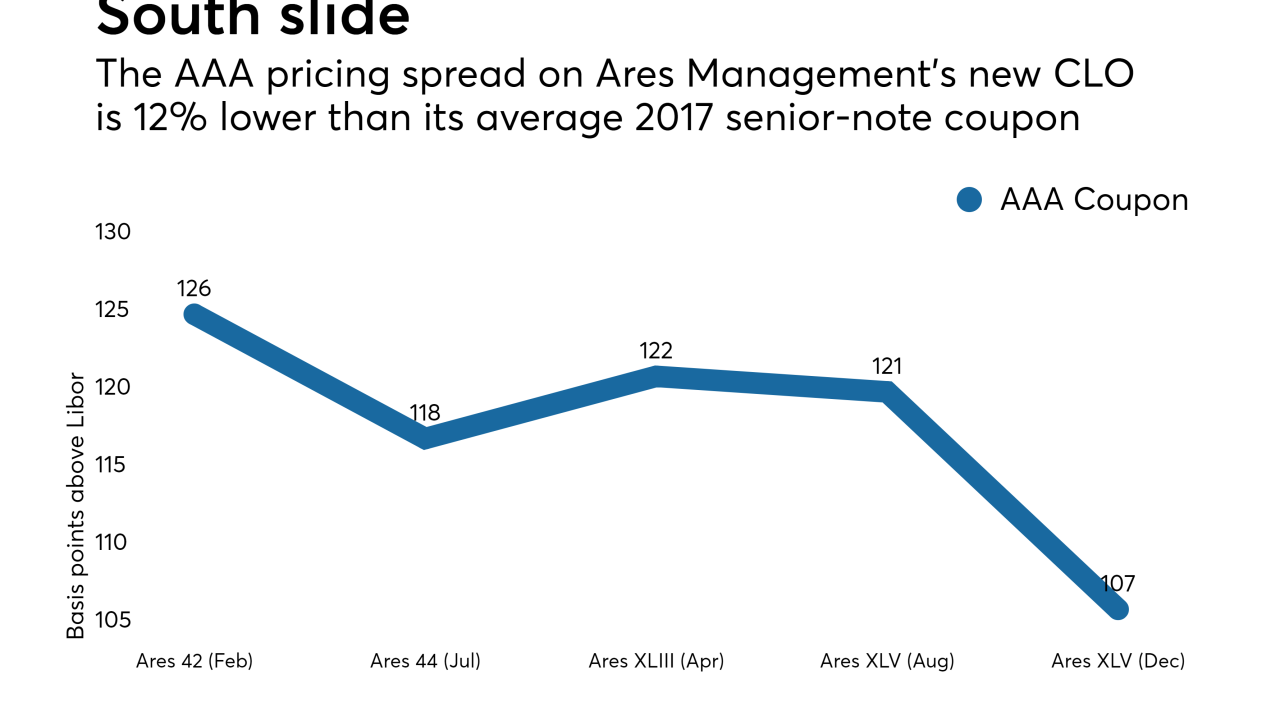

Three broadly syndicated deals printed in December have senior, AAA-rated tranches that pay just 107 basis points over Libor - the lowest coupon of the year.

December 6 -

The deal, BXMT 2017-FL1 weighs in at $1 billion, making it more than twice as large as most CRE-CLOs issued this year; its size isn't the only unusual feature, however.

December 5 -

Junk-rated firms pay little tax, and so won't benefit much from a lower corporate rate. And this benefit could be offset by a limit on the interest deduction.

December 4 -

The dramatic tightening in loan spreads this year made it difficult for the CLO manager to manage to various performance metrics of its deals, and this required building flexibility into deals being refinanced.

December 4 -

Carlyle Euro CLO 2017-3 is the latest under its new shelf managed by affiliate CELF Advisors, with a AAA coupon of just 75 basis points over three-month Euribor.

November 28 -

The deal will relaunch with a weighted average spread (4.22%) and excess spread (2.86%) well above the three-month industry average for issued U.S. CLOs.

November 22 -

CBAM Asset Management's $1B CBAM 2017-4 is not its largest deal among the four BSL portfolios it has issued in less than eight months; but the latest transaction is still almost double the average peer CLO deal size of $511 million since the third quarter.

November 17 -

The securitization market is weathering risk retention and rising interest rates, though Fitch Ratings is keeping its eye on some consumer asset classes as the credit cycle lengthens.

November 15 Fitch Ratings

Fitch Ratings -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

November 15