-

The Federal Reserve is getting more concerned about risks from the leveraged loan market, with a key official saying it's now taking a "closer look" at whether banks are chasing deals without adequately protecting themselves against losses.

October 24 -

It seems a lot of CLO managers who were worried about competing amid heavy supply in the fourth quarter have put issuance on hold until 1Q 2019.

October 23 -

S&P also upgraded five more senior tranches of the deals citing paydowns, which in one CLO was accelerated by the diversion of interest from sub notes.

October 17 -

The $462.3 million VMC 2018-FL2 will be backed by 25 properties, two of which will be acquired after the deal closes.

October 16 -

Fitch Ratings and Moody's Investors Service each rate a single collateralized loan obligations with exposure to debt of the former retail giant.

October 16 -

The rating agency feels that “late-cycle credit behavior” is allowing less established issuers to rely on the securitization market more heavily for funding.

October 15 -

The reinvestment period of $457.8 million Palmer Square CLO 2013-2 is being extended for another four years; there are also changes to the capital stack.

October 15 -

The senior tranche of Oak Hill European Credit Partners VII has an assumed coupon that is inside of the market average for September.

October 12 -

LCM 28 can pay noteholders across the capital stack based on three-month Libor or "any applicable" alternative - including one-month Libor.

October 10 -

The Oak Brook, Ill.-based manager is adding interest-only notes as well as a subordinate, single-B rated tranche in an extension of a 2016 CLO.

October 9 -

The average exposure is well under the overcollateralization cushions for CLO managers, who also had plenty of notice about ATD's longstanding leverage concerns and supplier issues well before the Chapter 11 filing.

October 5 -

A growing number of asset managers are waking up to the opportunity to lend to small and medium-sized companies, and much of this direct lending is making its way into the securitization market.

October 2 -

The four-year-old transaction is still in its original reinvestment period, but the collateral has had growing levels of defaulted and triple-C rated assets.

October 2 -

The spread on the AAA rated notes issued by KKR 23 CLO is unchanged from the manager's prior deal, but three of four subordinate tranches are priced wider than the June transaction.

October 1 -

Four new repriced portfolios from BlueMountain, CIFC, GoldenTree and HPS each exceeded 10x debt-to-equity ratio, compared to a three-month prior average of 9.16x on S&P rated deals.

September 28 -

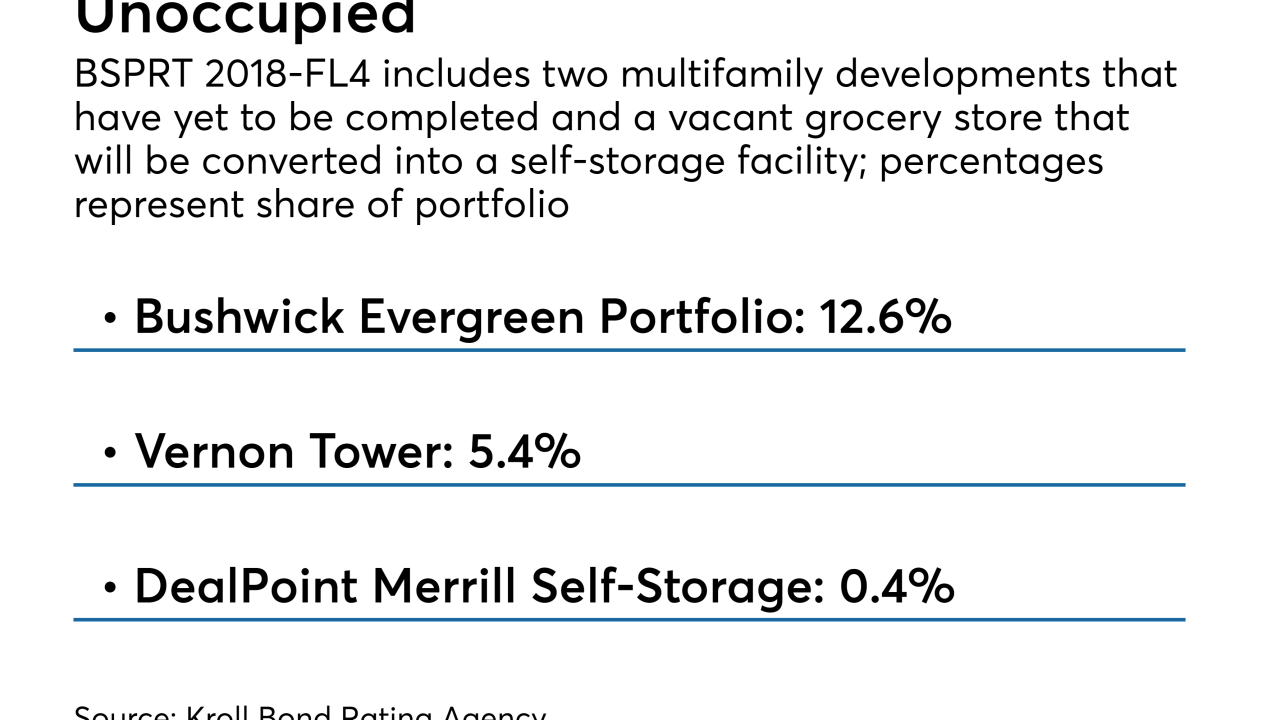

Three of the loans backing the $868.4 million BSPRT 2018-FL4 representing 18.4% of the collateral are either still under construction or have yet to be redeveloped, according to Kroll Bond Rating Agency.

September 24 -

While banking regulators are currently looking the other way when corporate debt packages exceed 6.0 leverage, that could easily change under a new administration or Congress.

September 24 -

A conflict between risk retention rules and prohibitions against self-dealing were limiting options for some lenders to hold skin in the game; a no-action letter issued to Golub Capital creates a "clear path" to compliance.

September 20 -

Tetragon Credit Income Partners is considering a move outside its niche CLO equity investment strategy in expanding its portfolio management team.

September 19 -

The Boston-based firm has refinanced two existing deals within the last 10 months, but hasn't printed a new deal since October 2015, well before U.S. risk retention rules took effect.

September 17