Eaton Vance is issuing its first publicly rated primary collateralized loan obligation in three years.

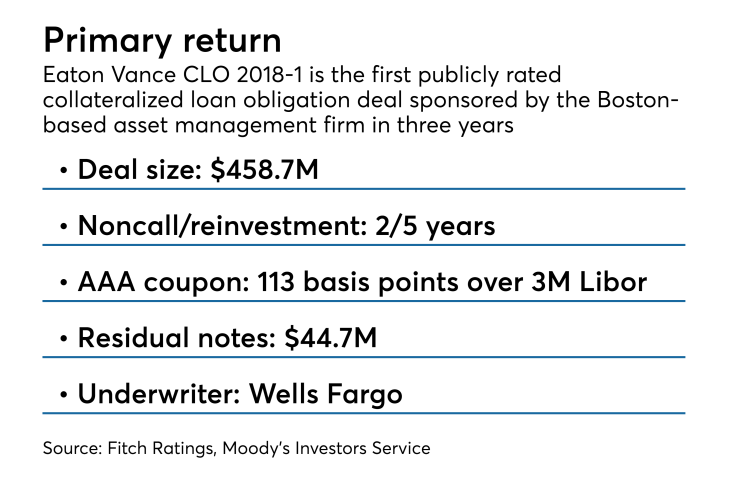

According to presale reports from Fitch Ratings and Moody’s Investors Service, Eaton Vance Management will manage a new $458.7 million CLO, the first new-issue CLO by the global asset management firm since 2015 (the $408.2 million Eaton Vance CLO 2015-1 portfolio priced that October).

Eaton Vance CLO 2018-1 will have a five-year reinvestment period and a two-year noncall period, and is expected to price at Libor plus 113 basis points on its $276.8 million, triple-A rated Class A-1 senior-note tranche.

The deal is expected to have a nine-year weighted average life.

Wells Fargo is the underwriter.

Boston-based Eaton Vance manages three other CLOs with a combined balance of $1.5 billion,.

That was prior to the December 2016 enforcement of U.S. risk-retention regulations that required CLO managers to have a 5% notional stake in the portfolios of broadly syndicated, open-market CLOs, and the start of a three-year lull in Eaton Vance issuance prior to the new deal.

The new transaction will not comply with U.S. or European risk-retention rules. U.S. skin-in-the-game rules enacted as part of Dodd-Frank in December 2915 have since been voided, at least for managers who acquire collateral in the open market, rather than securitize loans on their balance sheeets.

Although it has not issued new deals, Eaton Vance has recently refinanced CLOs originally issued in 2014 and 2015. Eaton Vance CLO 2015-1 exited in non-call period last fall, after which the firm extended and refinanced the transaction by another 2.5 years of reinvestment. The AAA coupon was narrowed to 107 basis points from the original 146, according to presale reports.

Last month, the manager re-issued and refinanced the $497.8 million Eaton Vance CLO 2014-1, which repriced at an AAA spread of 111 basis points over Libor, according to Thomson Reuters LPC.