Benefit Street Partners’ next commercial mortgage securitization includes three loans on properties that are either still under construction or have yet to be redeveloped, according to Kroll Bond Rating Agency.

The $868.4 million transaction, called BSPRT 2018-FL4 Issuer, is a commercial real estate collateralized loan obligation, a vehicle designed to finance properties that are being rehabbed or converted to a new use. But it is still relatively unusual for CRE CLOs to be collateralized by properties under construction.

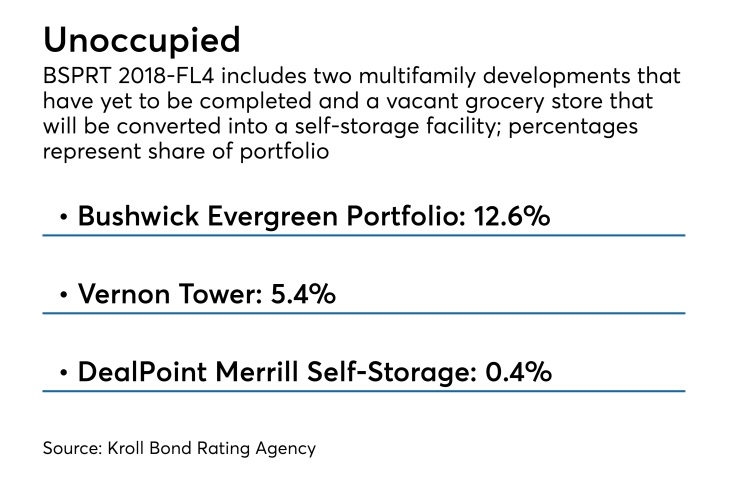

But that’s the case for the Bushwick Evergreen Portfolio, the second largest loan in the pool representing 12.6% of the total. It finances a multifamily project in the Bushwick neighborhood of New York City’s borough of Brooklyn. The property contains three adjacent phases of development, one of which (5.7%) is under construction and expected to be completed in January 2019. The loan also includes a future funding component to cover remaining construction costs.

Likewise, Vernon Tower, the sixth largest loan at 5.4% of the collateral pool, finances a 103-unit mid-rise multifamily property located in the Astoria neighborhood of New York City’s borough of Queens. The property was recently constructed and is anticipated to receive its temporary certificate of occupancy by mid-October 2018. The loan includes a future funding component that can be used for interest shortfalls or returned to the borrower.

And DealPoint Merrill Self-Storage , representing 0.4% of the collateral pool, is a former grocery store in Cleveland, Ohio, that is currently 100% vacant. The owners plan to redevelop the property into a two-story self-storage facility. Construction is expected to be completed by the end of 2018. The loan includes upfront reserves as well as a future funding component to cover the remaining construction costs.

When the deal closes, it will collateralized by 32 whole loans and participations with an aggregate balance of $738.1 million and $130.3 million of cash that can be put to work acquiring new loans over the following 18 months, subject to eligibility criteria.

Benefit Street will actively manage the portfolio for two years, during which it can reinvest principal repaid on loans in the pool, as well as cash contributed by the preferred equity shareholder, subject to the reinvestment criteria, which include a maximum stabilized loan-to-value ratio, minimum stabilized debt service coverage requirements, and pool-level concentration limits for property type and geographic location.

Kroll expects to assign an AAA to the senior tranches of notes to be issued; there are also six subordinate tranches with ratings ranging from AA- to B-; the two most subordinate tranches are payment-in-kind notes.