Palmer Square Capital Management is planning another makeover of a CLO that has been modified two times since being issued during the Kansas City-metro area manager’s debut year in the market.

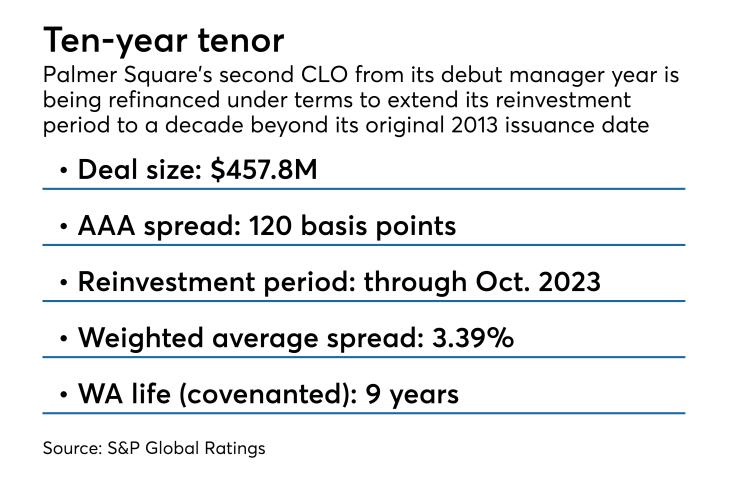

The $457.8 million Palmer Square CLO 2013-2 is being renewed for another four years of reinvestment via JPMorgan, according to a presale report from S&P Global Ratings.

With the new actively managed period extended through October 2023, the original $425 million transaction would have a decade-long shelf life.

The refinancing is the third time the 2013 deal, Palmer Square's second deal in its first year, has been amended and/or extended since being printed in September 2013. In March 2014, Palmer Square upsized the transaction that was set to reinvest through October 2017, but before that date it had been refinanced and extended to October 2019.

The new coupon on the Class A-1A-R2 triple-A notes tranche sized at $280.1 million is assumed at 120 basis points over Libor, according to S&P’s presale report. That slightly narrows the 122-basis-point spread the firm received for the first refinancing conducted 18 months ago. The original spread, in September 2013, was 140 basis points.

While the deal maintains three Class A note tranches, Mission Woods, Kan.-based Palmer Square continues to tinker with the senior capital structure.

The Class A-1B notes have been downsized to $10.2 million from $25 million, and were stripped of the triple-A ratings that S&P to the tranche in both the original transaction and the subsequent March 2017 refinancing. The notes were also repriced at a wider coupon of 145 basis points vs. 132 basis points.

(Moody’s Investors Service also carries a triple-A rating for the A-1B notes, but has not issued any new preliminary ratings on the new replacement notes.)

The Class A-1B notes size returns the tranche to near the original balance of $10 million from the deal’s September 2013 launch. But those notes were initially fixed-rate securities that Palmer set to floating rate when upsized in last year’s refinancing.

The $51.4 million in Class A-2-R notes remain double-A rated, but have been upsized from $37.7 million from last year’s refinancing and also widened in price to 175 basis points over three-month Libor from 165 basis points, according to S&P.

Other changes to the capital stack involve the downsizing of the subordinate equity stakes to $35.4 million from $43.9 million, and the elimination of an unrated, $1.3 million junior mezzanine notes tranche. (The refinanced transaction last year was compliant with U.S. risk-retention standards then in force through an eligible vertical interest stake held by a majority-owned affiliate of Palmer Square.)

Palmer Square CLO 2013-2 refinancing and extension also adds a new two-year noncall window to the deal.